ATO Small Business Super Clearing House Closure

The ATO SBSCH is closing — Stay compliant the easy way

SBSCH Closure: What businesses need to know

From 1 July 2026, the ATO’s small business superannuation clearing house will shut down. Businesses without a super clearing house solution will not be compliant and may face penalties. Reckon Payroll software includes a free, integrated clearing house so you can stay compliant, and schedule and lodge super contributions all in one single workflow.

SBSCH Closure Explained

Watch our explainer video to get a rundown on exactly what is happening and what small businesses need to do.

What is a super clearing house?

A super clearing house is a payment gateway that allows your employees’ super contributions to be distributed to their nominated super funds.

Super clearing houses are an efficient way to handle super contributions without manually uploading each payment to separate super funds.

Why do Super Clearing Houses matter to small business?

In Australia, not all workers have the same superannuation; without a superannuation clearing house, employers would need to make separate payments to each of their employees’ designated fund. Super clearing houses allow you to:

- Package all super payments and send in one batch.

- Remove manual handling of multiple super payments to be dispersed to different super funds.

- Reduce human error.

- Stay compliant.

What is Payday Super?

Payday Super is a law that requires super payments to occur within seven business days of salary and wages being paid. This represents a shift from the current convention of superannuation being paid at least quarterly. The law comes into effect 1 July 2026.

All businesses will be responsible for finding their own solution for this change. As part of the changes to Payday Super, the government has decided to close the ATO online service, the Small Business Superannuation Clearing House (SBSCH).

This decision is final regardless of the outcome of the legislation, meaning the free online service will no longer be available, and small businesses will need to find alternative options in commercial clearing house services.

The ATO’s SBSCH is closing: Key Dates

With the closure of the SBSCH, there are some key dates that small businesses need to know:

- No new registrations or new users after 1 October 2025

- Complete closure on 1 July 2026

The decision to close the ATO SBSCH will impact over 200,000 small businesses, leaving many needing a new system to ensure their employees’ superannuation is paid correctly.

Make a smooth transition with Reckon Payroll

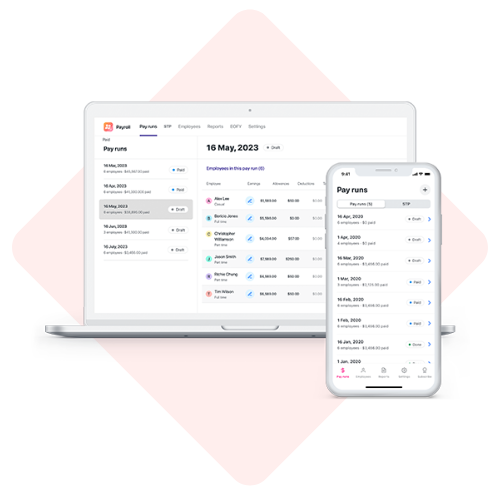

Reckon Payroll software is an all-in-one, compliant payroll system that can take care of your super contributions:

- Stay compliant: The ATO’s clearing house will be switched off from 1 July 2026. Reckon Payroll ensures you remain compliant with Payday Super and SuperStream.

- All-in-one workflow: Calculate, pay and report super directly from within Reckon Payroll through our integrated clearing house partner, Beam. (link)

- Save time: Super contributions are automatically calculated and sent within 7 business days of payday.

- No extra cost: The clearing house feature is already included in Reckon Payroll — no add-ons, no third-party fees.

- Easy to switch: Move from SBSCH in just a few steps — subscribe, connect your bank, and start automating payments.

Make the switch to Reckon Payroll, and you’ll be ready for Payday Super and the SBSCH closure on 1 July 2026.

Pay super from your payroll software

30-Day free trial

Cancel anytime

Unlimited users

† Free data migration offer includes 1 year of historical data + YTD only. Paid subscriptions only.

Helping thousands of businesses with their payroll

Download your free super clearing house guide

Everything you need to get ready for the SBSCH closure

Our guide details everything you need to know, from what a super clearing house is to software solutions. Don’t get caught out, and download your guide today!

Already a Reckon customer using Reckon Accounts?

Existing users of Reckon desktop software can seamlessly transfer across to Reckon Cloud Software. If you are worried about staying compliant, start a free trial and book a free migration to bring your accounts across now!

Clearing House Resources

Here are our resources to help you navigate the changes to superannuation payments:

Frequently asked questions

Can I still use the ATO's Small Business Superannuation Clearing House after the 1 July 2026 deadline?

No, the SBSCH will close and no longer be available for small businesses looking to distribute their employees’ super contributions. This will happen regardless of Payday Super legislation becoming law.

Note: You will need to switch to a payroll system that supports SuperStream-compliant contributions by 30 June 2026.

What happens if I don't find a compliant software?

Businesses that do not pay superannuation correctly are subject to fines like the superannuation guarantee charge, which:

- Shortfall in payment covered by the super owed on salary and wages, plus choice liability capped at $500.

- Administration fees.

- Accrued interest on the failed payment of 10% per annum.

Do I need to pay super using software?

To stay compliant, you need software that allows you to make super payments. Without software that helps you make super contributions, you stand to face fines and penalties.

Software like Reckon payroll lets you pay staff wages and superannuation funds from the same platform, making it easier to comply with regulations, including the upcoming Payday Super reform.

How do I switch from the SBSCH to Reckon Software?

First, subscribe to your preferred Reckon payroll plan to register for Beam. Second, set up your bank account for auto super direct debit payments.

It’s then straightforward to manage your small business superannuation payments.

Get prepared with Reckon Payroll!

Start a free trial of our compliant and easy-to-use payroll software, which makes super contributions a breeze.