Volunteers and donors are the lifeblood of most Australian charities and not-for-profit organisations. But alongside their innate missions comes a stack of compliance duties, including volunteer safety and screening, donor receipts, annual reporting, and more.

Thankfully, we’re here to give you a complete breakdown of the essentials of volunteer management, donor reporting, and day-to-day compliance, so you and your fellow do-gooders can focus on impact while staying compliant.

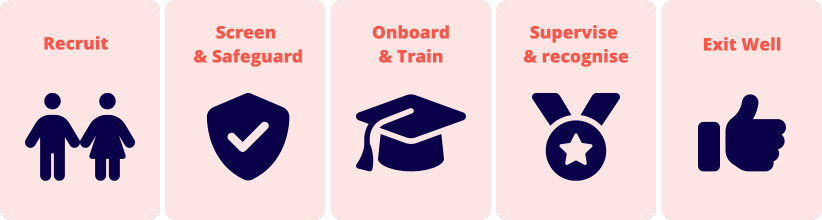

Volunteer management is about building simple volunteer lifecycles

It can be helpful to think of managing volunteers as a clear, repeatable lifecycle in five basic steps:

1. Recruit

Figure out the specifics of the role, how much of a time commitment is needed (including micro volunteering options), the location, and the skills you need. Then advertise volunteer opportunities where your community already is – on social media, community boards, volunteer centres, etc. Good ads make it so much easier to engage with the right people.

2. Screen and safeguard

Match the screening to the risk. That can include things like reference checks and any mandated checks (e.g. a Working With Children Check, depending on your program and state/territory). As a volunteer-involving organisation, you are also responsible for giving volunteers a safe environment and protecting them so far as is reasonably practicable – think risk assessments, inductions, and incident reporting among other measures.

3. Onboard and train

Give them a short but practical induction. Cover off your mission, code of conduct, privacy basics, safety procedures, who to ask for support and how to record their volunteer time. Make sure your practices line up with the National Standards for Volunteer Involvement, too.

4. Supervise and recognise

Nominate a contact person, check in with them regularly and record all the ‘volunteer impact information’ (hours, outputs, outcomes). Recognition doesn’t need to be fancy – a simple shoutout, certificate, reference, or new learning opportunities can keep people engaged.

5. Exit well

Thank your volunteers and collect feedback from them. A streamlined exit will help you improve your programs and protect your organisation’s internal controls (e.g. removing former volunteers from being able to access your systems).

Donor reporting 101: DGR, receipts, privacy and more

Lots of Australian charities try to get a deductible gift recipient (DGR) endorsement so that donors can claim a tax deduction. Most organisations apply for DGR through the ACNC registration process (or with the Australian Taxation Office). Make sure you keep your registration details and governing documents up to date, because any changes can impact your status.

If your organisation issues receipts for tax-deductible gifts, the ATO sets out minimum content rules (e.g. your organisation name and ABN, the date and amount, as well as a statement that the gift is for a DGR). Missing information can cause headaches – so standardise your template across all programs and fundraising events. Also remember that if a donor gets a material benefit (like a gala dinner seat), that payment is not a deductible gift.

You also handle personal information about donors. The Privacy Act 1988 and Australian Privacy Principles set out expectations for collection, use, security and access requests – use a basic privacy notice, restrict all access to donor data and set up ‘least access’ permissions in your CRM.

BAS, GST and some ‘services tax’ scenarios

If you’re registered for GST, you’ll lodge a BAS and report goods and services tax collected (on taxable supplies) and input tax credits on purchases. Charities and certain not-for-profit organisations can take advantage of GST concessions – including special rules for fundraising events, raffle or bingo sales, as well as some non-commercial activities. Each of these concessions affect how you remit GST, claim GST credits, and calculate GST turnover for registration.

Here are some examples that will shine further light on how it all works:

- Fundraising dinners: Eligible entities can choose to treat certain fundraising events as input taxed (no GST on sales, no credits on related purchases). Decide and minute this before ticket sales start.

- Raffles and bingo: Tickets sold by an eligible entity (registered charity, DGR, government school) are, in most cases, GST-free as long as state/territory law is met.

- Non-commercial activities: Supplies can be GST-free where prices are below the defined market value or cost thresholds.

Volunteer expenses and GST credits

Reimbursing one of your volunteers does not automatically let you claim input tax credits. The ATO says charities are generally not entitled to GST credits on reimbursements to employees, partners, or volunteers, except in a few limited situations. If you reimburse, keep the tax invoice and check the ATO rules before trying to make a claim.

Financial reporting and nonprofit compliance

Most charities have to submit an Annual Information Statement to the ACNC every year. The statement discloses your organisation’s activities, finances, and governance – and late lodgement means you risk penalties and, in serious cases, revocation.

Beyond the statement, your governance obligations include meeting the ACNC’s Governance Standards (e.g. acting with due care and diligence, managing your financial affairs responsibly, keeping appropriate internal controls, etc.). Keep minutes, resolutions, and policies up to date – especially any conflicts of interest, fundraising, safeguarding, and privacy information.

If you’re DGR-endorsed, you also need to be in compliance with the tax law conditions attached to your DGR category (e.g. purpose and public benefit), as well as make sure all donations and tax-deductible gifts are applied to your stated charitable purpose.

And don’t forget to comply with state/territory fundraising licences and rules when collecting donations in public or online.

Getting into a compliance rhythm

Here’s a simple breakdown of what to do and when:

- Quarterly: BAS (if registered for GST), board finance pack, review of internal controls, bank and CRM access checks and a quick policy refresh where necessary.

- Half-year: Mid-year review of your organisation’s activities, budget re-forecast, compliance reviews (DGR conditions, fundraising licences, insurance cover, risk register).

- Year-end: Prepare financial statements and Annual Information Statement, program outcomes summary (great for donors), inventory of policies, as well as a board self-assessment against ACNC Governance Standards.

Great volunteer management and donor reporting are essential admin tasks that can make or break your trustworthiness as a non-profit and risk controls.

If you’re not sure about a particular issue (such as whether you can claim GST credits on a complex fundraising event, or whether a grant is a taxable supply), always check with the Australian Taxation Office and ACNC advice, or speak to your accountant as soon as possible. Asking a few ‘silly questions’ today beats having to pay penalties later on.