So, why should you learn about gross pay? For workers, it helps you get a better understanding of your income tax obligations with the Australian Taxation Office (ATO), while for employers it’s used when calculating net pay and managing your financial planning for the business.

Gross pay vs net pay

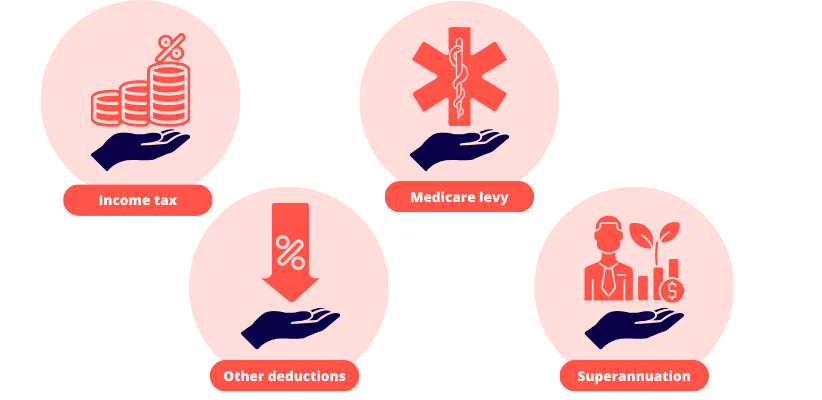

In short, gross pay is the total earnings before any deductions. On the other hand, net pay – what most people would call their ‘take-home pay’ – is the amount deposited into the employee’s bank account. The deductions made to the gross pay include things like:

- Income tax withheld by the employer and remitted to the ATO.

- The Medicare levy, which is generally 2% of taxable income.

- Superannuation contributions, which must be at least 11.5% of an employee’s ordinary time earnings, paid by the employer, as of 1 July 2024. This figure will rise to 12% for the 2025–26 financial year and beyond.

- Other voluntary deductions, such as health insurance premiums, union fees, salary packaging arrangements, etc.

Here’s an example to help illustrate how it works: if an employee has a gross annual income of $75,000 and pays $15,000 in taxes, superannuation and other deductions, their net salary will be $60,000.

Why is gross pay important?

Its main usefulness is how it helps clarify for employees how much they are liable to pay in income tax and other deductions. It can also be used as a benchmark when negotiating a pay bump with employers, or applying for loans or rental agreements. In essence, gross pay helps employees get a broader assessment of their overall earning capacity and plans for savings or investments.

For employers, gross pay is essential for things like managing payroll and calculating tax withholdings, as well as staying compliant with Australian employment laws in general. It can also inform your business budgeting plans by helping you estimate staff costs and any plans for future growth

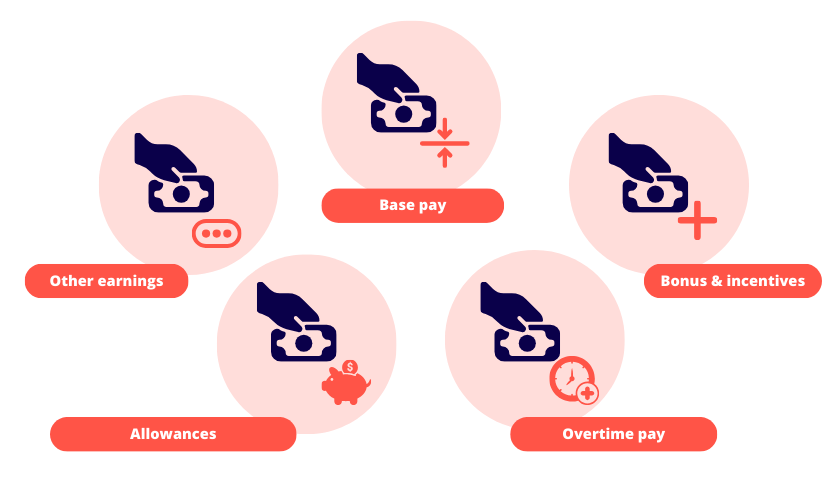

Main components of gross pay

Gross pay encompasses more than just the base salary. Let’s break it down into its five core parts:

- Base pay: For salaried workers, this is the agreed-upon annual salary. For hourly employees, it’s the hourly rate multiplied by the hours worked during the pay period.

