TABLE OF CONTENTS

Trade debtors – you might know them better as accounts receivable – are customers who owe your business money for goods or services that have been delivered but not yet paid for.

When a company sells on credit, it generates a trade debtor, and their ‘debts’ represent the amounts due from those customers. All unpaid invoices are recorded as current assets on the company’s balance sheet because they are expected to be converted into cash within a short period, usually around 30 to 90 days.

Trade debtors and accounts receivable

It can be helpful to frame trade debtors as a big part of your business’s cash flow and financial health, because they are. When a business allows customers to buy goods or use services on credit rather than requiring immediate payment, they become trade debtors.

Let’s say your business provides consulting services to a client. As soon as you issue an invoice for $2,500 (with payment terms within 30 days), that client becomes a trade debtor, and the $2,500 is recorded as an account receivable until the owed money is received.

Trade debtor as an asset

Trade debtors are considered assets because they represent all the money payable that will be received in the near future. On your balance sheet, they should fall under ‘current assets’, meaning they are expected to be converted into cash within 12 months.

However, if customers fail to pay on time or you extend credit even further, these debts might need to be reclassified as doubtful or bad debts. How you manage the payment process from there is up to you.

Trade debtors vs trade creditors

Trade debtors and trade creditors are the opposite sides of the same transaction. Trade debtors are the money your business is owed, whereas trade creditors are the amounts a business owes to suppliers for goods and services received but not yet paid for. Essentially, one company’s trade debtor is another company’s trade creditor.

For example, if a company sells goods to another company on credit, Company A records the transaction as a trade debtor (money owed to them), while Company B records it as a trade credit (money they need to pay).

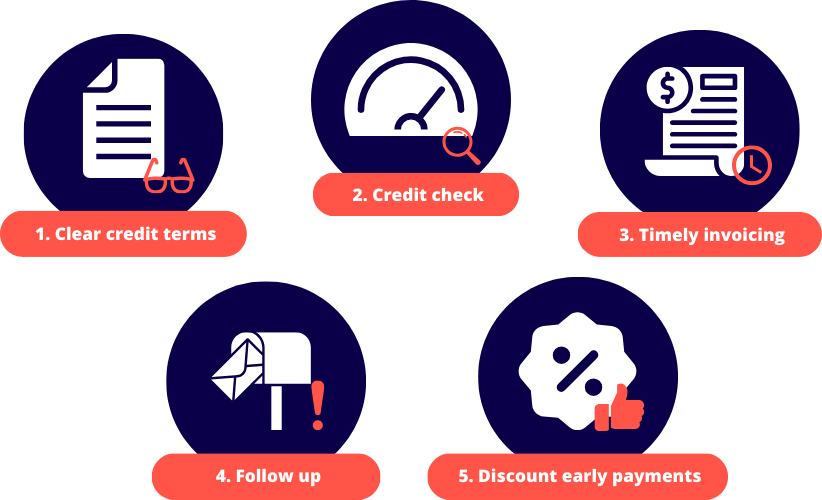

5 tips for handling trade debtors

From how you send invoices to handling late payments to getting everything organised on your sales ledger, it’s a good idea to have some strategies for managing your trade debtors.

1. Establish clear credit terms

Before extending credit to your customers, you should set clear terms and conditions, including the deadline for receiving payment, late fees, and any interest to be charged on overdue amounts. Being clear and upfront with your contracts and invoices will avoid any misunderstandings and delays in payment.

2. Carry out credit checks

Before offering credit, make sure you check out the customer’s creditworthiness. Are they financially stable and likely to make payments on time?

3. Issue your invoices in a timely manner

Invoices should be sent as soon as a sale or service is made. Make sure every invoice contains all due dates, payment methods, penalties for late payments, etc.

4. Follow up on all overdue payments

Track your invoices and follow up on overdue payments with trade debtors. Send polite reminders first, and escalate to formal demand letters if necessary to encourage prompt payment.

5. Give discounts for early payments

You can encourage faster payments by offering small discounts for customers who settle their invoices early. A 2% discount for payments made within 10 days could, for example, rapidly improve your cash flow.

Implementing a few smart credit-management strategies and monitoring your accounts receivable means you can be proactive with trade debtors and help your business stay financially viable into the future.

See related terms

What are trade creditors?

What is a liability?

What is a write-off?