TABLE OF CONTENTS

Firstly, let’s answer the question ‘what is accounting?’ and get on the same page. Accounting is the recording, analysing and summarising of financial information. It’s imperative in helping you understand the financial health of your business and planning your costs and budget for the year. Additionally, accounting ensures you’re properly preparing tax reports for government compliance.

So why is knowing accounting concepts important? Within a small business, good accounting practices allows you to:

- Track and ensure you have adequate cash flow – vital for the success of your business.

- Monitor the profit and loss statement and analyse which areas of the business are most profitable and identify where peaks and troughs occur.

- Produce reports on your businesses’ financial position. This information is necessary to show banks when applying for a business loan, or to show potential investors.

- Make better use of your accountant’s time, allowing them to help with your business and financial planning, rather than sifting through a shoebox full of receipts.

- Keep track of your businesses’ tax obligations such as collecting and remitting GST. By law, the Australian Tax Office (ATO) requires owners to keep records of all business transactions for five years from the date the tax return is lodged in case of an audit.

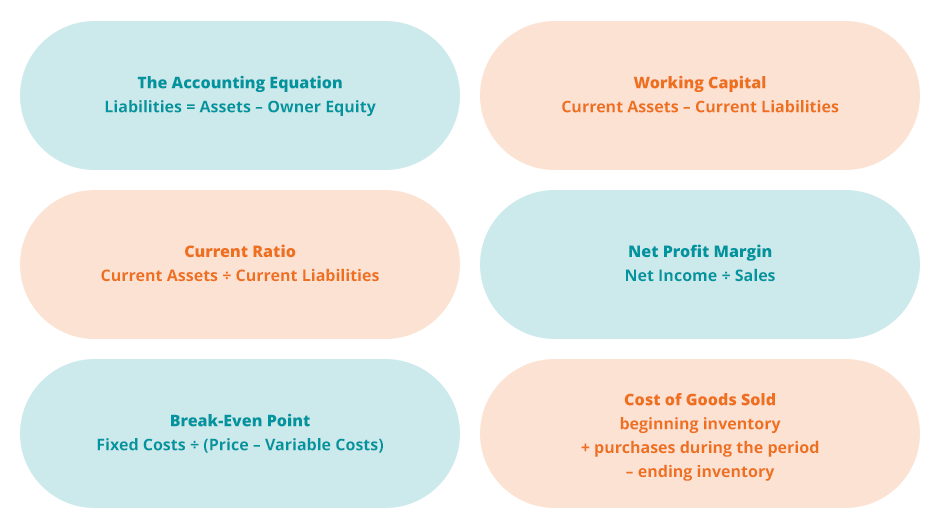

Accounting formulas

Here are some handy accounting formulas you can use to calculate and understand the financial health of your business.

- The Accounting Equation

This shows the relationship between assets, liabilities and owners’ equity, which is the basis of the statement of financial position (balance sheet) and is the most important principle in accounting.

Liabilities = Assets – Owner Equity

Remember that the accounting equation must always balance.

2. Working Capital

This is the money that is immediately available to your business for its day-to-day operations and can be calculated by Current Assets – Current Liabilities. If you have a positive working capital this means you have enough assets to cover your short-term debts, whereas a negative working capital indicates that you’re unable to do so and you’ll need to consider a better way to drive sales and manage payments.

3. Current Ratio

Similarly to working capital, this is a liquidity ratio that measures your ability to turn assets into cash to pay off short-term liabilities. Current ratio is calculated by dividing current assets by current liabilities: Current Assets / Current Liabilities. This figure helps investor and creditors understand how easily you can pay off liabilities. A higher ratio is more favourable and shows you can more easily make current debt payments.

4. Net Profit Margin

This shows the profitability of your business calculated by Net Income / Sales and expressed as a percentage – the higher the number the more profitable the business. This number tells you how well your business uses its income, showing you either a high profit for every dollar of revenue or it may show high costs that reduces the profit for each dollar of income.

Note the difference of ‘gross profit margin’, which applies to a specific product or service rather than the entire business.

5. Break-Even Point

This will tell you the point at which your sales will cover its expenses and is calculated by:

Fixed Costs ÷ (Price – Variable Costs)

This break-even formula is handy to know so you can be aware of your level of sales and how much you need to cover your fixed and variable costs.

6. Cost of Goods Sold

You’ll want to know the direct costs that went into the goods you’re selling including your cost of materials and labour to produce the goods. This is helpful in determining how profitable your business is, what areas have potential growth opportunities and which ones you need to improve on.

The cost of goods sold formula is: Beginning Inventory Costs (at the beginning of the year) + Additional Inventory Cost (inventory purchased during the year) – Ending Inventory (at the end of the year)

The financial statements

A financial statement is a report that’s completed to help analyse the overall financial performance of your business and can give you insights into where your cash is being spent and where it’s coming in from.

1. Balance sheet

This is also called the statement of financial position and shows your business’s total assets and how these assets are financed. The balance sheet equation is Assets = Liabilities + Equity.

Take the time to understand your balance sheet so you always know your financial position, what you have and what you owe.

2. Profit and loss statement

This report is also called the income statement and is generally required for your end of financial year reporting. It summarizes the revenues, costs, payments from invoices, and expenses such as payroll incurred during a specific period. It helps you understand your ability to generate profit, either by reducing costs and expenses, or by increasing its sales.

3. Cash flow statement

The cash flow statement reports the cash generated and used during the specified time. It looks at operating activities, investing activities, financing activities and supplemental information. Essentially, it identifies the cash that is flowing in and out of the company, and helps you make decisions such as reducing debt or reducing costs.

If you’re ready to get started and want help in automating your accounting, you can use online accounting software such as Reckon One to help manage your everyday finances.

by Jane Chan, December 5, 2018