Acting on bad information about your business can set you back in the long term. Part of your job as a business owner is to filter out these misconceptions and myths so you can focus on solutions that actually meet your needs.

Let’s look at the myths and misconceptions in running a business and how to avoid them.

Financial myths

Financial mismanagement is one of the most common causes of businesses failing. Acting on bad advice will lead to insolvency issues, and the last thing you want to do is have a business that can’t generate profit or pay its debts.

If you have a great product, that’s all you need.

Great products do not sell on their own (link why is my product not selling? Article when ready). If having a great product were all you needed, companies would consist only of the individuals who make or provide the good or service, and no one else. Many moving parts of your business contribute to sales, from marketing and production to how your customers purchase from you.

High revenue means great business

Having a high revenue doesn’t necessarily mean your business is at the top of its game. Sure, high revenue is a plus, but it is not the be-all and end-all, as there is more to a business’s performance than generating income.

What this statement ignores is the fundamentals of running a business that affect profitability. Key metrics that provide more context on profitability are revenue against variable costs and margin. These determine whether the revenue you bring in will convert to profits. If the cost of doing business, like COGS and operating expenses, balloons and carves up your revenue, then it doesn’t matter how much revenue you make: your margins will be razor-thin.

So while high revenues are great to have, it is equally important to lower variable costs and maximise your profit margin.

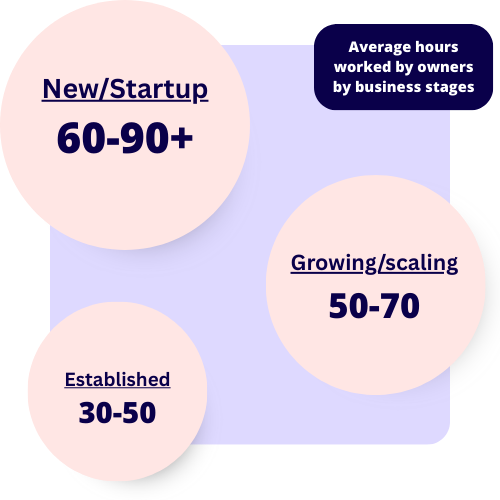

Running a business gives you more flexibility and free time

Running a business gives you more flexibility, and free time is a misrepresentation of the hours required to own and operate your enterprise. While a side business may be less intensive, committing yourself to running a business full-time can mean overwork, long hours, and little free time. The misconception stems from the hours worked by business owners who run mature, established enterprises. Here are the stats for hours worked for small business owners with their companies at different stages:

- Early/startup: on average, 60-90+ hours

- Growing/scaling: On average, 50-70 hours

- Mature/established: on average, 30-50 hours

Profit is cash flow

Profit and cash flow are not the same thing. Profit is the money you have left over after your business expenses; cash flow is the money coming into and leaving your business. Related, but different.

A company with high profits may not necessarily have cash available to pay operational costs or debt. An example of this would be a business that handles high-value transactions for products or services. While showing great profit on paper, delays between when invoices are sent and when they are paid could result in periods when no money is actively flowing through the business. The misconception arises from a disconnect between what’s in a business’s books and the reality of running a business.

I don’t need employees when software can do it for me

This may be true for freelancers and sole traders who do everything for their business, but as your operations expand, it becomes impossible to do everything. Delegating roles and hiring staff are signs of your business’s growth. As your business becomes more profitable, your time becomes more valuable—you can’t afford to spend hours on day-to-day tasks.

Debt is bad

The idea that debt is bad is a misconception rooted in a misunderstanding of finances. Sure, there is bad debt, like high interest rates on credit card debt, but there is also good application of debt, like low interest rates on a loan you use to invest in your business.

In business, you look at the exchange of positives. Business loans can give you funding to grow your business and increase profits, allowing you to ‘leverage’ your debt. Debt is bad when you only see the negatives, but when you leverage it, you borrow money to make money.

Debunking myths and your small business

Myths arise from our desire to simplify—finding quick solutions to our problems. In business, there are no shortcuts. Even if there is truth in a generalisation, it doesn’t paint the whole picture. To separate myths from sound advice in business, speak with other business owners, your accountant, or a financial advisor; thousands of people have walked the same path as you. Back yourself and get the right information to run your business successfully.