Free payslip template for small businesses

Create a professional payslip in minutes

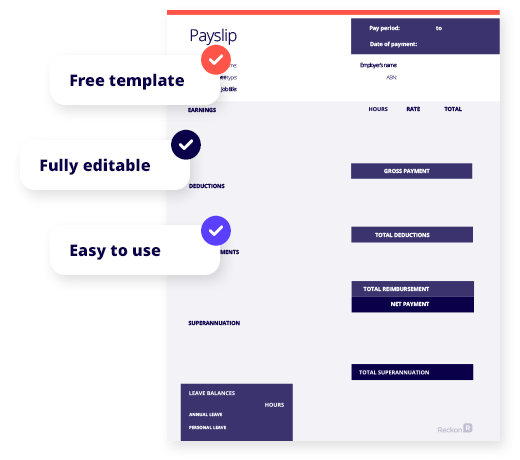

Free template

Our Australian payslip template can save you time & money.

Fully editable

Ready to customise with all employee details like earnings, deductions, reimbursements, taxes, overtime, benefits, and superannuation.

Easy to use

Add your company payroll data and our templates will do all the calculations for you.

Download your free payslip template

Free payslip template Word, Excel, PDF

Use our free payslip templates for small businesses. The payslip creator is a fully editable and customisable document that contains all the Australian legal requirements to help you save time on compliance. Simply add your employee payroll details!

You can download your payslip templates as Word documents, Excel spreadsheets, or editable PDFs.

Why choose software over a payslip template?

Up your game with Reckon’s payroll software. You can manage company wages, annual leave, super, and Single Touch Payroll (STP) for your employees from just $14/month.

Payroll that’s designed for small business

A modern design and clear workflows make managing pay runs, wages, leave, superannuation, Single Touch Payroll and data entry a breeze.

Simply enter your default settings, add employee details and hit pay! Save time is one of the many benefits of having payroll software.

Fair and affordable payroll software pricing

Easily manage wages, leave, super and STP for up to 4 employees from just $14/month with our payroll software. As your business grows our pricing scales fairly with your business size making it an affordable option for Aussie small businesses that require payroll system.

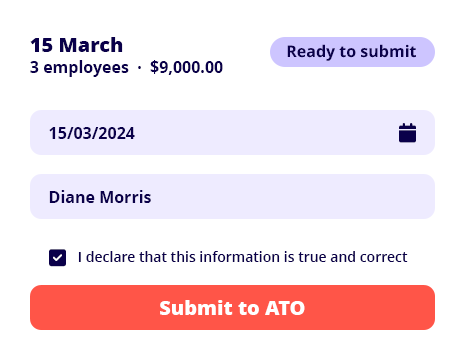

STP Phase 2 and ATO compliant

Process pay runs & send your STP reports directly to the ATO each payday in just a click. You can even keep track of ATO messages and access past submissions.

We’ve processed 500,000+ successful STP reports for our customers in 2023 alone!

Stay up to date with payroll & tax regulations

It’s simple to stay up to date with the latest payroll and tax compliance changes with updates such as PAYG tax tables, superannuation guarantee rates and SuperStream requirements automatically pushed into Reckon payroll software.

Leaving you more time to focus on running your business.

Aussie payroll software with local support

Our cloud payroll software is designed and built for the Australian market with local support available when you need it.

Reckon is a proud Australian, publicly listed company with over 30 years of experience in the industry - so your payroll management is in safe hands!

Reckon Payroll software vs free payslip template

Features

Free Payslip Template

Automatically email payslips

Manage Single Touch Payroll

Easily share online with your employees

Send directly from your mobile

Schedule pay runs

Automatic payroll and compliance updates

Free downloadable templates

Invoice template

Free & customisable Excel and Word invoice template for your small business.

Payslip template

Free & editable payslip template for Aussie small businesses.

Business plan

Free editable business plan template to build out your business strategy.

Cashflow forecast template

Free cashflow forecast template for small businesses.

Balance sheet template

Free & customisable balance sheet for your small business.

Profit & Loss template

Free & editable profit & loss template for Aussie small businesses.

Cashflow statement template

Free cashflow statement template for small businesses.

Quote template

Free quote template for

small businesses.

Business continuity plan template

Free continuity plan template for small businesses.

Frequently asked questions

What is a payslip?

A payslip is a document that records an employee’s income earned over the pay period. It is broken down into three key areas: gross pay, tax and deductions, and net pay, which is the amount the employee actually receives. Payslips help employees keep track of payments and deductions and ensure they are being paid correctly.

As an employer, you must provide a company payslip at every pay run via email or a physical paper copy (to suit different needs).

What should a payslip template include?

A payslip template must include the following information:

- the amount of pay, both gross (before tax) and net (after tax);

- the date of receiving the pay;

- the pay period;

- any loadings, bonuses or penalty rate entitlements;

- deductions;

- superannuation contributions including the name of the super fund;

- the employer’s name and ABN if they have one; and

- the employee’s name.

If you workers are paid hourly, the payslip template should also contain their ordinary hourly rate and how many hours they worked at that rate. If an employee is paid an annual salary, the rate should be as on the last day of the pay period. While this is not a legal requirement, it is best business practice to include the balance on each payslip.

When do I need to provide a payslip?

As an employer, you must provide payslips within one business day after your employee receives their pay.

How long do I need to keep payroll information?

As an employer, you must keep your employee details, timesheets, and payroll information for seven years. For more information, see the Fair Work Ombudsman.

Is there a payslip format I should follow?

There is no specific format that your payslip should follow as long as it contains all the legal requirements. However, there is a level of commonality between most payslips that most people recognise and are familiar with. It makes sense to keep your chosen format similar to these known conventions, e.g. employer name at the top, gross pay before net pay, insurance, etc., as it will help employees understand their payslips easily.

How do I create a payslip?

A payslip is generated from your payroll & employee information.

You can use our free payslip template to create a payslip manually. However, one of the easiest ways to generate your payslips automatically is via your payroll solution.

Need payroll software? Check out Reckon’s affordable range.

Do I need payslips if I report under STP?

Yes, you still must provide your employees’ payslips even if you are reporting via STP.

However, the STP Finalisation Declaration has replaced the need to produce Payment Summaries for employees. The information provided on the Payment Summaries is available in their MyGov account and is known as an Income Statement. If an employee doesn’t have a MyGov account, their accountant will be able to access this information via the Tax Agent portal.

Is your payslip generator STP compliant?

Sending your payslips is only part of your compliance obligations as an employer and small business. You are also required to comply with specific rules from the Australian Tax Office (ATO) and Fair Work Australia. One of these obligations relates to Single Touch Payroll. Once you’ve processed your pay run you still need to submit the payroll information to the ATO via an STP-enabled software solution. For more information on STP-compliant products, visit our range of payroll solutions.

Try Reckon Payroll today!

30 days free. Cancel anytime.