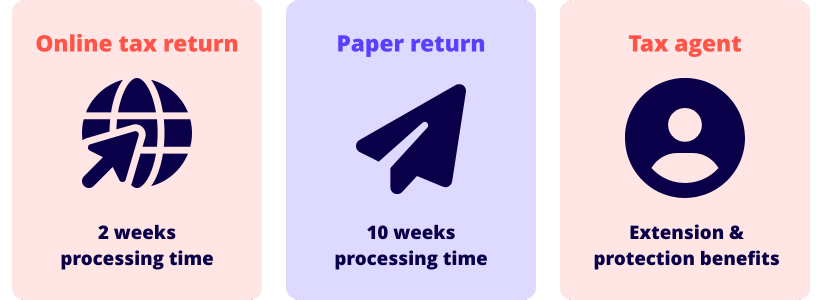

When lodging a tax return for the tax year, you can expect online returns to process within 2 weeks or 10 business days of submission. If the return needs to be processed manually, it may take up to 30 calendar days. For paper returns, expect to receive your return in 10 weeks or 50 business days.

Before you get started, let’s first look at what a tax return is.

What is a tax return?

A tax return is a form you complete and send to the Australian Tax Office (ATO) to tell them:

- How much income you earned over a financial year

- How much tax you owe on the income that you earned

The ATO uses this information to assess whether you are eligible for a tax refund, owe money in taxes, must pay the Medicare levy surcharge, or are entitled to any tax offsets.

What to do before you lodge your tax return

Before you get started and begin your tax return, you need to know that the due date to lodge your return is the 31st October unless using a registered tax agent. With that being said, you will need to have the following details on hand:

- Bank account details (BSB & account number)

- Your income statement

- Centrelink payment summaries (if applicable)

- receipts and statements of the expenses you plan to claim against

- Your spouse’s income (if applicable)

- Your private health insurance cover details (if applicable)

Once you have all your details, you can lodge your tax return.

How to lodge your tax return

There are three ways you can lodge your tax return:

- Online through your MyGov account and the MyTax ATO online services.

- Post a paper return to the ATO

- A registered tax agent can prepare your return on your behalf

If you are lodging your return via the ATO online services or by paper, the process for filling out the necessary fields is identical. You will need to cover:

- Personal information (Tax file number, bank details, etc.)

- Income details (income statement, dividends, interest, etc.)

- Deductions (receipts for work expenses)

- Offsets and rebates (your private health insurance and your spouse’s income if applicable)

- Additional documentation (Medicare levy, capital gains)

With online lodgements, expect a processing time of 2 weeks or 10 business days. For paper returns, expect a processing time of at least 10 weeks or 50 business days.

If you use a registered tax agent, the process is somewhat handled for you. You will still need to provide your tax information so the tax agent can lodge it. The benefits of using a registered tax agent are:

- They can lodge tax returns past the 31st October due date as they have special status with the ATO.

- Provide consumer protection for their clients.

- Can handle complicated tax information regarding business income returns and trusts.

Tax refunds

After the ATO has completed your tax return, you will receive a notice of assessment. A notice of assessment is a document provided by the ATO that indicates whether you are required to: pay more tax to the government, are eligible for a tax refund, or have issues with your tax return.

Tax refund process

Most refunds are issued after the ATO completes its assessment of your tax return.

To do a refund check, you can use your MyGov services and check on the progress of your tax return. If you haven’t received your refund from the ATO, there could be several reasons for the delay:

- Refund was paid to a closed bank account

- The refund was sent to the wrong bank account

- Paid to a known bank account of yours (spouse’s, old account, tax agent’s account)

Amended return

When filling out your return, it is important to double-check the details that you have provided. If you have found an error in your form, you can send an amended return to the ATO using one of the three methods mentioned above. You can also send the ATO a letter regarding the status of your return.

Amended returns must be completed manually by the ATO, which means your return can take a minimum of 30 business days to process after lodging.

What if I don’t file my tax return?

If you don’t send your tax return on time or make a mistake when filling out your forms, the ATO will send you a notice. The ATO will notify you via SMS, email, phone and mail about your missing tax return. If you fail to complete your tax return, the ATO will take a number of actions:

- Refer overdue lodgements to external agencies to collect

- Retain your refund until lodgement is made

- Issue penalty fines

- Conduct an audit

- Prosecution as a last resort

Filing your tax return for the year is an essential part of your ongoing employment and/or business. If you make a mistake or fail to file, the ATO will work with you to complete your tax return.

For businesses, tax returns and income assessment are more complicated, so having accounting and payroll software that you can rely on to record your finances can simplify things immensely.