Being owed an outstanding debt is a common problem for any small business. When you’re owed cash from reluctant clients, you need to be smart about how to collect debt.

But how does a small business learn how to collect a debt from a payer? What should you have put in place beforehand to prevent it? Not everyone can afford a debt collection service, so let’s check out some debt collection pitfalls to avoid, as well as some tips on how to collect debt effectively.

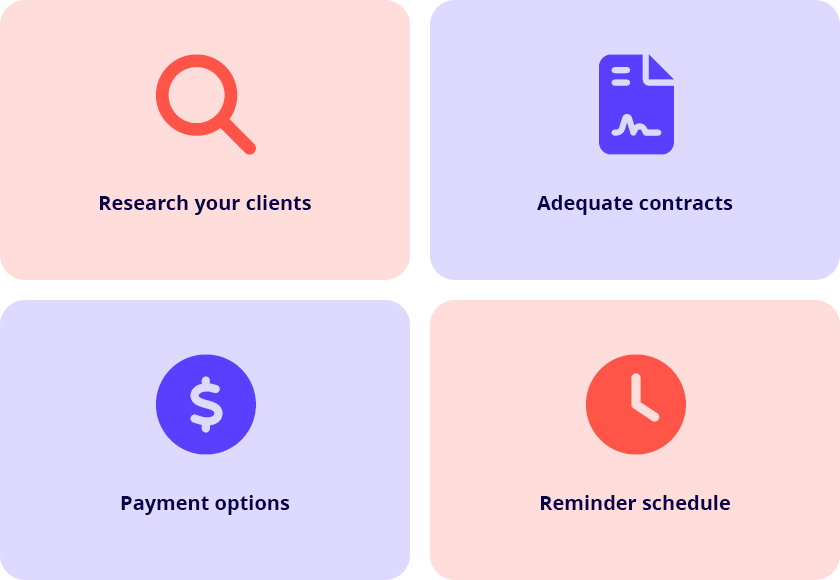

1) Research your clients

When you provide goods or services first and follow up with an invoice for payment, you’re essentially offering a loan. This loan can easily become an unpaid debt and threatens crucial cash flow.

Would you loan money to unknown parties in your personal life? Probably not. Before offering work on credit, do some investigation into the personal and business credit ratings of your potential debtor to avoid laborious debt collection activities. You want to avoid parties who are at risk of insolvency and unable to pay their debts.

You can use services such as ASIC to determine any defaults, bankruptcies, or poor credit scores.

While you’re at it, ensure you have full and independently verified information on the client such as their ABN, phone number, address, trading name and email address.

2) Inadequate contracts

Sometimes small businesses get caught out by scripting inadequate contracts/agreements or forgoing contracts altogether, especially with known clients.

This is a huge mistake. Consult a lawyer if necessary or find easy to download pre-prepared legal documents.

Eventually the day will come where a customer refuses to pay and, if you don’t have a written contract with clear terms or a paper trail of the transaction, you’ll have no evidence to support your attempts to recover the debt through any potential legal action.

Stay safe and protect yourself with adequate, signed and safely stored agreements.

Your payment terms are of the utmost importance here – create strict terms for payment and detail consequences if a payment isn’t made by a debtor, including legal and debt collection activity.

For example, if you’re a photographer you can add a clause stating the photos you took for them remain your own copyrighted property up until the point of payment, disallowing them from using images for their business website or advertising.

This will assist in any potential legal action over unpaid debts and will form a paper trail in anticipation of writing off bad debts.

3) Payment upfront

Do you really need to be extending lines of credit to a debtor? Consider avoiding one lump sum payments entirely, depending on your style of business. By invoicing in instalments, you’ll never have to ask, ‘how to collect debt?’ ever again.

If you run a retail sales business dealing in knowable pricing structures, you can choose to require prepayment of an invoice before you begin work. Sometimes you could decide a down payment is at least necessary.

Make sure you have a great system for signing legal e-documents (there are many apps available for this), as well as various payment options including credit cards and PayPal. This may be harder for service-based companies where hours worked may change and full prepayment isn’t a viable option.

4) No reminder schedule

Following up on your invoices is paramount to debt repayment. If you run a small business, you’ll undoubtedly be taking on a lot yourself and chasing payments can quickly fall by the wayside.

If you want to clear your accounts receivable, what you need is a proper debt reminder schedule. If you’re using modern accounting software you should be putting out invoices with exceptional ease, in seconds, right there on your phone.

However, once your invoice is issued, what do you have in place to follow these up? Create a schedule of reminders, calendar appointments for calls, set up email templates for quick wins and where possible, re-fire invoices from your accounting software.

Time is never your friend, so a timely beat of reminders is necessary to ensure rapid debt recovery and avoiding action that includes a debt collection service or a demand letter

If you follow the above steps the likelihood of you needing to ask how to collect debt will diminish greatly and your available cash flow will be markedly improved.