What would you say is the ‘starting point’ of financial success in a business? For most owners, it’s revenue. In short, it shows the total money earned through a company’s primary operations, whether from selling goods or services or earning rental income.

As the top line on your company’s income statement, revenue is the most basic indicator of a business’s ability to generate income before deducting any expenses. But to fully understand the revenue meaning, you’ll need to know what counts as revenue, as well as how it fits into your company’s financial statements.

Revenue (definition)

In accounting terms, revenue is the gross income a business earns over a specified period – which is usually a quarter or the entire financial year – and it includes all the money brought in from the sale of goods or services related to the company’s day-to-day activities. It’s also called operating revenue.

Here’s a simple example: a plumbing business earns operating revenue from services it performs for customers, while a property management company might receive rental income from tenants. Both are considered revenue because they come as a direct result of the company’s operations.

On the other hand, non-operating revenue comes from other sources – think interest income, dividends or gains from selling assets. While these sources aren’t central to the business’s main purpose, the earnings still appear on the income statement, just under a separate heading.

Revenue is recognised differently depending on the accounting method used. Under accrual accounting, a business records revenue when a service is delivered or a product is shipped, even if a payment hasn’t been received. Under cash accounting, revenue is only recorded when the cash is in hand.

Revenue vs income

Revenue and net income are easy to confuse – but they are not the same. Revenue is your business’s total earnings before costs, whereas net income is what’s left after taking away all your expenses, including the cost of goods sold, operating expenses, interest, taxes and more.

In other words, revenue measures how much your business generated and net income measures how much it kept. On the company’s income statement, revenue is listed at the top (hence the term ‘top line’) while net income appears at the bottom (‘bottom line’).

If you want to see how profitable your business really is, you need to compare both figures. This is because a company can have high revenue but very little profit if its costs are too high.

Types of revenue

There are two main types of revenue:

- Operating revenue: The income generated from the company’s normal business activities, like selling products or providing services.

- Non-operating revenue: Includes earnings from investments, the sale of assets or interest earned on savings or loans.

In some industries, especially with big or diversified companies, revenue can be broken down by different departments or product categories, which can help business owners and investors get a full picture of the company’s performance.

How is revenue calculated?

The basic idea is simple: multiply the amount of goods or services sold by the price per unit. Say you run a café that sells 500 coffees at $5 each. In this scenario, your total revenue for that item is $2,500.

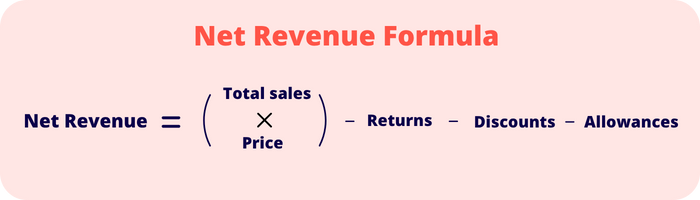

In more complex businesses, calculating revenue will also need to factor in discounts, product returns, allowances and other things. After making these adjustments, the resulting figure is called net revenue or net sales.

Here’s a simplified formula:

Net revenue = (Total sales × Price) – Returns – Discounts – Allowances

With this figure, you’ll get a much more accurate picture of the money earned from customers that your business expects to keep.

Why revenue matters

Revenue is more than just a number on your annual reports. It shows how well your business can attract and retain customers, how competitive your offerings are compared to others in the market, and how scalable your operations really are.

Investors and stakeholders will look at revenue growth as an early sign of a company’s potential. Consistent increases in annual revenue point to a healthy and expanding business.

Revenue also plays a part in other financial ratios:

- Gross profit margin compares revenue with the cost of goods sold.

- Revenue per employee shows how productive a company is at generating sales.

- The price-to-sales ratio compares a public company’s stock price to its revenue earned.

Revenue in government and non-profits

Yes, revenue is a business term, but it also applies to the public and non-profit sectors. Government revenue, for example, is the money the government receives from taxes, duties, fees and other sources. It’s used to fund public services and infrastructure.

In the not-for-profit world, non-profit organisations also generate revenue, although it’s from donations, grants, service fees and other streams. Their goal isn’t to make a profit, but they still need to track their revenue so that their operations can be sustained.

Example of revenue in action

Let’s look at a practical example. A digital marketing agency sells two services: campaign strategy and content production. In one quarter, they deliver $120,000 in strategy services and $80,000 in content creation. They also earn $5,000 in interest income from business savings.

- Operating revenue = $120,000 + $80,000 = $200,000

- Non operating revenue = $5,000

- Total revenue = $205,000

If the agency later issues refunds of $10,000 for cancelled projects and offers $5,000 in discounts, their net revenue is $190,000.

The main usefulness of revenue is that it gives you an immediate glimpse into your company’s operations and growth trajectory.

Now that you know how revenue is calculated, you can use it to inform future business decisions and optimise your pricing structure for goods and services. And as your business grows, focusing on not just more revenue but also smarter revenue can help turn those earnings into sustainable net income and real progress.

See related terms

What are assets?

What is capital?

What is gross profit?