Pricing models are how customers engage with your prices. Think of them as a first impression: it can make or break a purchase. It is why having the right pricing model is important, as it packages what you sell, who you are as a business, and the value you provide, all in a price tag.

Let’s look into pricing models and how you can incorporate them into your business.

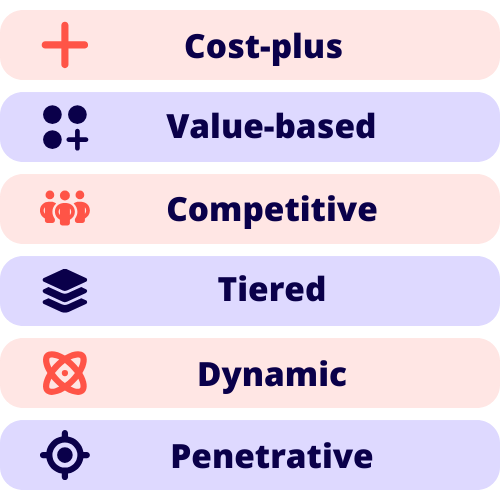

Pricing model types

There are a bunch of different pricing models to choose from, and more often than not, you don’t need to settle on just one — you can use multiple models to sell your products.

Cost-Plus pricing

Cost-plus pricing is a simple way to price your services while remaining flexible in the face of changing costs. You will find trades, retail, and manufacturing using this model to deliver their services, as these industries are heavily dependent on wholesale materials.

To implement, calculate your production costs, then add your desired margin. To determine your production costs, first identify your cost of goods sold (COGS), operating expenses (OpEx), and labour costs.

For example, let’s look at this as a quick calculation on a 50% margin:

COGS: $20 (per job)

OpEx: $25 (spread across a month and 100 jobs)

Labour: $25/hr (it takes 1.5 hours to provide service)

Total cost per job: $58.00

Cost of service (50% margin): $87.00

While easy to implement, cost-plus pricing has some drawbacks. One, you may be leaving money on the table, as customers may be prepared to pay more than the markup you add to your costs. Two, just as customers may be willing to pay more, they may also be unwilling to pay when your costs increase substantially. Cost-plus pricing is reactive to your expenses; if materials and wages rise, so does your cost base. If you operate in a competitive market, you may have no choice but to trim your margin to retain customers, leaving you with less profit.

Value-based pricing

Value-based pricing uses the perceived worth of a product or service. Businesses determine the value customers are willing to pay for and price accordingly. Industries like tech (Apple), auto (Mercedes), and luxury (Rolex) rely on the perceived value of their products, whether that is image, quality, or both. Production costs are less of a factor in determining this pricing model, and it requires a deep understanding of your customers through market research.

Where value-based pricing succeeds is that it allows you to go beyond your costs and increase revenue by leveraging the value you create for your customers. Your business benefits from a stronger brand, higher margins, and a more engaged customer base.

Where value-based pricing struggles is in keeping pace with shifting customer values and sentiment; your prices might not match customers’ needs. It also requires significant investment and research to determine the right price, and businesses using this model often take years to reach profitability.

Competitive pricing

Competitive pricing, or the going-rate model, is when your prices align with market rates or your competitors’. In this model, you need to cover production costs while remaining ‘competitive’ in your industry. Pricing for retail, hospitality, and airline carriers is heavily influenced by market prices, i.e. what customers are willing to pay.

Competitive pricing adds value to businesses by providing predictability and stability. What your competitor is doing is what you’re doing, and the market sets the standard. No intensive analysis is required. This has its drawbacks, however, because it makes your business reactive rather than proactive. It is harder to charge more even when you provide more value, because the market sets the price.

Tiered Pricing

Tiered pricing is where your product or service has different entry points (basic, pro, premium). This model offers customers options tailored to their purchasing power and needs. Software and professional services often use this model, since not every customer needs the same level of features or service. Typically, they base products or services on the idea of good, better, and best. Your margins increase with the additional offerings at each pricing tier.

Tiered pricing models are effective at capturing price points for different customers. It also scales because your customers will purchase more from you as their needs grow. Issues with this model arise when customers become confused about your offerings or drop from higher tiers, making forecasting unpredictable.

Dynamic pricing

Dynamic pricing, or price surging, depends on demand, seasonality, and availability. This model is elastic; prices are subject to factors that can increase or decrease. Airlines, hotels, and ride-share services rely on dynamic pricing to set their rates.

Dynamic pricing generates high revenue during ‘surges’ or ‘peak’ periods of operation, giving you flexibility in your offerings. The negatives come from customer sentiment during peak periods, as value is derived from demand, which discourages customers. Another challenge is the constant monitoring of prices to stay competitive.

Penetration pricing

Penetration pricing is a strategy in which startups and emerging businesses deliberately enter the market at lower prices, operating at a loss, to attract customers. The idea is that once you have established a customer base, you then raise your prices to gain profitability.

Penetration pricing allows businesses to enter markets quickly and build a customer base. However, while this model can quickly give you a foothold in the market, it isn’t sustainable. To achieve profitability, you need to raise prices, which will affect the customer base that initially flocked to your business because of cheap pricing.

How to choose a pricing model

Finding the right pricing depends on several factors about your business: industry, customers, competitors, and your business goals. Your pricing model needs to address each of these points about your business. For instance, consider a small business entering a new market. While a penetrative pricing strategy may serve them in the short term, it isn’t sustainable in the long term.

Let’s look at an example of how to implement pricing models into a business.

Pricing model example

Mary, a boutique furniture vendor, wants to increase her revenue. Her current pricing uses a value-based model: her customers pay for high-quality, practical, and chic furniture that improves their living spaces. To improve the value of her business, Mary adds an interior design service using a tiered pricing model.

Pricing model in action:

- Mary adds an interior design service with three tiers.

- Each tier has a different price and level of service to suit different customer needs.

- The model employs a good-better-best approach, with higher margins for higher tiers.

- She adds greater value to customers by offering both a product and a service in a single transaction.

By combining a tiered decoration service with the furniture that Mary’s business sells, she has enhanced the value of her brand. Her business doesn’t just sell furniture; it sells a lifestyle that her customers can buy into.

Pricing models and your small business

To get your customers to purchase from you, you need to nail your pricing model. Pricing your goods and services under the right model helps customers feel like they get great value from each transaction. This doesn’t just translate to more revenue; it strengthens your brand and reputation and creates a loyal customer base. Whatever your approach, the right model should align your prices with customer expectations, cover your costs, and still make a profit.