TABLE OF CONTENTS

Do you have burning questions about registering for GST? We’ve got you covered.

If you’ve just started a business in Australia, you’ll need to know whether you should register for GST and how to do it. Below, we’ll walk through the rules, the grey areas and the steps to getting set up.

What is GST?

GST (Goods and Services Tax) is a 10% tax on most goods and services sold in the country. Businesses that are registered for GST collect it on taxable sales and claim input tax credits for GST paid on business purchases. You then report and pay (or get a refund) through a business activity statement (BAS).

When to register for GST

First, if you’re over the GST threshold in terms of income, you must register. Simple as that. Australian tax law sets out very clear triggers:

- Your business has a GST turnover (not including GST) of $75,000 or more in a 12-month period.

- Your non-profit has a GST turnover of $150,000 or more.

- You operate a taxi or do ride-sharing (e.g. Uber), regardless of turnover.

GST turnover is different from profit, and it’s not just last year’s sales – it’s a rolling test that looks at both what you’ve earned (current) and what you reasonably expect to earn (projected).

Under the threshold? You can choose to register

While the threshold is set in place, your decision isn’t always black and white if you’re under it. There are some good reasons why businesses choose to voluntarily register (or hold off).

Many owners register for it because they regularly buy from GST-registered suppliers and want to claim input tax credits. Or sometimes they want to present themselves as being more established and ready for larger contracts.

But there are also good reasons to wait. Maybe your customers are mainly consumers, and you want to keep sticker prices 10% lower. Or perhaps your inputs attract little GST, so credits would be minimal.

There’s no one-size-fits-all answer. Your best bet is to run the numbers according to your pricing and target market.

Breaking down GST turnover

GST turnover is your business’s gross sales excluding GST from taxable and most GST-free supplies over any 12-month period. It excludes GST itself, input-taxed supplies (e.g. residential rent, most financial supplies) and sales outside of Australia. It also excludes sales of any capital assets.

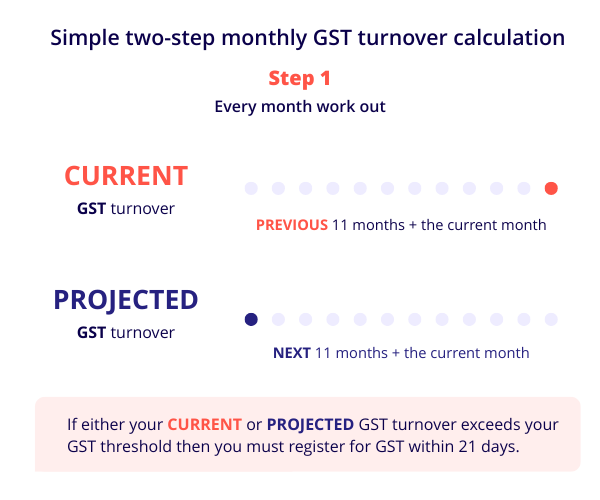

You’ll need to consider two tests:

- Current GST turnover: This is your turnover for the current month plus the 11 months just gone.

- Projected GST turnover: This is your reasonable estimate of turnover for the current month plus the next 11 months.

Say you’ve billed $40,000 so far this year and just signed a contract that will add $50,000 over the next six months. Your projected GST turnover is now $90,000 (ex-GST), so you need to register. Don’t wait for invoices to hit – register as soon as you become aware you’ll go over the threshold.

How to register for GST (and the basics you’ll need)

If you have a trusted bookkeeper or accountant, they can register you on your behalf. But doing it yourself is pretty straightforward, too:

- Get an ABN (Australian Business Number): You can’t register for GST without it. Apply via the Australian Business Register.

- Register for GST online: Use the ATO’s online services for business, your myGov account (for sole traders) or call the ATO. Have your ABN, business details and bank account information ready to go.

- Choose your GST reporting cycle and accounting basis: Most small businesses report quarterly and choose the cash basis (you pay GST when customers pay you and claim credits when you pay suppliers). The accrual (non-cash) basis recognises sales and purchases when invoiced.

- Update your systems: Turn on GST in your accounting software, set up tax codes and add GST-inclusive pricing wherever it’s relevant to do so.

Do you need an ABN to be registered for GST?

Absolutely. You can’t operate a business in Australia without an ABN, regardless of GST. During the online GST registration process, you’ll supply your ABN and important business details. If you don’t have one yet, apply via the Australian Business Register first – then complete your GST registration.

Dates, backdating and penalties

Your registration takes effect from a date agreed with the ATO, which is usually the day you hit (or reasonably expect to hit) the threshold. If you delayed and already charged customers without GST, you might need to backdate and pay GST on those sales – even if you didn’t collect it. Late registration can also mean penalties and interest, so avoid the drama by watching your numbers monthly.

After you register for GST

Once you’re set up and registered, you’ll need to:

- Charge GST (10%) on taxable sales and issue tax invoices for sales of more than $82.50 (GST-inclusive) or upon request.

- Report and pay (or claim) via BAS – usually quarterly by the due date.

- Keep good records (invoices, receipts, adjustments) for five years.

- Display prices correctly. Retail prices must be GST-inclusive. For quotes to business customers, make it clear whether the amounts are ex-GST or not.

- Claim input tax credits for GST paid on business purchases.

If at some later stage you fall well below the threshold and expect that to continue, you can cancel your GST registration. Just remember, once you’ve cancelled, you’ll need to stop charging GST and won’t be able to claim credits from that date.

Should I register for GST?

You have to register once you hit the turnover threshold. Being registered can help you claim back GST on costs and present as ‘tender-ready’ for larger clients. But staying unregistered can also keep consumer prices 10% sharper.

There’s no single right answer – choose the option that suits your market and margins.