If you run a small business, there’s a high chance you’ll need to be able to understand and manage ‘accounts payable.’

If you purchase business supplies of any kind, and are invoiced for these expenses or goods, then you’ve got accounts payable on your hands.

Accounts payable is an extremely important part of your bookkeeping, budgeting, and compliance with the ATO.

Furthermore, to be successful in business you need to pay your debts on time. If you don’t, suppliers will not want to work with you, debts will spiral, and you could face penalties.

So, what is accounts payable, how does it differ from accounts receivable, and how do you manage an accounts payable process?

What is accounts payable?

Accounts payable, stored on a ledger or in your accounting software, refers specifically to unpaid invoices.

In essence, this means that your accounts payable is a record of your business debts, usually for business expenses. However, it doesn’t include payroll and other long-term debts such as mortgages.

An account payable is usually recorded upon receiving an invoice in response to the payment terms that have been agreed on in the initial stages of your supplier relationship.

Your accounts payable debts are recorded on your general ledger as ‘expenses’. If you produce financial reports that include balance sheets, the financial statement totals your accounts payable, though it does not detail individual transactions.

It’s also important to understand that having a large accounts payable ledger is a liability.

What is an account payable with example?

Let’s look at a journal entry example of a cafe purchasing cupcakes from a supplier to sell in-store.

| Date | Account name | Debit | Credit |

|---|---|---|---|

| 2-Aug | Inventory | 500 | |

| Accounts payable | 500 |

We see that the cafe owner has increased their inventory assets (cupcakes) in this transaction and increased their accounts payable liability (credit card payment). The credit card payment represents a liability owed to the business’s creditors which would be the credit card provider.

Of course, if you pay for any of these things upfront, they never land on accounts payable, just your expenses.

An account payable only indicates the balance yet to be paid by you, associated with this activity or supply.

Accounts payable vs accounts receivable: key differences

Another ledger you may have on your books or accounting software is known as ‘accounts receivable’. In opposition to accounts payable, your accounts receivable refers to outstanding debts that are owed to your business.

If your business issues invoices for work completed, any unpaid are your accounts receivable.

If you’re a tradie for example, you may do a job and issue an invoice. This unpaid debt will sit on your accounts receivable ledger until such time as the client in question settles their account with you. Even if the debt is still outstanding, your accounts receivable will sit on your general ledger as ‘income’.

The similarity between accounts payable and accounts receivable is that you want to eliminate both accounts receivable and accounts payable as soon as humanly possible. A large ledger of either kind means you have too much money owed to you and too many outstanding debts, which will compromise cash flow.

The accounts payable process – how to do accounts payable

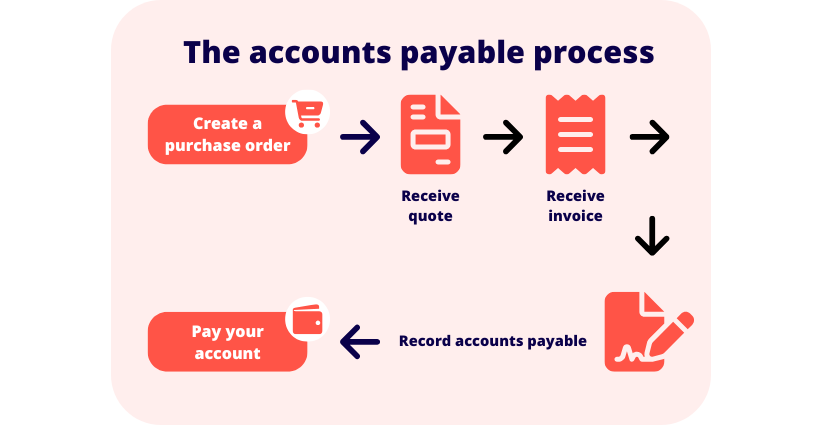

Here is a basic accounts payable process:

1. Create a Purchase Order (PO)

Decide on what you need to order or receive a quote on. Now complete a PO as per the supplier’s templates or order forms.

2. Receive a quote or report

The supplier will usually now provide a quote of some variety, detailing what you ordered and how much it will cost. You now either approve or deny the quote – check it carefully.

3. Receive an invoice

Once services or goods have been supplied you will now receive an invoice. Again, check you received what you requested and with the correct prices.

4. Record accounts payable and invoice processing

Now enter the details into your accounting or expense software. Include due dates and important details. (This process can sometimes be automated to some extent.)

5. Pay your accounts payable

It’s wise to set aside time every week to clear your accounts payable ledger with a regular payment process, especially if you’re not large enough to have your own accounts payable department! Double check your calculations for accuracy and pay them off (usually in order of due date). Clearing this ‘liability account’ is a top priority.

Accounts payable best practices

Strangely, one of the best practices is avoiding having accounts payable in the first place. This means that when using regular suppliers, or services such as electricity, it’s useful to set up direct debits instead of receiving invoices.

Setting up automatic payments will help minimise your accounts payable ledger, but you must also keep a closer eye on these to ensure you still need such supplies, or that you were charged accurately.

Next, set a calendar appointment every week to tend to your invoices and pay them off with regularity.

Finally, be scrupulous about accuracy. From creating POs to entering the data in your AP ledger, and paying the right amount to the right person, to ensure your balance sheet is on-point at every turn, you must be super vigilant and precise.

Pro Tip: Easily manage your accounts payable with Reckon cloud accounting software.