Most businesses are familiar with the standard invoicing process: the supplier issues the tax invoice and the purchaser pays. Simple, right? Not exactly. In some special cases, the process is flipped on its head – and that’s where Recipient Created Tax Invoices (RCTIs) come into play.

If you’re dealing with multiple suppliers or contractors, or if you need to juggle complex pricing arrangements, an RCTI might be the way to go in order to simplify your admin and keep the Australian Taxation Office (ATO) happy.

What is a Recipient Created Tax Invoice (RCTI)?

An RCTI is a valid tax invoice created by the recipient (the purchaser) of goods or services, rather than the supplier. In short, instead of waiting for a supplier to issue an invoice, the recipient creates the tax invoice and sends it to the supplier. This is only allowed under specific conditions set out by the ATO.

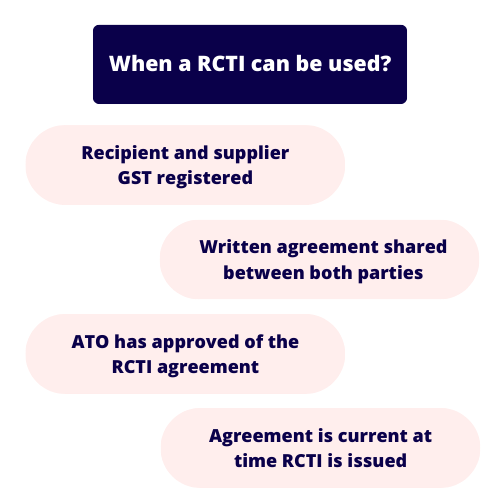

Here are the only scenarios where an RCTI can be used:

- Both the recipient and supplier are registered for GST.

- A written agreement exists between both parties.

- The ATO has approved the type of supply for RCTI use.

- The agreement is current at the time the invoice is issued.

As an example, let’s say an RCTI is used by a grain co-operative paying farmers for crops, or a government department disbursing grants. Both are situations where the purchaser is better placed to determine the value of services and then issue the invoice themselves.

When can you create an RCTI?

You can only generate a recipient created tax invoice if the goods or services fall under the categories approved by the ATO. The arrangement also needs to be properly documented in a written agreement that outlines:

- The goods or services covered.

- That the recipient will create the invoice.

- That the supplier won’t issue their own tax invoices.

- That both parties are registered for GST (and will notify each other if that changes).

If anyone fails to meet these conditions, it will mean the tax invoice is invalid, which could hamper your ability to claim input tax credits on your BAS.

How to create a valid RCTI

Creating an RCTI is similar to generating a standard tax invoice, but you have to label it as a ‘Recipient Created Tax Invoice’. It should include all the usual elements of a normal tax invoice like:

- Supplier and recipient details.

- ABNs for both parties.

- Description of goods or services.

- GST amount.

- Invoice date and number.

Need help getting started? Use a pre-made RCTI template in Word, Excel or your accounting software (like Reckon) to stay compliant.

See related Terms:

What is an invoice?

Gross profit vs net profit

What is marginal cost?