A trial balance is a worksheet that a company uses to compile the balances from all ledger accounts into a debit and credit column with equal totals. Trial balances are a test of the double-entry accounting system, ensuring that a company’s books are accurate for an accounting period.

How does a trial balance work?

A trial balance is a worksheet that compiles your assets, liabilities, and equity for a reporting period to ensure your total debits and credits balance. Trial balances are fundamental to double-entry bookkeeping and serve as an exercise in identifying mathematical errors within your accounting.

It is important to note that a trial balance is an internal document and isn’t a financial statement that can be sued outside of an organisation. It is also crucial to keep in mind that while a trial balance can help identify issues on a mathematical level, the report cannot identify problems that are outside of figures and numbers.

What is included in a trial balance

Trial balance report lists several components:

General ledger accounts

Your general ledger accounts encompass all your business activities and the departments to which your transactions belong. For example, your expense accounts, such as rent and cost of goods sold, are debit. You will find your general ledger accounts on the far left column of your report, and each account will be listed by its account number.

Debit entries

Accounts with debit balances, such as accounts receivable, will be listed as a column on the left side of the report. The debit column comes before the credit column. Your total debits will sit below.

Credit entries

Accounts with credit balances, such as accounts payable, will be listed as a column on the right side of the report. Your credit balances will sit at the bottom, much like debit balances.

All the balances

Below your accounts, debits and credits, you will have the account totals.

Trial balance format

| Account Name | Debit | Credit |

|---|---|---|

| Cash | $15,500 | |

| Accounts Receivable | $12,678 | |

| Equipment | $50,000 | |

| Accumulated Depreciation | $8,800 | |

| Accounts Payable | $16,378 | |

| Capital | $35,000 | |

| Service Revenue | $42,000 | |

| Rent Expense | $11,000 | |

| Salaries Expense | $13,000 | |

| Total | $102,178 | $102,178 |

A trial balance can come in three different types:

- Unadjusted trial balance: Impromptu exercise, produced when needed.

- Adjusted trial balance: Produced to prepare financial statements and has the final balances.

- Post closing trial balance: The final trial balance after closing entries have been completed. This is your balance for the next financial year.

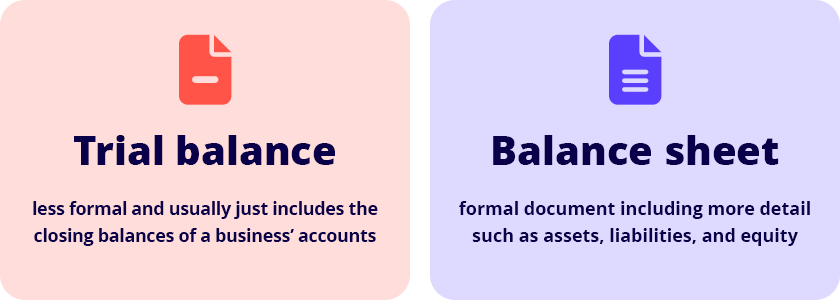

Trial balance vs. balance sheet

The key differences between a trial balance and a balance sheet are:

| Trial Balance | Balance Sheet |

|---|---|

| Internal document. | A legal financial statement. |

| Can be produced any time. | Lists more than account totals but also the entire assets, liabilities and equity of a company. |

| Helps in preparing financial statements. | Public and used to evaluate a business. |

See related terms

What is a sole proprietorship?

How to calculate profit margin (with formula)?

What does accrued mean?