Sole trader invoice template

Save time and keep your business compliant with our free and easy sole trader invoice template.

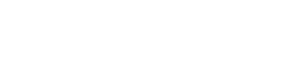

Create a professional sole trader invoice in minutes

Free template

Download and customise your sole trader invoice template completely free!

Fully editable

Add your logo, ABN, service details and payment terms. Our templates are ready to personalise with all the details of your business.

Easy to use

Enter your details and invoice like a pro – no design skills or complicated setup required.

Download your free sole trader invoice template

Easy to use custom invoice template in PDF

Not sure what to include on tax invoices for your sole trader business? Try our free invoice template for sole traders!

Downloadable as editable PDF, Microsoft Word, or Excel invoice templates, these easy-to-use print documents contain all the legal requirements your sole trader business needs for creating invoices, billing clients, and getting paid faster.

Add your business name, customise it, and you’re good to go!

Why choose software over a free sole trader invoice template?

Upgrade from templates to smarter invoicing with Reckon One for just $22/month.

Create & send unlimited invoices

Accept online card payments

Reduce admin & late payments

Customisable invoice templates

Automatically calculate tax

Affordable invoicing software for small businesses

|

Create and send unlimited professional invoices without worrying about extra costs, making it perfect for small businesses and freelancers. Whether you send 1,10 or 100 invoices you only pay one, low flat fee of $22/month. Our user-friendly app and web version offer seamless data syncing across devices, allowing you to manage invoicing quickly and easily to get paid faster! |

|

Get paid faster with online payments

|

Create online invoices with ‘PAY NOW’ links that your customers can pay anywhere, anytime and on any device! It’s easier for your customers and you get paid faster. Our invoicing software accepts credit card online payments via MasterCard, Visa and American Express cards. |

|

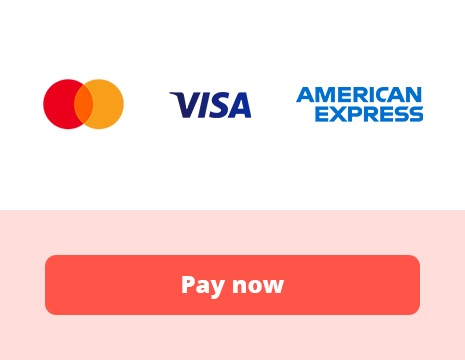

Add recurring invoices & set up automatic payment reminders

|

Simplify your invoicing process with recurring invoices that are automatically generated on your chosen schedule. No more manual entries or forgotten bills. Plus, you can set up automatic payment reminders, ensuring that late payments are promptly addressed and there are no interruptions to your cashflow. |

|

Invoices tailored to your business

|

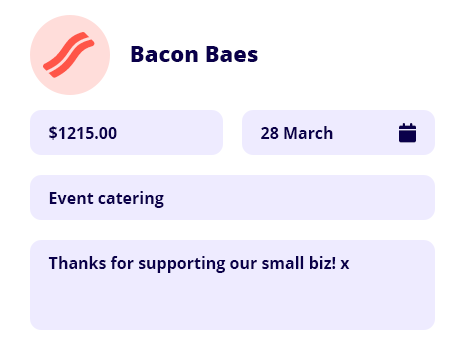

With our invoicing software, you can create professional-looking invoices in seconds. Add your logo to pre-loaded templates, notes to specify payment instructions, and even add personalised messages for your customers. |

|

GST, tax codes and compliance are covered

|

Select preset tax codes to automatically calculate GST and other taxes on your invoices. You can also incorporate discounts and set payment terms with a few taps. Our invoice template makes it easy to tick all the compliance boxes! |

|

Compare Reckon One vs Free Sole Trader Invoice Template

Features

Sole Trader Invoice Template

Automated data entry

Easily add your logo

Easily share online with your customers

Send directly from your mobile

Customers can click to accept and pay online

Tips for using this free sole trader invoice template

Customise this template for your business

You can personalise this template with ease, simply:

- Add your business and customer details in the “Invoice Address” and “Customer” sections

- Edit the invoice number and due date in the top right panel

- List your services under “Description” with quantity, unit price, and total

- Include optional notes (e.g. project summary or terms) in the “Notes” box

- Set up payment details at the bottom — update your bank name and account number

- Indicate if GST applies by adjusting the tax field and clarifying whether you’re GST-registered

Our template is formatted for you. Just enter your data and watch as the totals calculate automatically!

