Small business hub

Small business guides

Explore our range of guides designed to help you with important aspects of running a small business in Australia.

GST Guide

Everything you need to know about GST including thresholds, rates & how to register for it!

Invoicing Guide

Everything you need to know about invoicing including reducing your admin & getting paid faster!

Financial Guide

Everything you need to know about financial statements and managing reporting.

Business Financing Guide

Everything you need to know about business financing in order to grow your small business.

Hiring Staff Guide

Everything you need to know about hiring staff to expand your small business.

Inventory Guide

Everything you need to know about inventory to help your business run smoothly and profitably.

Starting a Small Business Guide

Everything you need to know about how to start up a successful business in Australia.

Business Growth Guide

Everything you need to know to grow your small business.

Bookkeeping Guide

Everything you need to know about bookkeeping for your small business.

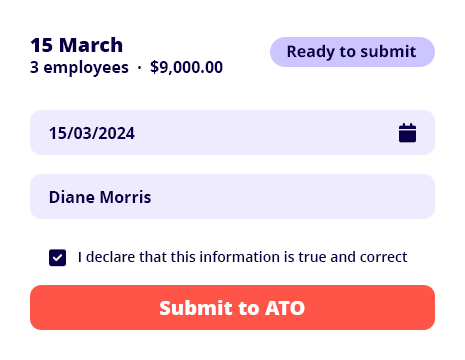

Payroll Guide

Everything you need to know to get your staff paid.

End of financial year (EOFY)

Everything you need to know to manage your tax obligations in the EOFY.

Australian Tax Guide

Everything you need to know about the tax system in Australia.

Employee Hub

Everything you need to know to manage your career.

Calculators

Everything you need to help with accounting and bookkeeping calculations.

BAS Guide

Everything you need to know about BAS (Business Activity Statement).

Insurance Hub

Everything you need to know to manage insurance

Technology and Security Hub

Everything you need to keep secure and up to date online

Explore our resource hub

Have access to our resources to help you grow and manage your small business all in one place.

The Hardest Working Cities in Australia

Start-up Cities

Single Touch Payroll Hub (STP)

eInvoicing Guide

Federal Budget Hub

Payday Super Hub

The Hardest Working Cities in Australia

|

We’ve looked a range of factors, from employment rate to productivity and commute times, to calculate which Australian cities work the hardest. |

|

The Best City in Australia to Start Your Business

|

We analysed and researched the 50 largest cities in Australia to see which city is the best for starting a business. |

|

Single Touch Payroll Hub (STP)

|

Ensure your business is compliant with the latest changes to payroll reporting. |

|

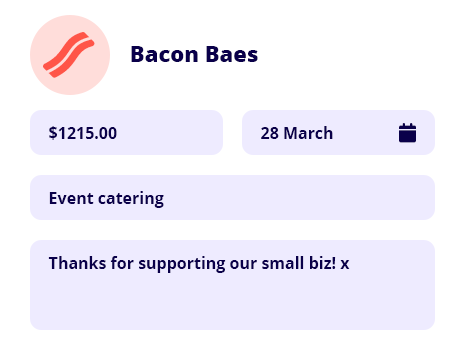

eInvoicing Guide

|

Everything you need to know about sending electronic invoices between a buyer’s and supplier’s accounting software systems! |

|

Get paid faster with unlimited online invoicing

|

Understand the key takeaways from the 2025 federal budget and how it will affect your business. |

|

Payday Super changes to employee superannuation contributions

|

Is your business ready for Payday Super? We have all the information you need to make sure you stay compliant. |

|

Reckon Accounting Glossary

New to accounting and bookkeeping? Dive into our accounting glossary and learn the basics from A to Z for your small business.

Free downloadable templates

Invoice template

Free & customisable tax invoice for your small business.

Payslip template

Free & editable payslip template for Aussie small businesses.

Business plan

Free editable business plan template to build out your business strategy.

Cashflow forecast template

Free cashflow forecast template for small businesses.

Balance sheet template

Free & customisable balance sheet for your small business.

Profit & Loss template

Free & editable profit & loss template for Aussie small businesses.

Cashflow statement template

Free cashflow statement template for small businesses.

Quote template

Free quote template for

small businesses.

Business continuity plan template

Free continuity plan template for small businesses.

Our most loved eBooks

5 low budget marketing hacks

A guide to marketing your business on a shoestring budget.

The case for the cloud

Growth process

The complete guide to growing your business.

Related resources

Outlook for 2025: A roadmap for small businesses

It’s a new year for businesses across Australia, and you may be looking to jump-start the engine that once ran smoothly in 2024. With 12 months ahead of you, the best way to get underway is through proper planning with a roadmap…

Research & Design: using customer feedback to improve your small business

Getting feedback from your customers is a great way to understand how you can improve your business.

Gender equality in Australian small businesses

In Australia, we celebrate our small business owners. But who owns small businesses here?

Try Reckon Invoicing today!

Unlimited invoices. 30 days free. Cancel anytime.