Petty cash refers to the small amount of physical money that businesses keep on hand to cover their most minor expenses. Instead of using their business bank account or writing cheques for small purchases, a petty cash fund gives owners a convenient way to handle everyday business expenses. It’s especially useful for covering things like office supplies, employee reimbursements, and other incidental costs.

Petty cash (definition)

A petty cash fund is a designated pool of money set aside by a company for small business expenses. You’ll find it kept in a secure spot – usually a locked box – and all petty cash should be managed by an employee who is responsible for disbursing funds, collecting receipts, and keeping good records of how the money is going in and out of the fund.

Many small businesses establish what’s called a petty cash float, which is the total amount of cash allocated to the fund. As cash is used, the balance decreases and receipts are collected to account for each expense. When the remaining balance reaches a low threshold, the fund is replenished by withdrawing more cash from the business bank account.

How petty cash works

To set up a petty cash fund, your business will withdraw a fixed amount from your bank account and record it as a petty cash account in the general ledger. Employees can then use the fund for minor expenditures (e.g. office supplies, birthday cards, employee reimbursements, etc).

Each transaction must be documented with petty cash receipts and recorded in a log or accounting software. When the petty cash balance runs low, the receipts are reviewed and more cash is withdrawn from the bank to restore the fund to its original amount.

Whoever you’ve appointed to manage petty cash must make sure that money is always available for small business essentials.

Common types of petty cash expenses

- Office supplies (e.g. pens, paper, printer ink)

- Employee reimbursements for minor work-related expenses

- Catering costs for small staff events

- Postage and shipping

- Birthday cards and small gifts for employees

Petty cash rules and best practices

The best way to manage petty cash funds is to choose a custodian (i.e. a reliable employee) who is responsible for overseeing the fund and tracking expenses. All petty cash transactions should come with receipts, which should be stored and reviewed every few months to avoid mistakes or stolen funds.

Record keeping via a petty cash log will help track expenses related to the fund, the remaining balance and when it might need topping up. Setting a spending limit per transaction means the fund will only be used for small expenses.

How to record petty cash transactions

Petty cash transactions should be recorded in the general ledger for financial reporting purposes. Here’s how it works:

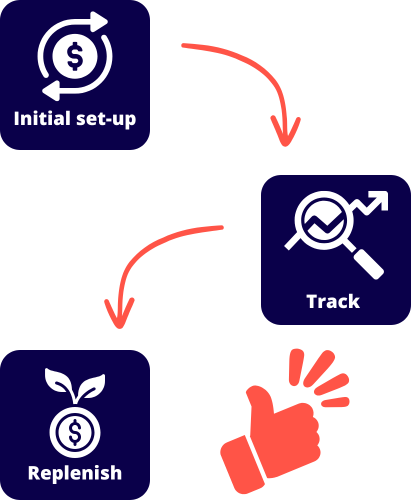

- Initial set-up: Debit the petty cash account and credit the business bank account when the fund is created.

- Tracking expenses: Each payment should be recorded with a credit to the petty cash account and a debit to the appropriate expense account.

- Replenishment: When more cash is needed, a cheque is issued to withdraw money, which is then recorded as a credit to the bank account and a debit to petty cash.

Bottom line: petty cash is a practical way for businesses to cover minor expenses without the need for formal payment processes.

See related terms

What is credit?

What is an expense?

What is overhead?