Sending invoices to your clients

Fill out, save, and send via email. Word, Excel or PDF, you can format how you like. You can also print and hand it over in person, depending on your workflow.

What to include on your tax invoice template

Your tax invoice must include the following 7 pieces of information to be valid. These include:

- the words ‘Tax invoice’ (if you are GST registered)

- business name (or trading name)

- Australian Business Number (ABN)

- invoice issue date

- brief description of the goods or services sold, including quantity and price

- the GST amount payable (if any) and,

- the extent to which each item sold includes GST.

What our customers are saying

Why use this free invoice template for sole traders?

Reduce errors

Running a business is stressful, and being a sole trader makes it even more so. An invoice template helps focus your time, avoid mistakes and send invoices quickly.

Give your business a standard

Having inconsistent documentation will confuse your customers and add extra time to your data entry duties. Having a consistent standard for your invoicing and billing processes adds professionalism to your operation.

Duplicate, share and simplify your invoicing

An invoice template enables you to produce and share your invoices with ease, eliminating the time spent recreating them from scratch. With easy-to-create templates, you can get paid faster and stay on top of missed payments.

Free downloadable templates

Invoice template

Free & customisable Excel and Word invoice template for your small business.

Payslip template

Free & editable payslip template for Aussie small businesses.

Business plan

Free editable business plan template to build out your business strategy.

Cashflow forecast template

Free cashflow forecast template for small businesses.

Balance sheet template

Free & customisable balance sheet for your small business.

Profit & Loss template

Free & editable profit & loss template for Aussie small businesses.

Cashflow statement template

Free cashflow statement template for small businesses.

Quote template

Free quote template for

small businesses.

Business continuity plan template

Free continuity plan template for small businesses.

Frequently asked questions

What makes this invoice template ideal for sole traders?

It’s tailored for sole traders, with fields for ABN, GST, and clear service breakdowns—no extra complexity.

Why should sole traders use professional invoices?

Using a professional-looking invoice template helps you get paid faster, build credibility with clients, and ensure you meet tax and compliance requirements (including ABN and GST where applicable).

Do I need to use software if I use this template?

The sole trader invoice template is a great start. But if you want to automate invoicing, track payments, or send reminders, Reckon One offers invoicing software for just $22/month.

Why is invoicing important?

An invoice is how you get paid. It lets the buyer know how much they owe you, when the payment is due, and the ways in which they can pay. Invoicing is also extremely important for tax reasons and staying compliant with the Australian Tax Office. When you run your own business, save copies of your invoices to report how much you earned, if you’re GST registered, and track how much tax you’ve collected.

Are invoices and tax invoices different?

If your small business is registered for the Goods and Services Tax (GST), your customized invoices must say “tax invoice.” A regular invoice is for businesses not registered for GST. For more, refer to our guide on GST.

How do I create an invoice?

Download our free basic invoice template! We have a PDF invoice template, Word invoice template, or Excel invoice template to choose from. Simply add your logo, business information, and billing details, and you’re ready to send the first invoice to your customer! When your business starts growing with new customers and projects, using accounting software to send recurring invoices may save you time and money. Compare Reckon’s accounting plans today.

What are some tips for invoicing?

- Check formatting, spelling, and grammar, and ensure invoices are correct before sending. Unprofessional invoices can affect your brand image and even prevent you from getting paid!

- Ensure your invoices look good in print and can be read easily on mobile devices.

- Create an email address specifically for invoicing and accounting. For example, set up accounts@yourcompany.com and send all your invoices from that email. This will have a stronger impact on the buyer when asked for payments.

- Set crystal-clear terms on the invoice so that you get paid on time, and include late fees associated with late payments on the invoice.

For more info check out how to avoid mistakes when creating your invoices, here!