Starting a business is something many of us have dreamt about. Yes, you can turn that dream into a reality, but it might require you to make some serious financial investments in your future.

As an entrepreneur, your first step might be to turn to venture capital firms or look for external funding to get your business idea off the ground. But not all businesses get their start with large injections of cash. Bootstrapping is a way for a business owner to build up their company using their own money, personal savings or business revenue rather than relying on outside investors.

The reasoning behind bootstrapping? It lets entrepreneurs stay in control of everything — but be aware of the financial challenges and risks ahead of you.

Bootstrapping (definition)

Bootstrapping is just a term used to describe self-financing a business without outside funding. A bootstrapped company relies on internal resources — e.g. the founder’s savings, revenue from early sales, and personal investment from friends or family — to grow and sustain operations. Unlike companies backed by venture capital or other financial foundations, a bootstrapped startup retains full ownership and decision-making authority but takes on all the financial risks.

The bootstrapping method requires business owners to be highly resourceful – in other words, they need to minimise expenses and really focus on generating revenue early on. It’s an approach that can foster business growth, however it does tend to translate to slower expansion because of no large-scale funding.

The 3 stages of bootstrapping

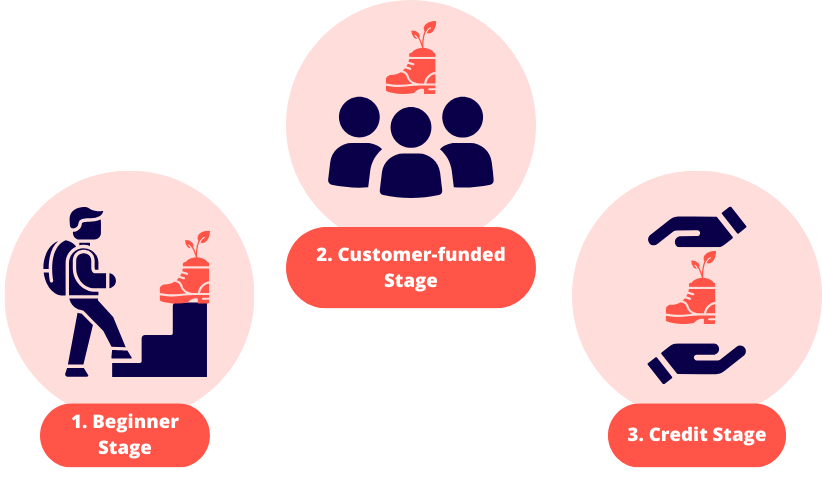

A bootstrapped business model will usually move through three stages as it grows:

1. Beginner stage

At this stage, the entrepreneur uses their personal savings or borrows personal loans from friends or family. Some business owners will keep their full-time jobs while working on their startup business idea in their spare time.

2. Customer-funded stage

As the business gains traction, revenue generated from early customers helps fund ongoing operations. This stage could involve reinvesting net profits into business operations, eliminating the need for outside funding or future investments that will eat away at the founder’s ownership.

3. Credit stage

If the business operating starts to see demand exceeding supply and extra funding is necessary, the company’s growth might have to rely on small business loans or lines of credit. Remember, though, that this is still considered bootstrapping as the company doesn’t give up equity to outside investors.

Why entrepreneurs choose bootstrapping

Many business owners choose the bootstrap method over external funding for several different reasons:

- Ownership and control: Entrepreneurs keep full control over their business decisions rather than being influenced by investors.

- Financial foundations: Managing cash flow and avoiding unnecessary debt strengthens a company’s financial foundation for future investments.

- Avoiding VP pressures: Venture capital firms tend to expect rapid scaling up, which can pressure a business owner to prioritise growth over sustainability.

- Risk mitigation: Saving capital and avoiding excessive debt means business owners can minimise the overall financial risk.

5 bootstrapping strategies for success

Bootstrapping requires that you have smart financial management skills and are a strategic decision-maker. For a proven bootstrapping strategy, you might want to consider:

1. Reinvest profits where needed

Rather than taking early profits as income, successful bootstrappers save capital by reinvesting earnings into product development, marketing or operational improvements.

2. Keep costs low

Cutting out unnecessary spending helps sustain a bootstrapped business model. Some ways to lower your expenses include:

- Operating from home instead of renting office space.

- Outsourcing tasks rather than hiring full-time employees.

- Using free or low-cost digital tools for things beyond your company’s ability in the early stages (e.g. marketing and administration).

3. Generate early revenue

Instead of waiting for perfect products, many entrepreneurs who go down the bootstrapping path release minimum viable products (MVPs) to test the waters in the market and generate sales as quickly as possible.

4. Build strong customer relationships

Happy customers are a valuable asset. Encouraging word-of-mouth referrals for your business idea and repeat purchases can really help your startup grow.

5. Find alternative funding sources

While bootstrapping excludes VP, some entrepreneurs are nowadays leveraging creative funding options like crowdfunding, pre-orders, barter agreements with suppliers and more.

Pros and cons of bootstrapping

If you’re thinking about bootstrapping your way to entrepreneurial success, here are some of the biggest advantages and disadvantages of bootstrapping to consider before diving in head-first:

Pros

- Full ownership and control: A bootstrapped business is entirely owned by its founders, so they are the ones making independent strategic decisions.

- Encourages resourcefulness: Without the safety net of outside funding, bootstrapped companies need to make the most of their resources. The result is usually leaner, more efficient operations.

- Financial stability for the future: By avoiding hefty loans and external funding, bootstrapping means you can have stronger financial foundations for investments.

- Attract future investors: Investors are more likely to fund a company’s growth if it demonstrates financial discipline and self-sufficiency in the early startup stages.

Cons

- Slower growth: Limited capital can make it harder to scale up.

- More personal risk: Business owners take on most of the financial burden, which can be stressful.

- Demand exceeds supply: A lack of funds might prevent a startup from meeting higher customer demand.

- Missed opportunities: Without external funding, some business opportunities requiring lots of investment can be out of reach.

When to think about external funding

While bootstrapping is an excellent business model for many entrepreneurs, there are times when outside funding will be necessary. If, for example, demand outstrips your company’s ability to supply, funding can help expand operations. It doesn’t mean a founder cannot pull oneself up by their bootstraps!

Alternatively, if you plan to enter competitive markets, some industries will demand huge upfront investments for you even to compete – let alone thrive.

Finally, external funding can be great when you are developing expensive products. Some business ideas, like those conceived in cash-strapped tech startups, need plenty of upfront capital for research and development.

Bootstrapping is not just a way to fund a business – it’s more of a mindset. Entrepreneurs who commit to bootstrapping need to be highly resourceful, disciplined, and willing to take on calculated risks. It’s a challenging journey for sure, but making a bootstrapped company thrive without VP investments proves you have the determination and financial savvy to succeed.

See related terms

What is credit?

What is cash flow?

What is capital?