TABLE OF CONTENTS

- What is cloud payroll software?

- Why small businesses are switching to cloud payroll

- Benefits of cloud payroll for employers

- What features should small businesses look for?

- Who uses cloud payroll?

- Common misconceptions about online payroll software

- How to make the switch to cloud payroll

- Future-proof your payroll

Ask a dozen small business owners what their most time-consuming and stressful tasks are, and most will say “managing payroll”. Between calculating wages, processing superannuation, staying up to date with changing payroll legislation, and making sure employees are paid correctly and on time, it’s no wonder payroll becomes a source of anxiety.

Thankfully, technology has evolved. Modern cloud payroll systems give businesses of all sizes the ability to streamline the payroll process, save valuable time and money, and – most important of all – reduce the risks of making mistakes with manual calculations.

It doesn’t matter if you’re a solo operator preparing for your first hire or managing a growing team across multiple locations; this guide will help you understand exactly how cloud payroll software works and how to choose a payroll solution that fits your needs.

What is cloud payroll software?

Cloud payroll software is a type of online payroll system that lets businesses run their payroll and manage all the associated tasks completely online. Unlike basic software that needs to be installed on a computer, cloud-based payroll tools are hosted off-site by a provider, which means you don’t need to worry about servers, updates or backups. It’s all handled for you.

With a cloud payroll system, your payroll teams can tackle jobs like:

- Organising employee information (e.g. tax file numbers, bank details, superannuation preferences).

- Working out wages, deductions, tax and superannuation.

- Generating and issuing payslips.

- Keeping up with real-time compliance requirements like single touch payroll (STP).

- Compiling ATO-compliant reports for the end of the tax year.

All this can be done from any device with an internet connection, allowing employers to update payroll information anytime, anywhere.

Why small businesses are switching to cloud payroll

Right around Australia, small and medium-sized businesses are turning to cloud-based payroll software in droves. It’s a simple, cost-effective way to get an all-in-one solution to help them manage not just payroll, but also workforce management, reporting, and so much more.

Let’s break down exactly why this shift could make good business sense for your operations:

1. It’s cost-effective

Unlike older systems, online payroll software runs on a subscription model. That means your business will only pay for the features you need, so it’s more affordable and very scalable for growing teams.

There’s no need for a dedicated IT team or expensive software upgrades – the provider manages the infrastructure and security for you. The result? A more user-friendly, professional experience without the corporate price tag.

2. It helps you stay compliant

The Australian payroll system is complicated and constantly changing, whether it’s changes to superannuation guarantees, updates to the minimum wage, or new reporting standards from the ATO.

Cloud payroll platforms help businesses feel more confident that they’re ticking all the right boxes by automating compliance tasks like:

- STP submissions to the ATO.

- Calculating tax and super at the correct rates.

- Generating correct leave balances and entitlements.

- Creating compliant payslips and payroll reports.

The bottom line? The chances of errors or missed deadlines are minimal, protecting your business against expensive penalties.

3. It reduces manual admin

Manual data entry is one of the biggest time-drains in traditional payroll systems, not to mention the source of numerous errors. Cloud payroll software replaces these tasks with automation, helping you to:

- Auto-calculate wages, leave accruals, superannuation and more.

- Process pay runs faster and more accurately.

- Instantly generate end-of-year payroll summaries and tax documents.

- Cut back on double-handling and cross-checking.

Your team can then redirect their valuable time towards growth activities, rather than needless paperwork.

4. It improves data security

In a cloud-based system, your data isn’t stored on a single desktop computer – it’s held on secure, encrypted servers managed by the provider, which hugely reduces the risk of data loss or breach. Don’t underestimate how useful this is, especially since small business scams are rising.

You can also control who is able to access what. Managers, payroll admins and employees can each have secure, role-specific access for total transparency with protection. And because the system is online, you can get into it from the office, at home or even overseas – perfect for remote teams or businesses with multiple locations.

Benefits of cloud payroll for employers

For employers, using cloud payroll software is about more than just ticking boxes. It’s actually a great way to start building a smarter, more agile business. Here are some of the advantages that could make the switch worthwhile for you:

- Save time: Fewer manual inputs mean quicker pay runs and less admin.

