Calculating GST for your small businesses with our calculator is easy. Enter the dollar amount you wish to apply GST to (or find the GST-inclusive number) and click ‘Calculate’.

Price

Results

Goods and Services Tax (GST): What is it?

The goods and services tax (GST) is a consumption tax in Australia. It is the most recognisable tax, since almost everything you purchase on an ordinary day has a GST component. The government uses tax revenue to fund public services, including roads, schools, and hospitals. The GST rate is 10%.

How to calculate GST

Determining how much GST is included in an item’s original price is relatively straightforward. All you need to do is keep two equations in mind.

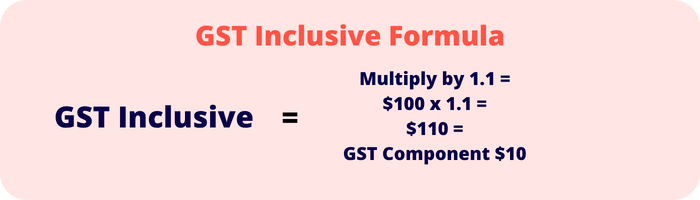

GST inclusive

To add GST to find the total value of an item, you multiply it by 1.1. For example:

$100 (GST exclusive) =

110 X 1.1 =

110 (GST inclusive)

$10 is the tax amount

GST exclusive

To subtract GST from the total price of an item, you divide it by 1.1. For example:

$110 (GST inclusive) =

110 / 1.1 =

100 (GST exclusive)

$10 is the tax amount

Are there GST-free items?

Yes, there are items on which you don’t pay GST. These include:

- Basic food, such as fruits, vegetables, meat, fish and eggs.

- Medical and other health care services for which a Medicare benefit is payable.

- Some educational services that schools, universities and TAFE provide.

- Goods and services that are exported from Australia.

- Some government charges, such as car registration and passport fees.

- Invoices from non-gst registered businesses

Understanding GST for your small business

Paying and collecting GST is a standard process for most Australian businesses. While you don’t need to register for GST until you reach the $75,000 turnover threshold, it is good practice to register regardless. While you don’t need to add the GST value on your invoices, you can’t get a refund for any GST paid.

Whatever choice you make, make sure that you have the right accounting software to help with your finances. Software like Reckon automatically calculates your GST and adds the GST amount to your accounting and bookkeeping activities.