If your business deals in physical goods, chances are inventory is one of your biggest assets. It’s what you sell and what you use to create products. But most of all? It’s what helps you keep your customers happy.

If you’ve ever asked yourself questions like “How much inventory should I keep on hand?” or “Why does inventory tie up so much of my cash?”, you’re not alone. The reality is that managing inventory – and doing so properly – can be the difference between maintaining a healthy cash flow and your customers looking elsewhere.

Inventory meaning: What is it?

Let’s start with the basics. ‘Inventory’ is an umbrella term for the goods your business holds to sell, produce, or operate. This includes everything from raw materials and components to finished products and even maintenance supplies (i.e. cleaning gear and office supplies).

Inventory might not be the flashiest part of running your small business, but it is one of the most important because it connects your supply chain to your sales strategy.

In financial accounting, inventory is listed as a ‘current asset’ on your company’s balance sheet because it’s expected to be sold or used within the accounting period (~12 months). Proper inventory control is necessary here because it affects your business operations so much – think cash flow and storage costs, as well as your ability to fulfil customer orders on time.

Types of inventory

Not all inventory is created equal. Businesses tend to divide inventory into a few main categories:

- Raw materials: The base materials used to make your product. For someone who makes candles, this would include wax, wicks, essential oils, packaging, and other materials.

- Work in Progress (WIP): Also known as Materials Work in Progress, these are items that are partway through the production process. Think half-assembled furniture or garments mid-sewing.

- Finished goods: Products that are complete and ready to sell. In retail, this might be shoes on shelves. In manufacturing, it’s packaged goods ready for shipping.

- Maintenance, repair and operating (MRO) supplies: Support items used in production or day-to-day operations. They don’t get sold, but they do keep your lights on.

Some businesses also track anticipation stock (inventory bought ahead of seasonal spikes), decoupling inventory (extra WIP items that prevent production delays) and safety stock (buffer stock so that you won’t run out during sudden surges in demand).

Why inventory matters

Your company’s inventory has a huge influence on how much revenue you generate. Too little inventory can cause stockouts and/or lost sales. Too much inventory will raise your storage costs and tie up cash. You will also run the risk of those goods becoming obsolete or damaged.

Poor inventory management can also result in excess inventory sitting idle, creating delays that negatively impact customer satisfaction. On the other hand, effective inventory management can keep your supply chain running smoothly and ensure your business can always fulfil orders.

The impact of inventory on financial health

Inventory has a part to play in both your income statement and your balance sheet. When goods are sold, their cost moves from inventory to cost of goods sold (COGS), which plays into your profitability. If that inventory sits around for too long, it becomes a drag on your financial health – especially if you’ve overinvested in stock that won’t sell quickly.

Keeping your inventory levels in check is also essential for strong cash flow. If you’ve spent a large portion of your capital stocking up on goods, you might struggle to cover your operating supplies and wages until that stock is converted into revenue.

Inventory turnover: a key indicator

Your inventory turnover ratio shows how many times you sell and replace your inventory over a set period. You can calculate it very easily by dividing your cost of goods sold by your average inventory value:

Inventory turnover = COGS ÷ Average inventory

A low turnover ratio might suggest you’re holding too much inventory or struggling to sell your products. A higher ratio often signals strong customer demand or good inventory management – but if it’s too high, it could mean you’re cutting it too close and risking stockouts.

Use this ratio alongside things like demand forecasting and historical data to find your ideal inventory levels.

Inventory management best practices

Smart inventory management doesn’t need to be a headache. It just needs to be consistent. Here are a few practical tips to get things right:

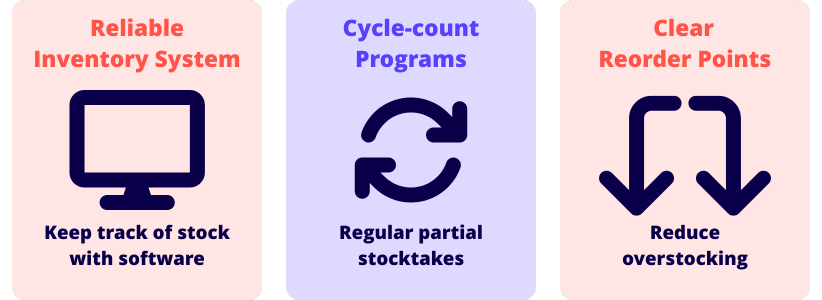

- Use a reliable inventory system: Whether you’re a sole trader or scaling up, tracking stock in real-time (preferably with cloud-based software) will help you stay on top of what’s coming in and going out.

- Start a cycle-count program: Regular partial stocktakes will help you spot issues before they become major problems and cut down on the need for lengthy (and disruptive) end-of-year counts.

- Set clear reorder points: Use sales trends and supplier lead times to set minimum thresholds for reordering. No more stockouts without overstocking.

Real-world inventory examples

Let’s say you run a small skincare brand. Your raw materials inventory may include items such as essential oils, bottles, and packaging. As products are made, those materials move into WIP inventory – for example, creams may be filled but not labelled. Once labelled and boxed, they become finished goods inventory. You might also keep ‘safety stock’ of your bestsellers to handle unexpected surges in customer demand.

Now imagine your products are stocked by a national retailer. Some of your finished goods might be sitting in distribution centres or even on consignment inventory terms – meaning they stay as your property until sold. Tracking all these moving parts is crucial for smoother business operations and cash planning.