Small business hub

Small business guides

Explore our range of guides designed to help you with important aspects of running a small business in Australia.

GST Guide

Everything you need to know about GST including thresholds, rates & how to register for it!

Invoicing Guide

Everything you need to know about invoicing including reducing your admin & getting paid faster!

Financial Guide

Everything you need to know about financial statements and managing reporting.

Business Financing Guide

Everything you need to know about business financing in order to grow your small business.

Starting a Small Business Guide

Everything you need to know about how to start up a successful business in Australia.

Bookkeeping Guide

Everything you need to know about bookkeeping for your small business.

Business Growth Guide

Everything you need to know to grow your small business.

Free downloadable templates

Invoice template

Free & customisable tax invoice for your small business.

Business plan

Free editable business plan template to build out your business strategy.

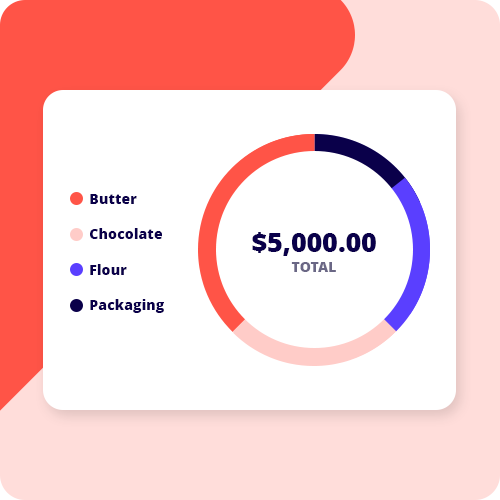

Balance sheet

Free editable balance sheet template to analyse your finances.

Cashflow forecast template

Free cashflow forecast template for small businesses.

Quote template

Free quote template for

small businesses.

Our most loved eBooks

5 low budget marketing hacks

A guide to marketing your business on a shoestring budget.

The case for the cloud

Growth process

The complete guide to growing your business.

Related resources

Small Business news wrap for January!

What’s been cranking in the world of business in the early stages of 2024? We rounded up the top business news for the month of January. Let’s dive in…

Accounting mistakes businesses should avoid

Good accounting practices play a major role in small business because it helps you track the overall financial health of your company. Poor accounting, on the other hand, may hamper your business’s growth and success – keep reading to find out the 10 accounting mistakes to avoid.

Free downloadable templates

Explore our range of guides and easy-to-use templates for helping you running your business.

Try Reckon Invoicing today!

Unlimited invoices. 30 days free. Cancel anytime.