Small business bookkeeping is an inescapable element of running your own well managed small business.

Some small business owners are more than capable of performing their own small business bookkeeping and forgo the professionals and advisory services.

Other small business owners will decide their time is better spent elsewhere and would rather outsource bookkeeping responsibilities to a dedicated bookkeeper or accountant.

The choices involved in tackling small company bookkeeping are clear:

- You can rely on the services of a good bookkeeper or accountant to complete bookkeeping tasks on your behalf.

- You can go it alone and undertake your own small company bookkeeping.

We’ll be laying out the second option which will see you doing your own small business bookkeeping, including various methods and responsibilities you’ll encounter and how to go about handling them with relative ease.

If you do wish to take the first option to engage the services of a bookkeeper or accountant yet remain unsure of your choices, please refer to this article to better understand your options.

How to do your own bookkeeping when you own a small business

You’ve decided to back yourself. You’re confident that you have the requisite skills and time to do your own bookkeeping.

With a little know-how, the duties are well within your grasp.

The point of small business bookkeeping

Before we unpack methods and tasks – what’s the actual point of small business bookkeeping? By undertaking basic bookkeeping duties, you’ll benefit from the following:

- You’ll have accurate financial records from which you can deduce your profitability and cash flow.

- You’ll be able to meet your compliance responsibilities, including lodging tax returns and claiming deductions on business expenses.

- You’ll have reliable financial records and financial information to underscore and inform business decisions and forecasts.

- You’ll be able to budget with a much higher degree of accuracy.

- You’ll be well informed of your outgoings and incomings, including overdue invoices and expenses.

Accounting software vs manual bookkeeping

Spreadsheet or ‘shoebox’ accounting is still technically a viable option, to a degree. But with the emergence of cost effective, automated, and accessible accounting software, those archaic methods have been rightfully replaced.

While you can always make use of spreadsheets to record your business transactions, dedicated software is a much more accurate and time-conscious method, with the additional benefit of automation.

For example, if you use a POS set-up to take payments, you can link this with your chosen accounting app. This means you can immediately import sales records and get a live view of your cash flow.

Similarly, if you link your bank account with your accounting software, bank reconciliation becomes a pedestrian affair when compared to manual cross checking.

Relying on dedicated cloud accounting software is undoubtedly the easy way to do bookkeeping.

Primary bookkeeping duties

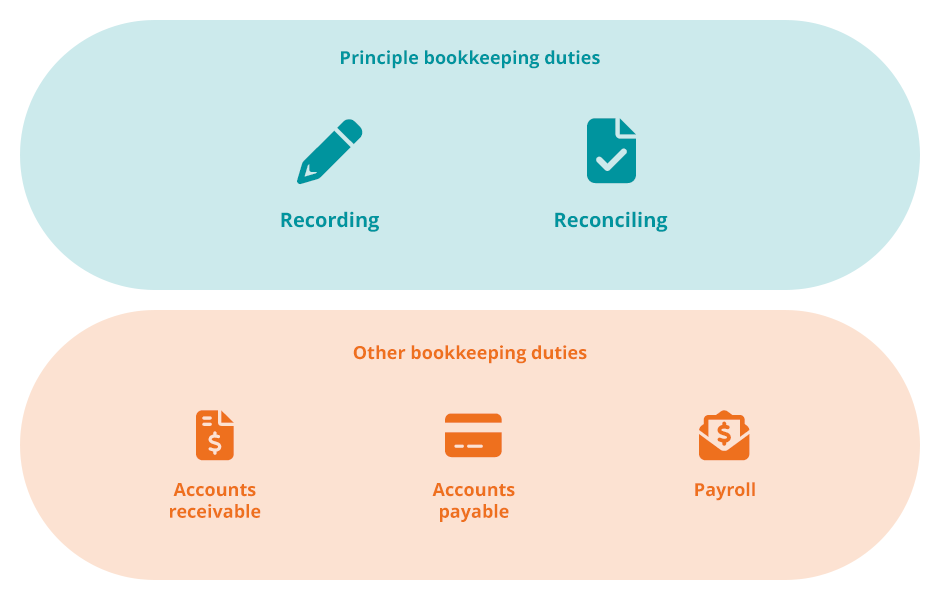

To perform your own bookkeeping, you’ll first need to understand the core concept of bookkeeping. The principle bookkeeping duties for a small business owner are recording and reconciling.

