When you’re running a business, the numbers matter. But you shouldn’t just be concerned about what you earn, it’s also about what you spend. That’s where operating expenses, or operating costs, come in. These are the costs your business incurs day to day just to keep things running. From paying staff wages to keeping the lights on to buying in office supplies, operating expenses can significantly impact your profit margins – and your ongoing success.

Let’s break down exactly how operating expenses differ from capital expenditures and how managing operating expenses with a strategic mindset can give your business a competitive advantage.

What are operating expenses?

Operating expenses are the costs incurred during your normal business operations – think everything from rent and utilities to sales commissions, insurance, and costs related to administration and marketing. All these things are necessary for your business to function, and they will appear on your income statement under the section that covers ongoing operational outgoings.

In simpler terms: if it helps your business stay up and running – and isn’t a one-off investment in a long-term asset – it’s probably an operating expense.

- Staff wages and superannuation contributions.

- Rent and utilities.

- Marketing and advertising.

- Office and IT supplies.

- Insurance premiums.

- Legal and accounting fees.

- Repairs and maintenance.

OpEx vs capital expenses (CapEx)

To fully get to grips with your business’s cost structure, you’ll need to know the main differences between operating expenses and capital expenditures. While the former are your day-to-day costs, CapEx is the money spent on assets that will (hopefully!) deliver long-term benefits.

Let’s say you buy a company car. That’s a capital expense. But if you pay for petrol or servicing on that car, those are operating costs.

Capital expenditures include purchases of tangible and intangible assets like investment properties, machinery, patents, or software that’s expected to last longer than a fixed period (usually 12 months). All of these purchases go on your balance sheet and are depreciated or amortised over time. Operating expenses, on the other hand, are fully tax-deductible in the financial year they’re incurred.

Fixed and variable costs: How OpEx breaks down

- Fixed costs stay the same regardless of how much you produce or sell. Think rent, insurance and yearly software subscriptions. You pay these whether business is booming or sluggish.

- Variable costs, by contrast, fluctuate with business activity. If you sell more goods, your goods sold costs (like inventory and packaging) might rise. Hire more casual staff? Labour costs go up.

Clarifying the two can help with your budgeting and forecasting. Some expenses might even sit somewhere in between – wages for hourly staff, for example, might change depending on workload, but base salaries remain fixed.

How to calculate and monitor OpEx

The easiest way to figure out your business’s operating expenses is to simply add up all the costs associated with your business operations that aren’t related to capital purchases. That should include overheads, admin costs, research and development, interest expenses and more.

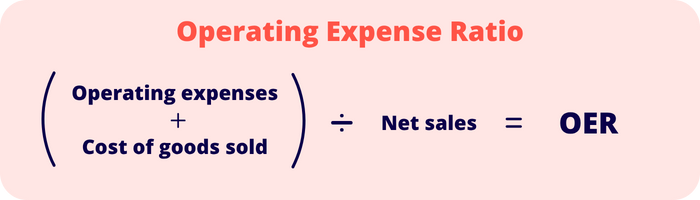

Operating expenses also feed into another useful metric: your operating expense ratio (OER), which shows you just how well you’re using revenue to cover operational costs. The formula is:

(Operating expenses + Cost of goods sold) / Net sales = Operating Expense Ratio

A lower OER means you’re running things very efficiently. That said, different industries have different benchmarks, so you’ll want to make comparisons only within your sector.

Managing operating expenses strategically

Reducing operating expenses is about much more than just cutting costs. When done well, you’ll be able to trim the fat without cutting into the muscle, as it were. In other words, it’s vital to find ways to be lean without undermining your team, product, or customer experience.

Here are four smart strategies to think about using:

- Regularly audit your expenses: Go line by line through your outgoings. Are there subscriptions you no longer need, supplier contracts you can renegotiate, or travel expenses that could be replaced with virtual meetings?

- Make the most of tech: Use cloud-based platforms and automation tools to streamline all your invoicing, payroll, customer relationship management and inventory. You might pay more upfront, but the time saved and fewer errors should outweigh the costs.

- Optimise your staffing: Could outsourcing or hybrid work help reduce your overheads? Outsourcing specialist tasks or cutting down on office space through flexible-working models can help lower your fixed costs, like rent.

- Review your expenses-to-revenue ratio: Track your operating expenses as a percentage of revenue over time. If it’s creeping up, that’s a sign it’s time to reassess things.

What about non-operating expenses?

It’s also important to differentiate between operating expenses and non-operating expenses, which are costs that aren’t part of your normal business operations. Some examples: losses from asset sales, foreign-exchange fluctuations, and damage from a natural disaster.

Yes, these expenses still have an impact on your business’s profitability, but they are reported separately on the income statement.

In summary

At its core, operating expenses are the everyday costs of running your business. From staff wages to energy bills, these outlays keep the engine running, but they also need to be kept in check. Otherwise, operating expenses can very quickly start eating into profits. The good news is that smart management can free up capital to reinvest in your business, helping you grow more sustainably.