Free tax invoice template for small businesses

Create a professional invoice in seconds with our easy-to-use Australian tax invoice template.

Create a professional tax invoice in minutes

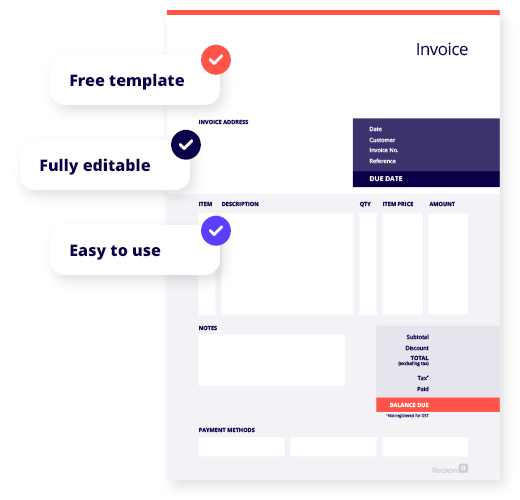

Free template

Our free invoice templates can save you time & money.

Fully editable

These professional-looking invoices are ready to customise with your logo, fonts, notes, due dates, invoice number, and customer, billing, and project details.

Easy to use

Fill out your company and clients’ data, and our invoice templates will do all the calculations for you.

Download your free tax invoice template

Custom invoice template in Word, Excel,

and PDF

Not sure what to include on tax invoices? Try our free invoice template for small businesses!

Downloadable as editable PDF, Microsoft Word, or Excel invoice templates, these easy-to-use print documents contain all the legal requirements your business needs for creating invoices, billing clients, and getting paid faster.

Add your business name, customize it, and you're good to go!

Why choose software over a tax invoice template?

Up your invoicing game with Reckon’s accounting software for just $22/month.

Get paid faster with unlimited online invoicing

Boost cash flow with professional invoices that include a 'Pay now' button for credit card payments. Time-saving features like recurring invoices, payment reminders and templates will shrink your to-do list and ensure you get paid on time.

Add recurring invoices & track overdue invoices

Recurring invoices takes the work out of managing invoicing. Easily set up the invoice and your preferred schedule to create the invoices automatically.

You can also check up on overdue invoices to keep track of late payments!

GST, tax codes and compliance are covered

Select preset tax codes to automatically calculate GST and other taxes on your invoices. You can also incorporate discounts and set payment terms with a few taps.

Our invoice template makes it easy to tick all the compliance boxes!

Reckon One software vs free tax invoice template

Features

Free Tax Invoice Template

Automated data entry

Easily add your logo

Easily share online with your customers

Send directly from your mobile

Customers can click to accept and pay online

Free downloadable templates

Invoice template

Free & customisable Excel and Word invoice template for your small business.

Payslip template

Free & editable payslip template for Aussie small businesses.

Business plan

Free editable business plan template to build out your business strategy.

Cashflow forecast template

Free cashflow forecast template for small businesses.

Balance sheet template

Free & customisable balance sheet for your small business.

Profit & Loss template

Free & editable profit & loss template for Aussie small businesses.

Cashflow statement template

Free cashflow statement template for small businesses.

Quote template

Free quote template for

small businesses.

Business continuity plan template

Free continuity plan template for small businesses.

Frequently asked questions

What is a tax invoice?

An invoice is a request for a payment, similar to a bill. It lists the products or services provided to your customers and what they owe you in return. A tax invoice template has certain legal requirements for things like business names, payment terms, and an invoice date. It’s important to get invoicing right because it’s how you get paid and maintain healthy cash flow. If your business is built around providing goods & freelance services, having to track invoices will likely be a huge part of your daily admin. Our Australian invoice template can save you time & money.

What should I include on a tax invoice template?

Your tax invoice must include the following 7 pieces of information to be valid. These include the words ‘Tax invoice’ – preferably at the top, business name (or trading name), Australian Business Number (ABN), invoice issue date, brief description of the goods or services sold including quantity and price, the GST amount payable (if any) and the extent to which each item sold includes GST.

Should I customise my invoice template?

Using a basic invoice layout is an easy way to avoid overdue invoices since customers will be familiar with it. However, that doesn’t mean your invoices have to be boring. Add your business branding through the use of business logos, accent colours, font, personal messages, or even small advertising to your invoices to entice repeat business.

Why is invoicing important?

An invoice is how you get paid. It lets the buyer know how much they owe you, when the payment is due, and the ways in which they can pay. Invoicing is also extremely important for tax reasons and staying compliant with ATO. When you run your own business, save copies of your invoices to report how much you earned, if you’re GST registered, and track how much tax you’ve collected.

Are invoices and tax invoices different?

If your small business is registered for the Goods and Services Tax (GST), your customized invoices must say “tax invoice.” A regular invoice is for businesses not registered for GST. For more, refer to our guide on GST.

How do I create an invoice?

Download our free basic invoice template! We have a PDF invoice template, Word invoice template, or Excel invoice template to choose from. Simply add your logo, business information, and billing details, and you’re ready to send the first invoice to your customer! When your business starts growing with new customers and projects, using accounting software to send recurring invoices may save you time and money. Compare Reckon’s accounting plans today.

What are some tips for invoicing?

- Check formatting, spelling, and grammar, and ensure invoices are correct before sending. Unprofessional invoices can affect your brand image and even prevent you from getting paid!

- Ensure your invoices look good in print and can be read easily on mobile devices.

- Create an email address specifically for invoicing and accounting. For example, set up accounts@yourcompany.com and send all your invoices from that email. This will have a stronger impact on the buyer when asked for payments.

- Set crystal-clear terms on the invoice so that you get paid on time, and include late fees associated with late payments on the invoice.