- Bonuses and incentives: Performance-based payments (e.g. sales commissions or end-of-year bonuses).

- Overtime pay: Extra pay for hours worked beyond the standard hours, usually calculated at a higher rate (e.g. 1.5x the hourly rate).

- Allowances: Payments for specific expenses related to the job, whether that’s travel, uniforms or housing allowances.

- Other earnings: This can include redundancy payments, unused annual leave payouts, back-pay adjustments and more.

How to calculate gross pay

Salaried employees

For employees on a salary, calculating gross pay starts with how often they are paid. This could be weekly, fortnightly or monthly.

Example: An employee with paid $7,500 every month (before deductions) will look like:

$7,500 (gross monthly pay) x 12 = $90,000.

If the employee also receives a $5,000 performance bonus, their total gross annual pay will be $95,000. You could then have that annual salary divided by 12 to get their final gross pay per month ($7,916.67).

Hourly employees

For hourly workers, an employee’s gross pay is calculated by multiplying the hourly wage by the total hours worked during the pay period, including overtime.

Example: An employee earning $30 per hour works 40 regular hours and 10 overtime hours (paid at 1.5x):

Regular pay = $30 × 40 = $1,200

Overtime pay = $45 × 10 = $450

Gross weekly pay = $1,650

Gross pay and your Australian tax obligations

Understanding gross and net income forms the basis for determining an employee’s taxable income, which affects:

- Income tax: Employers are responsible for withholding the appropriate amount of tax from their employees’ gross salary and remitting it to the ATO. The exact amount depends on the employee’s tax bracket and any applicable offsets.

- Medicare levy: Most employees pay a 2% levy on their taxable income, although some might qualify for exemptions or reductions.

- Superannuation: Employers need contribute a minimum of 11.5% (FY24–25) of an employee’s gross ordinary time earnings to their superannuation fund.

- Other deductions: These can include salary sacrifice arrangements, union fees or other pre-tax deductions agreed upon by both the employee and employer.

Gross pay vs gross income

In Australia, gross income is the total income from all sources before deductions, which can include:

- Gross pay from employment.

- Investment income, such as dividends or interest.

- Rental income from property.

- Business gross income for sole traders or partnerships.

A person earning $80,000 in gross pay and $20,000 in investment income, for example, will have an individual gross income of $100,000 for the year.

Why employers need to understand gross pay

Employers must accurately calculate gross pay to make sure they are in compliance with Australian employment laws and tax requirements. They also need to do so for managing payroll and to meet reporting obligations for the ATO. Then there’s the need to use gross profit numbers to budget effectively for staff costs and other business expenses.

How gross pay impacts employees

Gross pay can have an effect on a number of different parts of an employee’s financial life, including their:

- Tax returns: The higher the gross income, the greater their tax liability, although tax offsets and deductions can reduce the amount that’s actually payable.

- Loan and mortgage applications: Banks look at a person’s gross income in order to determine their borrowing capacity.

- Superannuation contributions: A percentage of gross pay goes directly to an employee’s retirement fund.

What’s the difference between gross pay and net pay?

Gross income is the total earnings before deductions, while net income is the amount the employee takes home after taxes, super and other deductions.

How is gross pay displayed on a pay slip?

Gross pay usually shows up at the top of the pay slip as the total amount earned for the period.

What if an employee works overtime?

Overtime pay is calculated at a higher rate and added to the gross pay for the period.

Wrapping your head around gross pay will give you clarity around your earnings, while at the same time helping both employees and employers meet their tax obligations.