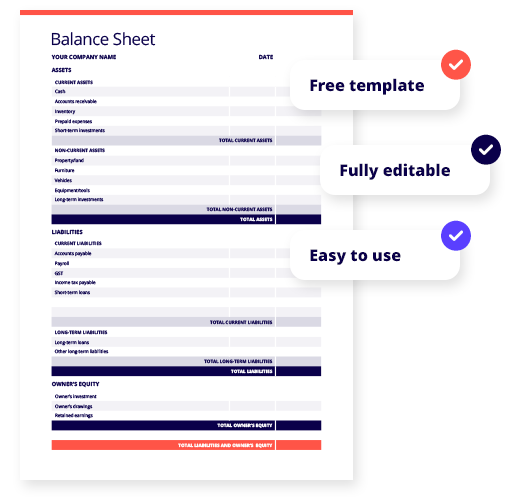

Free balance sheet template for small businesses

Create a professional balance sheet in minutes

Free template

Our Australian balance sheet template can save you time & money.

Fully editable

Easy to use

Simply add your data and our template will do all the calculations for you.

Download your free balance sheet template

Balance sheet template in Excel

Why choose software over a balance sheet template?

Up your accounting game with Reckon’s accounting software for just $22/month.

Control your finances in one dashboard

Gain immediate clarity over your net business. Take control by keeping track of receipts, payments, and expenses and watch your net position change in real-time.

Functionality that suits you

Import your bank statements into Reckon One. Then categorise unlimited transactions, helping you to keep track of the money coming in and out of your business.

Comprehensive reporting and budgeting

Create 30+ impressive reports, and use powerful tools to gain insights. The dashboard is customisable according to the needs of your business.

Reckon One software vs free balance sheet template

Features

Free Balance Sheet Template

Real-time financial position

Easily share online with your accountant

Update date range with a click

Manual data entry

Free downloadable templates

Invoice template

Free & customisable Excel and Word invoice template for your small business.

Payslip template

Free & editable payslip template for Aussie small businesses.

Business plan

Free editable business plan template to build out your business strategy.

Cashflow forecast template

Free cashflow forecast template for small businesses.

Balance sheet template

Free & customisable balance sheet for your small business.

Profit & Loss template

Free & editable profit & loss template for Aussie small businesses.

Cashflow statement template

Free cashflow statement template for small businesses.

Quote template

Free quote template for

small businesses.

Business continuity plan template

Free continuity plan template for small businesses.

Frequently asked questions

What is a balance sheet?

A balance sheet provides a snapshot of your business’ financial standing at a specific point in time. On one side, your business’ assets are reported, and the other side shows your business’ liabilities and shareholders’ equity.

A balance sheet is important because it tells business owners and investors what your company owns and what it owes. It’s an excellent tool to track your business’ worth at any given time and to show the profitability of your business to those who are interested in buying a share.

Why is a balance sheet important for a small business?

If your business is doing well, investors can take a look at your balance sheet and see if you have a profitable business they’d like to invest in. A balance sheet can also help you diagnose problems, pinpoint financial strengths, and keep track of your business’ financial performance over time.

What are the 5 steps to create a balance sheet?

There are 5 steps in creating a balance sheet:

- Determine the time period you’re reporting on.

- Identify your assets as of your reporting date.

- Identify your liabilities as of your reporting date.

- Calculate shareholders’ equity.

- Compare total assets against liability and equity.

Make sure to download our free balance sheet example template to make things easy!

What are the three main components of a balance sheet?

Assets

Assets represent things of value that a company owns and has in its possession, or something that will be received and can be measured objectively. They are also called the resources of the business, some examples of assets include receivables, equipment, property and inventory. Assets have value because a business can use or exchange them to produce the services or products of the business.

Liabilities

Liabilities are the debts owed by a business to others–creditors, suppliers, tax authorities, employees, etc. They are obligations that must be paid under certain conditions and time frames. A business incurs many of its liabilities by purchasing items on credit to fund the business operations.

Owner’s Equity

A company’s equity represents retained earnings and funds contributed by its owners or shareholders (capital), who accept the uncertainty that comes with ownership risk in exchange for what they hope will be a good return on their investment.

Our free balance sheet example template makes working out the above easy – try it out now!

Should a balance sheet always balance?

- Incomplete or misplaced data

- Incorrectly entered transactions

- Errors in currency exchange rates

- Errors in inventory

- Miscalculated equity calculations

- Miscalculated loan amortization or depreciation