Expenses are costs necessary for running a business. As a company makes revenue, it incurs expenses related to its operations. The goal is to keep your expenses low relative to your business’s income. Expenses can range from things like the rent you pay on your business property or lease, to the salary and wages you pay your employees.

Why are expenses important for businesses?

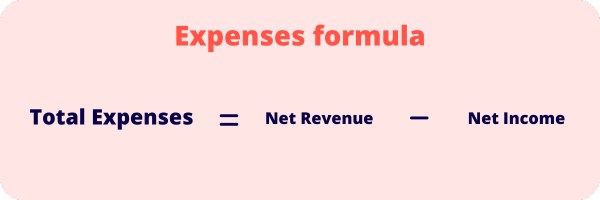

In accounting, businesses use expenses to help determine their net income. Here is a simple equation on how to identify your expenditure:

Total expenses = Revenue – Net income

The principle behind expenses and revenue is that for a business to earn an income, it needs to spend money (expenses). While this is an easy concept to understand, managing costs is a constant battle for businesses; simply looking at a balance sheet or income statement does not necessarily include the context and realities of running a successful business.

If your expenses are too low, you may lose service quality and work. If your expenses are too high, your business’s viability may be in trouble.

Expense Categories

Expenses fit into different categories. Each category affects how a business manages its accounting and bookkeeping.

Business expenses

Business expenses are costs directly incurred by a business as a whole. This is an umbrella term that most expense categories fall under:

- operating expenses

- employee expenses

- cost of goods sold (COGS)

- marketing and advertising

- travel and accommodation

- professional fees

- depreciation

- interest

- taxes

Operating expenses

Operating expenses (OpEx) are costs related to a business’s core operations. It should be noted that costs of goods sold (COGS) are not included in operating expenses. COGS is a direct cost associated with the production of goods and services, while OpEx is an indirect cost of producing goods.

Operating expenses include:

- rent

- salaries

- utilities

- marketing

- sales

- maintenance

Fixed expenses

Fixed expenses are costs that remain fixed over time and will not change as your business activities increase or decrease.

Here are some examples of fixed business expenses:

- rent

- salaries

- insurance

- fixed billing, like phone and internet

Variable expenses

While fixed expenses don’t change in cost, variable expenses do. Expect your variable business expenses to change depending on whether your activities increase or decrease.

Here are a few examples:

- raw materials

- direct labour

- utilities

- variable interest rate loans

Capital expenses

Capital expenses are spent on purchasing, maintaining, or improving property or assets. Businesses use capital expenditures (CapEx) to achieve long-term goals over more than 12 months. For example, a factory business owner will purchase more machinery to increase production.

Here are some capital business expenses:

- property

- vehicle

- computers

- equipment

- furniture

Non-operating expenses

Non-operating or non-business expenses are expenses that aren’t involved in a business’s core activities. For example, if a company director purchases lunch during their lunch break, this would be considered outside the realm of a business’s operations.

Expenses: cash basis vs accrual basis

To record expenses in your accounting and bookkeeping software, you will need to set up your record-keeping on a cash or accrual basis.

On a cash basis, cash inflows and outflows are recorded when money is received and when the expense is paid. For example, when a business receives a tax invoice for rent payment, the expense is only recorded when the funds have been sent directly out of the business.

Revenue and expenses are recorded when they are incurred on an accrual basis. In the same example above, a business would record the expense as soon as it received the tax invoice for rent.

Expenses and business deductions

For tax returns, businesses can only deduct expenses related to day-to-day operating expenses, the purchase of goods and services related to their business, or capital expenditures.

Expenses and your business

Business owners must consider how their expenses relate to their activities holistically. Just because an expense costs you money, it doesn’t mean it’s a barrier to generating revenue.

For instance, a company pays employees wages in return for productivity, which contributes to its profit intake. Similarly, if a business changes suppliers for a type of raw material that is marginally different in quality but significantly lower in cost, that business would be making a savvy cost-saving decision. An expense is reasonable if it helps your business and is worth the money.

See related terms:

What is a ledger?

What is cash flow?

What are fixed assets?