TABLE OF CONTENTS

If your organisation is a registered charity in Australia, the Annual Information Statement (AIS) is part and parcel of your must-do compliance jobs each financial year. It’s how you submit details about your activities, governance, and financial information to the ACNC, which then in turn helps to enhance public trust in the sector and reduce duplicate reporting.

What is the AIS?

An AIS is an online statement covering a 12-month reporting period for NFPs. You’ll use it to capture complete information about your organisation – what you did, who you helped, plus concise financial transactions and governance details. The ACNC uses the information received to:

- Update the public Register of charities (most AIS data is published to the register to build public confidence).

- Double-check ongoing compliance with registration obligations.

- Share standardised facts with other government agencies to limit red tape.

The good news is there’s no fee to lodge – no payment or refund scenarios are part of your AIS lodgement.

Who has to lodge and who is exempt?

All registered charities have to lodge an AIS every year, except those registered with the Office of the Registrar of Indigenous Corporations (ORIC). ORIC-registered charities instead report to ORIC and are exempt from having to lodge their AIS with the ACNC.

Basic Religious Charities still lodge an AIS, but they don’t need to give any financial information or attach an annual financial report – even if they’re medium or large.

Then there are non-government schools, which have a streamlined arrangement with the Department of Education. In short, they complete the department’s Financial Questionnaire so they don’t provide financials in the AIS itself.

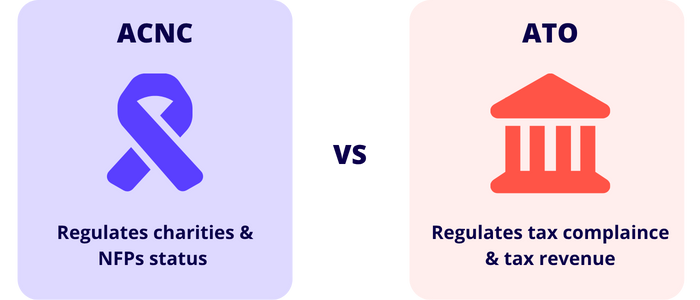

Top tip: The AIS is not an income tax return. It goes hand-in-hand with your ATO income tax and BAS obligations (where applicable). Your AIS doesn’t change your income tax or income tax rules status, and the ACNC doesn’t handle taxes, benefits or refunds.

Due dates

Most charities report on the standard financial year (1 July to 30 June). Your AIS submission is due six months after the end of your reporting period (usually due 31 December for a 30 June year-end). If you use a different year-end, you have to apply to the ACNC for a substituted accounting period before you lodge.

Newly registered charities start reporting from their registration decision date – aka, the date the ACNC approved you – and not from an earlier date you might have become eligible. If you were registered within three months of year-end, you don’t need to lodge an AIS for that short period. Instead, you’ll include those first few months in the next year’s submission.

What size are we – and what do we have to include?

Annual revenue is what determines your size (i.e. small, medium, large). Everyone has to complete the main AIS questions, regardless of size. However, medium and large charities also have to attach an annual financial report (audited for large, audit or review for medium). Small charities don’t have to attach an annual financial report, but you might still want to do so, especially if your governing document requires it.

The AIS will ask for financial information including revenue, expenses (including salary costs), profits (surplus/deficit), assets/liabilities in summary, etc. The data is helpful for the public understand a nonprofit’s performance at a glance, whereas more detailed financial statements give a fuller financial picture.

How to lodge in the Charity Portal

- Log in to the ACNC Charity Portal, click your charity’s name then open Manage reporting.

- Pick the correct reporting period and enter all your information in the AIS fields. You’ll see sections for activities, people, governance, financial data, etc.

- Upload your annual financial report if your size requires it, then complete the declaration and submit.

After submitting, you’ll get sent to a receipt page with a reference number and a link to download a PDF of your AIS – keep this with your financial records. The ACNC will then mark your AIS as being published on the Charity Register, unless your requested for information withheld is approved.

Withholding sensitive information

You can apply to withhold information from the public Register if you believe that publication would saddle you with risk (e.g. safety concerns or commercially sensitive information relating to contracts). Just use the Portal to request withholding and state your reasons. If approved, those items will be hidden while the rest of your AIS will stay visible to be respectful of total transparency and confidence in the sector.

Group reporting and bulk lodgement

Where multiple organisations operate under shared control (e.g. denominations or multi-trust arrangements), you can apply for group reporting so you can submit a single AIS for the group. Large administrators can also use bulk lodgement to file a number of AIS forms in one submission. The outcome? A big reduction in your compliance workload.

Correcting errors and making amendments

Found a mistake after filing? It’s your responsibility to modify and correct it in the Portal:

- Sign in, click your charity, go to Manage reporting, then open ‘Amend [year] AIS’.

- Jump to the relevant section, update the details, follow the steps to the declaration and hit submit.

Small charities have to amend within 60 days of identifying an error, while medium and large charities have 28 days. The updated AIS will appear on the Register once it’s been processed.

Difference of AIS versus ATO reporting

The ACNC is all about your charity status and managing compliance, whereas the ATO handles things like your income tax and income tax return obligations. Most charities are exempt from income tax, but that exemption (and any taxpayer return obligations) are administered by the ATO, and you may have to complete an annual self-review to keep your tax-exempt status.

If you run a registered charity, make sure your ATO registrations (ABN, GST, PAYG) stay updated and that you take care of any separate income tax (or FBT/GST) obligations. Submitting an AIS does not replace any ATO lodgments.