You’ve no doubt already come across ‘gross vs net’ income. As a business owner, it’s an important staple of everyday operations that you need to get a grip on. But it’s also one of those pairs of terms that sounds similar but actually means very different things.

Both gross and net income show up in your income statement, but they measure different things. Gross income helps you see how much your business makes from selling goods or services before overheads kick in. Net income, on the other hand, shows the actual profit your company makes once all business expenses have been deducted.

What is gross income?

Gross income – sometimes called gross profit or gross margin – is your total income from sales minus the cost of goods sold (COGS). Think of it as your starting point: the money coming in after you cover the costs to produce what you sell.

COGS includes things like:

- Raw materials to make your product.

- Labour costs (wages for staff involved in production).

- Packaging, shipping costs and freight tied to the product.

- Items bought for resale.

It doesn’t include other expenses like marketing costs, administrative costs, rent or interest.

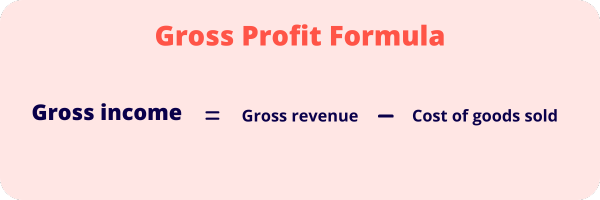

Formula to find gross profit

Gross income = Gross revenue – Cost of goods sold

Let’s say your company makes $500,000 in total sales over a given period, and it costs $300,000 in raw materials, labour and shipping to produce those goods. In this scenario, your gross income would be:

$500,000 – $300,000 = $200,000 gross profit

$200k is the money left over to cover all other expenses and (hopefully) generate a net profit.

Why is gross income important?

Gross income is a number, yes, but it’s also so much more than that. It really is a measure of whether your company is able to generate a profit from its business operations. It helps break down things like:

- Broad overview of earnings: It shows how much the business earns before deducting costs.

- Benchmarking: Comparing gross income with your competitors will help you see your profit margin and market share.

- Solid operations: Tracking gross income over time helps you spot changes in production costs and productivity. If your gross profit percentage shrinks, it might mean your raw materials are getting more expensive, or labour costs are eating into your revenue.

What is net income?

Net income is what’s left after all expenses are taken out of your gross income – think operating expenses and other costs of doing business:

- Rent/lease.

- Marketing.

- Administrative costs like office supplies and salaries for non-production staff./

- Interest on loans.

- Taxes (income taxes, payroll taxes, GST).

- Utilities and insurance.

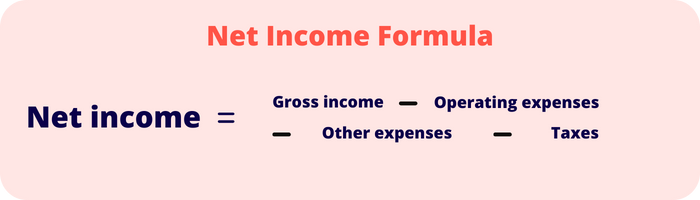

Formula to calculate net income

Net income = Gross income – Operating expenses – Other expenses – Taxes

Let’s jump back to our earlier example and say the gross income = $200,000. If you spent $100,000 on rent, salaries, marketing and other expenses, and another $30,000 on taxes and interest, your net income would be:

$200,000 – $130,000 = $70,000 net profit

So $70k is the final amount that truly matters to you, your investors and anyone else looking into your financial health (like a bank that you’ve approached for a loan). It’s how much profit your company makes after every expense involved in running the business has been deducted.

Why is net income important?

- Tax obligations: Your tax liabilities are based on net income, not gross.

- Profitability: Net shows how much profit the business earns after covering both production and operating costs.

- Decision-making: A sudden dip in net income could be a sign that you need to reduce your overheads or raise your prices.

- Investor interest: Investors, lenders and other stakeholders pay close attention to net income as it indicates how much profit your company makes after expenses.

Gross vs net differences

Both gross and net income are useful metrics, but they answer different questions:

- What’s included?

- Gross income = total revenue minus goods sold.

- Net income = gross income minus operating expenses, taxes, interest and other costs.

- Are we being purposeful?

- Gross is useful for analysing sales and productivity.

- Net is important for understanding your overall profitability and how much money the business actually keeps.

- How are things performing?

- Gross gives a snapshot of how well your company’s core products or services are performing.

- Net gives the complete picture of your financial position.

Think of it this way: gross is your starting line, net is your finish line.

Why both matter for your business

As a business owner, focusing on both gross and net income gives you a much clearer financial picture. Gross helps you stay on top of whether your production and sales model makes sense, whereas net confirms whether your business as a whole is profitable (once all expenses are deducted).

Here’s why you should track both:

- Planning growth: Gross income will show you whether scaling your production or sales will increase profit, while net income will reveal whether the overall business model is sustainable.

- Spotting risks early: Rising production costs can reduce your gross margin, while ballooning operating expenses will eat away at your net profit.

- Complete picture for reporting: Both figures are needed for financial statements and for sharing results with stakeholders.

Mastering the gross vs net income differences is essentially about seeing how your business earns, spends and keeps its money. While gross income shines a light on production and sales, net income shows the company’s ability to turn revenue into actual profit after all costs are factored in.

For the most accurate financial statements and better decision-making, you need both numbers at hand. Together, they’ll give you a holistic view of your business’s financial health and help you answer the most important question: how much profit does my company really make?

See related Terms:

What is an invoice?

Gross profit vs net profit

What is marginal cost?