TABLE OF CONTENTS

Divided into credits and debits, a trial balance is a bookkeeping table detailing the total ledgers in a business. If you have not made a bookkeeping error the trial balance should be mathematically equal in both the credit and debit columns. If both columns are equal, then the trial balance is balanced.

Purpose of a trial balance

A trial balance is a staple of double entry bookkeeping and is usually undertaken periodically, at the end of each reporting period.

A trial balance helps you to ascertain whether there are mathematical errors in the ledgers. If the trial balance is not equal in both columns, you must drill down to discover the error and fix it.

A trial balance is usually completed as an internal document to keep track of finances and your accounting and bookkeeping are accurate.

Trial balance vs. balance sheet

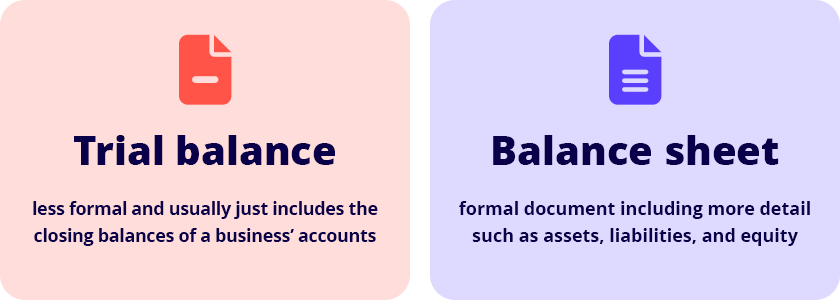

Although similar, the difference between a trial balance and a balance sheet comes down to scope and purpose.

A trial balance is less formal and usually just includes the closing balances of a business’ accounts. Whereas a balance sheet is a formal document, often intended to be released more broadly and will include more detail such as assets, liabilities, and equity.

See related terms

What is a sole proprietorship?

How to calculate profit margin (with formula)?

What does accrued mean?