Doing your own bookkeeping as a small business owner? Part of this process requires setting up and understanding your chart of accounts (COA).

Done manually, through a tool like Excel, setting up your accounting chart can be extremely cumbersome and error-prone, so using proper accounting software is ideal.

But first, let’s get into the nuts and bolts of the subject: what is a chart of accounts? What does it do? And how do you set one up?

What is a chart of accounts?

In a nutshell, a chart of accounts lists all the accounts used in an organisation’s general ledger.

A standard chart of accounts lets you categorise each transaction in your general ledger by type. For example, a standard COA has subcategories (usually separate tabs in your accounting software) detailing a variety of transactions such as:

- Income statement accounts – money your business earns.

- Expense accounts – things you need to pay for.

- Cost of goods sold (COGS) accounts – the total cost of providing an item for sale.

- Asset accounts – what you own.

- Liability accounts – debts you owe.

- Equity accounts – ownership interest in the business.

Configure the chart of accounts in your accounting software according to the types of financial statements you require and to fit your specific business needs. Within most modern accounting software, there are many different categories that you can choose to display. Essentially, you need to know what your business’s financial incomings and outgoings are, then organise your COA with these in mind.

Tailoring your COA, you should consider whether you want to see your income statement and your liability accounts – or if you’re a service business, you may not need certain elements such as COGS, but instead need to see accounts receivable.

Other COA categories may include, inventory, accounts payable, petty cash, payroll liabilities, and work vehicles.

Why is a chart of accounts important for small businesses?

By indexing your general ledger into types or categories, accounting charts represent the financial position of your business or organisation. (Unless you memorise all your records, you will have to rely on your dedicated chart of accounts.)

A properly organised chart of account system helps to easily identify your major accounts and the transactions which have been or are yet to be deposited or withdrawn. The system will ensure you have visibility over your entire financial position and can break it down into categories.

So, if you want to drill down into assets, accounts payable, expenses, or any other transaction type, you can do so with your chart of accounts.

Furthermore, your chart of accounts will be integral when reporting on your finances, doing taxes, or creating financial reports for various purposes.

Let’s say you want to sell your business or are seeking a loan or investors – you’re going to need the granular breakdown of your financial health that is made possible by a properly organised chart of accounts.

Using your COA, you can easily create financial statements, a balance sheet or determine things like income tax. Even if you are just going to see an accountant or advisor for advice or a business health check – you’ll need to show them your COA, so they can evaluate your position effectively.

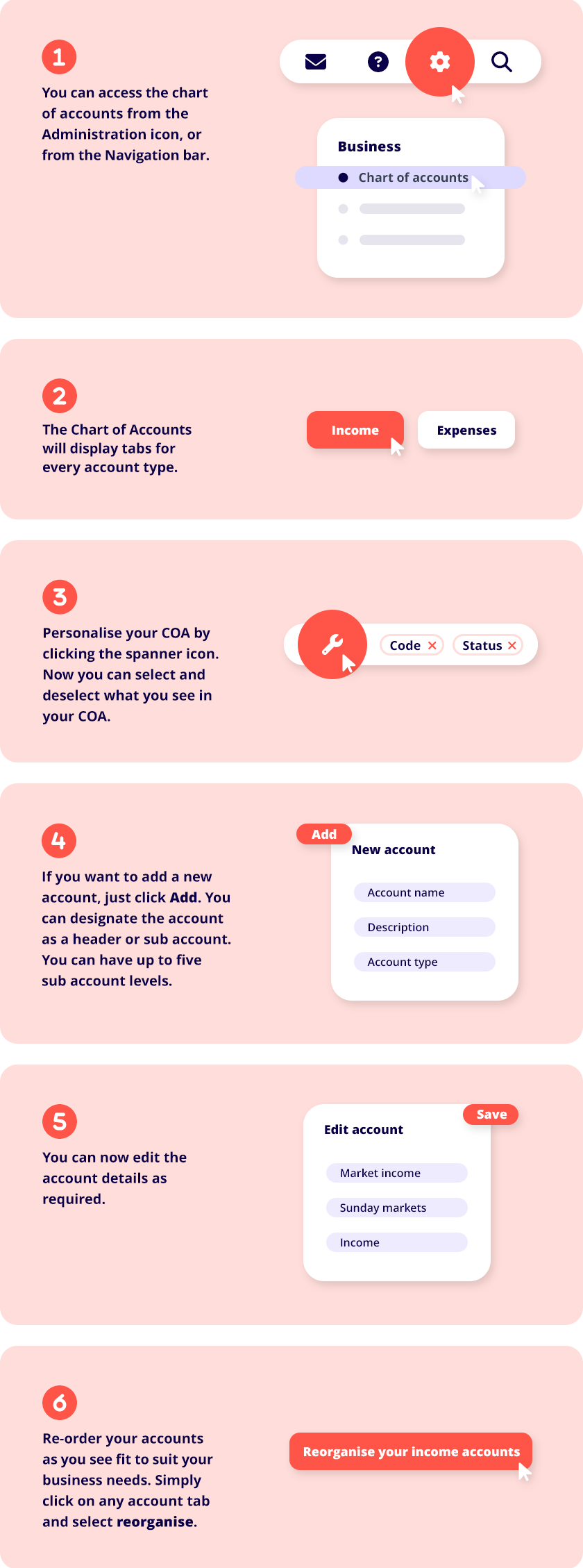

Here, we will show the procedure within Reckon accounting software to give you an example.