Recording

To do your own bookkeeping you’ll need to record everything. This was traditionally performed using physical logbooks, which originally gave rise to the term ‘bookkeeping’. These days, software such as cloud accounting apps, POS solutions and invoicing apps are a more broadly accepted method.

You’ll need to scrupulously record:

- sales

- expenses and purchases

- receipts

Not only is accurate recording necessary to understand your incomings and outgoings, you’ll also need access to these records when claiming tax deductions from the ATO.

Reconciling

Once you have a set of accurate records, you’ll need to reconcile them.

Reconciliation, or bank reconciliation, is the act of cross checking your sales or expense records against your bank statements.

By reconciling you can understand if there’s any errors in your records, which can then be identified and rectified as rapidly as possible.

You can choose any schedule you like to undertake reconciliation – many small businesses reconcile every day. Others do so weekly, fortnightly, or monthly. At the very least reconciliation needs to take place before the submission of a tax return.

By choosing to reconcile more regularly, you gain the benefit of immediate issue identification.

While you can choose to perform reconciliation manually, you’re much better served using accounting software to import bank records, which essentially automates the process of reconciliation.

Other bookkeeping duties for small business owners

In addition to recording and bank reconciliation, regular bookkeeping duties you’ll be tasked with also include:

- Accounts receivable: Accounts receivable duties involve both the reporting upon, and chasing of, late invoice payments.

- Accounts payable: Accounts payable duties involve ensuring you pay your own outstanding invoices on time.

- Payroll: Your regular payroll duties involve making sure you pay your staff accurately and on time, according to relevant awards and employee agreements.

Bookkeeping methods for small business

When it comes to the recording aspects of bookkeeping methods for small business, there are two primary accounting methods available – ‘accrual accounting’ or ‘cash accounting’.

Cash accounting

The cash accounting method refers to the act of tracking the actual flow of money in and out of your business in real time.

- If you make a cash sale, you record it that day.

- If you need to pay an invoice, you only record the expense when you’ve literally paid for it.

- Similarly, if you’re owed money on an invoice, you only record the income on the actual day you received it in your bank account.

The benefits of cash accounting are centred around simplicity. The cash accounting method is suitable for simpler, mostly cash based businesses who need to monitor their daily till and don’t have a lot of outstanding invoices or accounts receivable.

The drawback of this method is that you don’t have a clear view of what you owe, or what you’re owed – obscuring your true financial position.

Accrual accounting

With the accrual accounting method, you record transactions when the act takes place, not when cash has changed hands.

- If you’ve performed work for a client and sent them an invoice, you’ll record the income that day, despite not having been paid yet.

- If you owe money, you’ll record the expense when an invoice is received, even if you haven’t actually paid it yet.

The benefits of accrual accounting lie in the visibility of what you owe and what you are due. It works well for more complex, invoice-based businesses who’ll benefit from a more accurate overview of their finances.

The drawback of accrual accounting is that it’s a much more complex bookkeeping method, relying on a deeper understanding of bookkeeping practices that would often be outsourced to a professional bookkeeper.

How much time do small business owners spend on bookkeeping?

How much time a small business owner spends on bookkeeping is highly dependant on their tools, methods, reconciliation schedule and the size and scope of their business.

By relying on accounting apps, particularly when linked to your bank account and to other solutions such as POS or invoicing software, you can drastically reduce the time you spend doing your own bookkeeping.

Conversely, if your bookkeeping system relies on data entry in a spreadsheet and manual bank reconciliation processes, you could easily spend many hours per week doing small business bookkeeping.