Every business owner or investor worth their salt should have a decent understanding of what ‘return on investment’ is and how it should be leveraged to inform everyday financial decisions.

Return on investment (ROI) is a very basic metric that helps you figure out how profitable an investment has been by comparing its net profit to the cost of the initial investment. Think of it as an easy way to evaluate whether an investment was worth your time and money – not to mention the risk. You can apply ROI to everything from marketing campaigns to real estate investments and even your latest stock picks.

What is ROI?

Return on investment shows the monetary value earned from an investment relative to how much you paid for it. You’ll see it expressed as a percentage, and ultimately it’s there to help decision-makers see the investment’s real profitability.

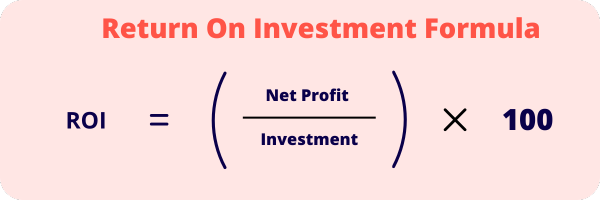

The ROI formula is very straightforward:

ROI = (Net profit / investment cost) x 100

For example, let’s say your business invests $5,000 into a marketing campaign that generates $7,500 in revenue (after subtracting costs, that’s $2,500). In this case, your ROI would be:

ROI = ($2,500 / $5,000) x 100 = 50%

This tells you that for every dollar invested, your business made a 50% return. Yes, it’s a very simple metric, but it’s also a great way to prioritise certain resources and compare the value of different investments you’ve made.

Why ROI matters

Trialling new marketing ads? Planning to expand into different areas? Want to improve your cash flow via different strategies? At its core, ROI can help you quantify success by guiding you in:

- Deciding where to set your budgets.

- Measuring how effective your projects have been.

- Justifying expenditures to stakeholders.

- Improving your financial decision-making over time.

Tracking ROI across various investments means you can see exactly what’s working and what’s not, which should help you improve sales and stabilise the business for the future.

What is a good ROI?

It depends on your goals and your risk tolerance. A 10% ROI, for example, might be excellent for a real estate investment over 12 months, while a 5% return on a short-term email marketing campaign could fall below expectations, thereby making the investment’s profitability fairly lacking.

Generally, a positive ROI means an investment’s net profit is solid. A negative ROI means a loss. However, even a lower ROI can still be a better investment if it carries less credit risk or is more in keeping with your long-term goals.

When comparing investments and different opportunities, always place ROI alongside other metrics like net present value (NPV), internal rate of return (IRR), and cash flows.

How to calculate ROI

To calculate ROI, you’ll need two main numbers: net income (or profit) and the total investment cost. Your net profit should cover all other expenses, including marketing spend, operational costs, opportunity costs, etc.

Let’s look at two examples:

Example 1: Real estate investment

Say you buy a rental property for $300,000 and spend $10,000 on renovations. Over the year, it brings in $30,000 in rental income, and you pay $8,000 in property taxes and upkeep/maintenance.

Net profit = Rental income – Expenses = $30,000 – $8,000 = $22,000

Investment cost = $300,000 + $10,000 = $310,000

ROI = ($22,000 / $310,000) x 100 = 7.1%

Example 2: Marketing campaign

You invest $2,000 in a paid social media campaign that generates $5,000 in new sales. After subtracting fulfilment and product costs of $1,500, your net profit is $1,500.

ROI = ($1,500 / $2,000) x 100 = 75%

As you can see, ROI lets you compare outcomes across unrelated projects. A real estate deal and a marketing campaign might not be apples-to-apples, but ROI puts them on common ground.

Comparing investments and annualised ROI

When comparing different investments, especially those that don’t last the same length of time, it’s a good idea to calculate annualised ROI. This is a version of ROI that adjusts for the time period to show how quickly returns are being generated.

Let’s say you get a 10% ROI in six months. That equals approximately a 20% annualised return (assuming that performance stays consistent). Comparing investments this way can help you prioritise short-term wins versus longer-term growth.

Also, keep in mind that the highest ROI isn’t always the best choice. A risky investment with a 40% ROI might look very tempting, but it might not match your financial return expectations or risk appetite.

ROI’s strengths and weaknesses

The biggest advantage of ROI is its simplicity and universality. It’s a quick snapshot of how much return you got from what you put in. Because it’s easy to calculate and understand, it’s a go-to metric for all industries.

But ROI isn’t perfect. It doesn’t account for the time value of money, which is why many analysts supplement it with NPV or IRR. It also doesn’t include qualitative factors (i.e. brand value and customer loyalty) that might result from an investment but aren’t easy to measure.

Bottom line? ROI is one of the most widely used financial metrics in business, and for good reason. It can help you nail down marketing campaigns or see if a real estate investment is a good idea.

But it’s not a silver bullet. A high ROI figure doesn’t guarantee success if other risks are overlooked. The most innovative approach is to use ROI as one lens in a broader financial toolkit. With diligence and a good ROI calculator, you can use ROI to make better-informed decisions and grow your business with total confidence.

See related terms

What are assets?

What is capital?

What is accounting?