1. Review your details

Before you take any action, make sure that all your business and employee details are correct. For your business, review the entity name, legal name, address, contact, and ABN in your software.

For your employees, check that their employment details and TFN are correct.

2. Finalise payroll activity for the year

Complete your final payroll activities for the year. This includes finishing your last pay run, including your employees’ super contributions. Remember that bonuses and commissions need to be paid out and reflect your YTD totals.

With your last pay run submitted, it’s time to create your end of year finalisation report.

3. EOFY finalisation and reconcile

Complete your end of year finalisation by matching your year-to-date figures to your payroll summary report. If anything in your figures or records doesn’t match, this means there was an error in your calculations along the way.

To fix any mistake, go back and identify what needs to be corrected and submit an adjustment or special event to the ATO.

With the end of year report finalised, you can move to the next step and…

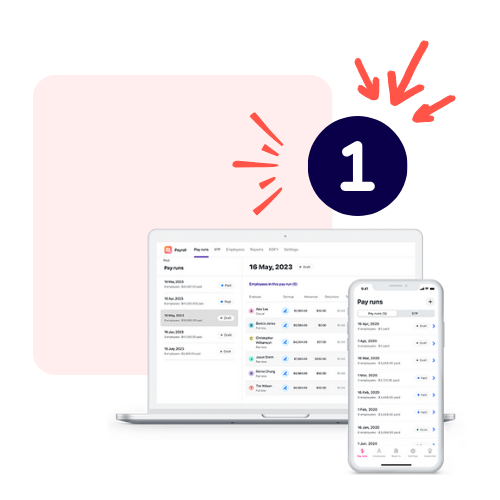

4. Submit your end of year finalisation

Once you have balanced your records and your payroll is ticked off, complete the process and submit your EOFY report to the ATO! This will be the last task to check off in your payroll software.

But don’t forget…

5. Action your payments!

Your records and reports are reconciled, completed, and finalised. Still, there is one task left to do: finish off your payroll by making payments for your employees’ final salary, wage, and superannuation contributions for the fiscal year.

Whether you need to schedule or pay on the day, make sure that your employees are paid for the ending financial year.

With all your obligations covered, you can strategise and look toward the coming financial year.

Please be aware that the information contained within this guide is for general purposes only. You should satisfy yourself of the requirements of applicable Australian laws and regulations and seek advice from your professional adviser for your specific circumstances before acting on any information provided in this guide. Reckon Limited does not provide legal, taxation, financial or investment advice.

Plans that fit your business needs and your pocket

30-Day free trial

Cancel anytime

Unlimited users

† Free data migration offer includes 1 year of historical data + YTD only. Paid subscriptions only.

Helping thousands of businesses with their payroll

Get STP ready today with Reckon

We’ve got ATO complaint solutions to suit any business.