Accounting software for farmers

Manage your farm’s finances with ease with our farm accounting software.

Why should you choose us?

Easy GST & compliance

Automatic bank connection

Real-time data

Automate everyday tasks

Take the hassle out of GST & compliance

| Our accounting software allows you to have automatic compliance updates for PAYG and GST, so it’s easy to process tax payments and keep up to date with the latest legislation. Plus, as a small business owner, you’ll always be working on the latest version to give you peace of mind and more time for doing what you love as farmer. |  |

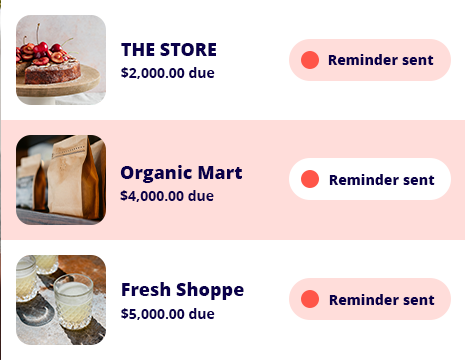

Cut your admin in half with automatic bank connection

| Set up your bank accounts and automatically import your latest banking and credit card transactions into Reckon One. This will help with account reconciliation by keeping track of your financial records, managing financial reporting, monitoring cash flow, tracking business expenses, reducing manual data entry errors, and ensuring your books are ready for tax time. |  |

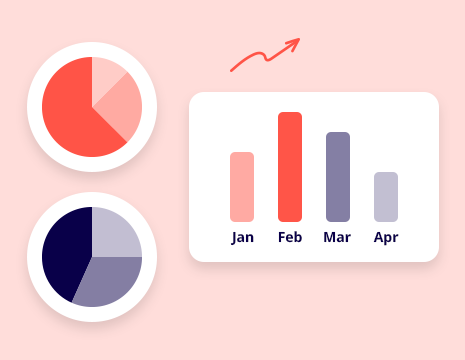

See your financial position in real-time with our farm accounting software

| In the farming business, it’s hard to find the time to sit behind a computer screen and do your bookkeeping. But with Reckon’s farm accounting software, you can keep up to date on the accounting process, run 30+ financial reports and see your overall financial position in your customisable dashboard.

|

|

Automate everyday tasks & share them with your accountant

| Minimise repetitive tasks and manual data entry of your farming business. With Reckon’s farm accounting software, you can automate bank reconciliation, save time on payroll and set up recurring invoicing. It’s also easy to share with your accountant no matter how remote you are. |  |

![]()

“Reckon gives us peace of mind that the numbers are taken care of and our staff are being paid, so we can take care of the farming.”

– Christine Metcalfe, Metcalfe Pastoral

set-up reckon one

The ideal online accounting software for farmers

Based in the Koojan Hills of Western Australia, Christine and her family primarily produce grass-fed cattle for the supermarket trade. With a wide support network comprising suppliers, customers, staff, other local farming families and a little help from Reckon accounting software, the farm runs harmoniously at maximum efficiency.

Related resources

Creating customer profiles and personas for your small business

Looking to take your marketing and sales strategy to the next level? Learn how to use customer personas and profiles for your small business.

Reckon Blog

Visit the Reckon Blog to get the latest news and insights into the small business world in Australia. Whether you're navigating new regulations, exploring growth strategies, or keeping up with trends, we’ve got you covered. Back yourself and learn how to think about your business differently!

Plans that fit your business needs and your pocket

30-Day free trial

Cancel anytime

Unlimited users

† Free data migration offer includes 1 year of historical data + YTD only. Paid subscriptions only.

Helping thousands of businesses with their accounting

Related resources

Creating customer profiles and personas for your small business

Looking to take your marketing and sales strategy to the next level? Learn how to use customer personas and profiles for your small business.

Reckon Blog

Visit the Reckon Blog to get the latest news and insights into the small business world in Australia. Whether you're navigating new regulations, exploring growth strategies, or keeping up with trends, we’ve got you covered. Back yourself and learn how to think about your business differently!

Frequently asked questions

How does the 30-day free trial work?

The Reckon One free trial allows you to try our accounting software for a period of 30 days to ensure it meets the needs of your business. After this period, your subscription will automatically convert to a paid one to avoid any interruptions to your data. However, if you find that Reckon One small business invoicing software is not suitable for your needs, you can cancel your subscription before the billing renewal date and your credit card won't be charged.

If life got in the way and you weren’t able to use your trial, no worries! Just give our friendly support team a shout and we’ll see if we can get you up and running again.

Can I change my software plan later on?

Definitely! Reckon One offers you the flexibility to change your plan to fit the unique needs of your business. Whether it’s downgrading or upgrading, you can easily make these changes right from your Reckon account.

How do I switch from another accounting software to Reckon One?

Making the switch to Reckon One from your current small business accounting software is a breeze with our data migration service!

Head to our data migration page and see how our free* migration service works.

What do I need to get set up with Reckon One?

There is no software installation required. All you need is a device with an internet connection to access your Reckon One account. Simply sign up for an account on our website and start using Reckon One to manage your business.

Is my data secure?

We use the best technology to ensure your data is safe and secure. Our accounting software for small business, Reckon One, is built with cutting-edge HTML5 technology and hosted on Australian servers powered by Amazon Web Services, a leader in cloud data storage.

Do you provide customer support?

We offer support through email, chat, and phone with our local team and resources such as webinars, a small business resource hub, and an online community to help you succeed from the moment you start using Reckon One.

Expert training is also available through the Reckon Training Academy or our trusted partners (accountants and bookkeepers).

Can I grant access to other people?

What are the advantages of using accounting software for small businesses?

Mobility

Online accounting software like Reckon One gives you the flexibility and mobility to manage your finances from any device. Gain clarity over your business’s financial position, automate your accounting process & reduce data entry, track business transactions, get paid faster, and more.

The latest version

Our small business accounting software Reckon One is automatically updated in the cloud. So you’ll always use the latest version without having to manually download compliance updates and accounting features.

Cost-effective

Reckon One pricing works on a SaaS (software as a service) pricing model. So you pay a low monthly fee instead of a large upfront payment for your software license. Paying month to month also means you aren’t locked into a contract and can cancel anytime.

Security

Your data is safely stored in the cloud so you won’t be affected by theft or accidents to physical hardware. All data servers have 24/7 security and several layers of encryption.

Is there a minimum subscription period?

Enjoy the benefits of Reckon One with the flexibility of monthly payments and if you decide it's not the right fit for your business, you can easily cancel at any time.

Try Reckon for free today

30-day free trial. Cancel at any time.