Tax Compliance

Stay up to date with the latest compliance changes and legislation with Reckon One.

What is compliance?

Compliance refers to regulations established by the Australian government, which every business owner needs to abide by to avoid penalties. It includes Single Touch Payroll, PAYG tax tables, Payment Summary, superannuation obligations, Business Activity Statement (BAS) reporting and record keeping. You will need to lodge your submissions with the ATO throughout the year to meet the regulatory requirements and remain compliant.

Single Touch Payroll

Single Touch Payroll (STP) is regulatory compliance legislation that changes the way employers report on employees’ payments including salary and wages, PAYG withholding and superannuation.

Ensure your accounting software meets this new payroll reporting obligation to avoid any fines. STP is available in all Reckon software with payroll programs since it became mandatory in 2019. Learn more about single touch payroll.

PAYG tax tables & Payment Summary

PAYG tax tables are individual income tax rates that help employers work out the amount of tax to withhold from their employees’ salary.

For businesses that have less than 20 employees, you can choose to use Single Touch Payroll from 1 July 2018 to streamline your pay run and payroll compliance.

If you choose not to report via Single Touch Payroll, you need to continue to provide Payment Summaries to your employees by 16 July 2018 and lodge the Empdupe file with the ATO.

Superannuation obligations

If you are self-employed or hire any employees, you will need to be compliant with SuperStream, superannuation guarantee rates and contributions.

You must pay 11.5% super for employees per month to be compliant with the ATO.

Pay on time every quarter of the year

(29 January, 30 April, 30 July, 29 Oct) to avoid a super guarantee charge.

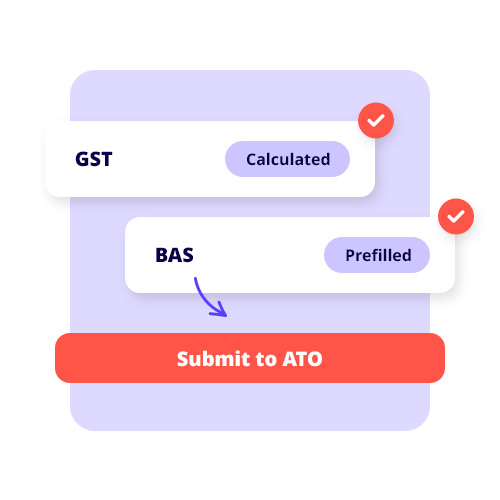

GST & BAS

Did you know your business has to register for GST if the GST turnover (gross income minus GST) is $75 000 or more, or $150 000 for non-profit?

You will need to lodge a monthly or quarterly Business Activity Statement (BAS) with the ATO throughout the year to determine the amount of GST you have to pay or claim.

Record keeping & reporting

As a business owner, you are required to keep records for 7 years including income and expense records, end of financial year records and more. The records need to be held even if your business is no longer trading.

Making your tax records digital can help ensure you have correct records. Plus, you can use this data to create accurate reports with the required info for lodgements with the ATO including BAS and more.

How can Reckon One help you be compliant with the ATO?

Try Reckon One free today!

See how Reckon One can help your business be compliant with the ATO.