TABLE OF CONTENTS

- What is IAS?

- Who needs to lodge an instalment activity statement?

- Core parts of an IAS

- How to lodge an instalment activity statement

- IAS vs BAS: What’s the difference?

- 4 tips for managing your instalment activity statement obligations

- Do I need to lodge an IAS if i’m registered for GST?

- Can I vary my PAYG instalments?

- What happens if I miss the due date?

An instalment activity statement – or IAS – is a tax reporting document that’s issued by the Australian Taxation Office (ATO) for people (i.e. individuals) and businesses in Australia. It’s a way to report and pay for certain tax obligations, including things like PAYG instalments, PAYG withholding and fringe benefits tax (FBT).

While it may seem a little bit complicated at first, we’ve got all the information to help break down IAS forms so you can stay compliant and avoid late fees or penalties from the ATO.

What is IAS?

Your instalment activity statement will come as a pre-printed document from the ATO, which makes it easy for any taxpayers who are required to report and pay taxes on a regular basis. Unlike your business activity statement (BAS), which encompasses a much wider range of taxes such as the Goods and Services Tax (GST) and PAYG withholding, the IAS is just about a few specific obligations like PAYG instalments, ABN withholding and FBT instalments.

You’ll need to manage IAS if you’re an individual or business that:

- Is not registered for GST but needs to report PAYG instalments, PAYG withholding or other tax types.

- Report PAYG withholding tax monthly while lodging quarterly BAS as a medium withholder.

- Have income from business and investment income that requires tax to be paid in instalments.

Who needs to lodge an instalment activity statement?

The ATO decides who is responsible for lodging an IAS based on your circumstances as a taxpayer (or tax-paying business). This can include:

- Sole traders and small businesses: If you operate as a sole trader, partnership, trust or company, and you’re required to pay PAYG instalments on your business income or investment income.

- Employers: Businesses withholding PAYG from employee wages or contractor payments need to report this via IAS.

- Self-funded retirees: People earning taxable income from investments or superannuation might be required to pay PAYG instalments.

- Entities not registered for GST: Businesses that aren’t registered for GST but are required to report PAYG withholding, ABN withholding or FBT instalments can use the IAS instead of BAS.

Core parts of an IAS

An IAS form includes a few different fields for reporting the various types of taxes, with the major components being:

1. PAYG instalments

Your PAYG instalments require you to pay portions of your expected tax liability on business and investment income throughout the year. The whole point of it is to reduce the burden of huge tax bills when lodging your annual tax return at EOFY.

2. PAYG withholding

Employers and certain businesses need to withhold a portion of payments made to employees, contractors or suppliers who don’t have a valid ABN, with this amount then being reported and paid via the IAS.

3. Fringe benefits tax (FBT) instalments

If your business offers fringe benefits like car allowances or subsidised loans, you will most likely need to report and pay FBT instalments on the IAS.

4. Other instalments

In some cases, an instalment activity statement can include extra reporting fields for taxes like ABN withholding or other types of income tax instalments.

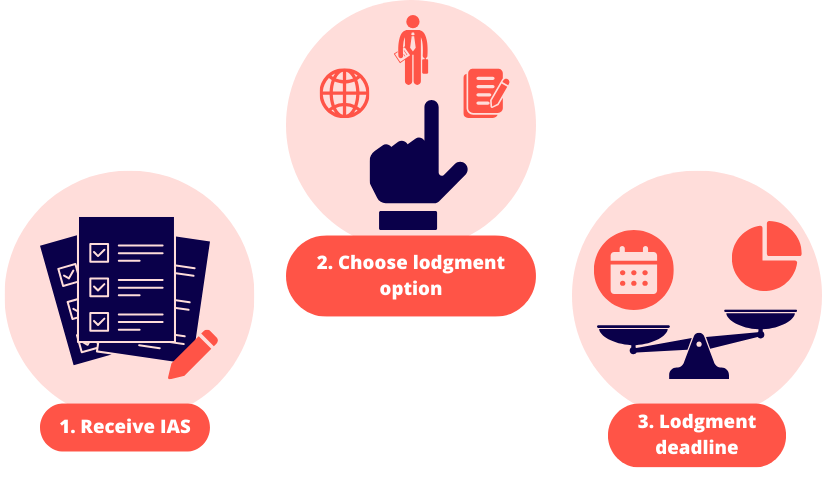

How to lodge an instalment activity statement

1. Receiving the IAS

The Australian Taxation Office sends out pre-printed IAS forms to all eligible taxpayers before the start of each reporting period, as there are different types of paperwork according to your circumstances. Many times these forms will include pre-filled instalment amounts to make your life easier.

2. Lodgment options

As a taxpayer, you can lodge your IAS forms via:

- Online services: Use the ATO’s online platform (as a business or individual) to lodge your IAS forms electronically.

- Tax agent portal: Registered tax agents can lodge IAS forms on your behalf using the tax agent portal.

- Paper forms: Complete and return the pre-printed IAS form by mail – just make sure it’s submitted before the due date.

3. Lodgment deadlines

IAS forms need to be lodged on time to avoid being stuck with late fees or other penalties. The due date will depend on whether the IAS is lodged monthly or quarterly. For example:

- Monthly IAS forms are due on the 21st day of the following month.

- Quarterly IAS forms are the same as your BAS due dates but could differ for certain obligations.

IAS vs BAS: What’s the difference?

While both the instalment activity statement and BAS paperwork are issued by the ATO, they serve different purposes.

For the IAS, its main focus is around PAYG instalments, PAYG withholding and FBT instalments. Non-GST registered businesses, medium withholders and specific entities are the main ones who use it, and they’ll have to take care of it either monthly or quarterly.

On the other hand, BAS is a bit broader and involves GST, PAYG withholding, PAYG instalments and other taxes. It’s for GST-registered businesses and is also managed either monthly or quarterly.

If you’re unsure whether to lodge an IAS or BAS, contact the ATO directly or speak to a registered tax agent.

4 tips for managing your instalment activity statement obligations

- Plan ahead and make sure you have enough funds set aside to meet your IAS obligations. Regularly review your cash flow to avoid having to deal with unexpected shortfalls.

- Keep good, accurate records of every payment, expense and instalment made, as this is the easiest way to complete your IAS forms quickly and accurately.

- If you find that managing your IAS paperwork is getting overwhelming, think about working with a registered tax agent as they’ll be able to process and lodge your forms on time.

- The ATO’s online tools make it easy to access and lodge your IAS paperwork, as well as check on your payment history and vary your instalment, if necessary.

Do I need to lodge an IAS if i’m registered for GST?

Not necessarily. If all your tax obligations are included in your BAS, you might not receive an IAS. However, medium withholders will need to lodge IAS forms for PAYG withholding tax even if they lodge a quarterly BAS.

Can I vary my PAYG instalments?

Yes. If your income has changed significantly, you can adjust your instalment amount to better line up with your expected tax liability. Just be cautious when varying these amounts, as underpaying could be detrimental at EOFY.

What happens if I miss the due date?

Late IAS lodgments can attract penalties or general interest charges from the ATO, so it’s best to stay on top of things and submit all your paperwork ahead of time.

See related terms

What is tax deductions?

What is a ledger?

What are trade creditors?