- Improve accuracy: Automatic calculations minimise the risk of underpaying (or overpaying) staff.

- Support scalability: Easily onboard new employees, add additional departments or adjust your payroll solution as your business grows.

- Streamline processes: With payroll, leave, timesheets and workforce management tools all in one place, you can break down silos and create more efficient workflows.

What features should small businesses look for?

The best payroll software for your business will come down to a few different factors, like business size, industry, and any existing tools that will need to integrate with it. That said, there are some universal features that every good cloud payroll platform should offer:

- Automated tax and super calculations.

- Single Touch Payroll (STP) reporting.

- Payslip generation and email delivery.

- Leave management.

- Can integrate with your accounting software.

- Secure data storage and backup.

- End-of-year reporting for the tax year.

- Role-based permissions.

- Local support and updates in line with payroll legislation.

The best payroll systems will also have add-ons like automated invoice reminders or industry-specific tools, which can help the platform be a better experience for business owners and staff.

Who uses cloud payroll?

Arguably, the biggest strength of cloud payroll is its flexibility. This is a huge benefit used by a huge number of businesses and organisations, including:

- Startups and small businesses: Where owners wear multiple hats and need help keeping admin tasks to a minimum.

- Growing businesses: Those that need to scale up their payroll capabilities quickly and cheaply.

- Larger organisations: Needing a more streamlined process for high-volume payments.

- Accounting firms and bookkeepers: Those who manage payroll for multiple clients and want consistent, automated tools.

In every case, the right payroll system can deliver real results: faster processing, better oversight, and less worry about compliance and reporting.

Common misconceptions about online payroll software

Despite the many advantages, some small businesses are hesitant to switch over to cloud payroll, so let’s dispel a few myths about cloud payroll software:

- “It’s too expensive.” Most platforms have tiered pricing based on your business size, and many are cheaper than outdated systems when you factor in less admin time and fewer mistakes.

- “I’ll lose control over payroll.” It’s actually the opposite. You get full visibility over your payroll process, plus automated checks and alerts to lessen the compliance risk.

- “It’s hard to learn.” Modern cloud payroll platforms are highly intuitive and user-friendly, with easy onboarding and plenty of support resources to guide you along the way.

- “My business is too small.” Even solo operators or micro-businesses can get huge benefits from automation and simplified payroll reporting. Your time is literally your money!

How to make the switch to cloud payroll

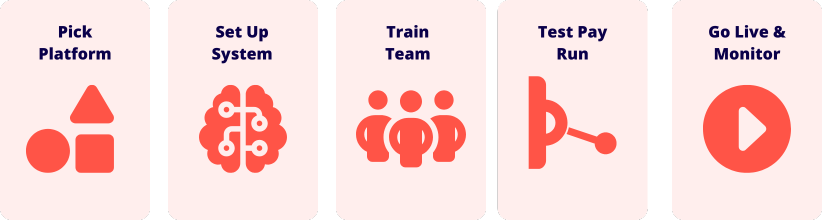

Ready to move your payroll online? Here’s what the transition will look like:

- Pick your platform: Look for a payroll solution provider that is in your budget, able to integrate with your existing accounting system, and has good local support.

- Set up your system: This might include entering employee data, importing historical payslips, configuring tax and super rules, linking your bank account, etc.

- Train your team: Most providers have onboarding help and training tools to get you and your team up to speed.

- Run a test pay run: Before launching live employee payments, do a trial run to see if everything is calculating correctly and that all reports look right.

- Go live and keep an eye on things: Once you’re confident, start running payroll via your new system. Just make sure to monitor everything for any issues and reach out for support if needed.

Future-proof your payroll

Living and working in a digital world means that cloud payroll software is no longer just a nice-to-have – it’s a must-have for small business owners who want to stay compliant and competitive. Shifting away from your outdated systems and embracing a modern cloud-based platform means you can unlock more time and save on costs.

It doesn’t matter if you’re managing one employee or one thousand; an online payroll software solution that works for you will help you manage your workforce with total confidence. With the right payroll system, you’ll be in the best possible shape to do exactly that, with less stress and more control at every step.