Simplify your bank reconciliation with bank feeds

Simply connect your bank account and watch your bank transactions update in real time – no manual data entry required.

Bank feeds and reconciliation software with all the features you need

Connect to major banks

Handles complex transactions

Peace of mind for your data

Real-Time Financials

Set up a bank feed in minutes

|

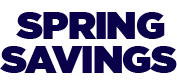

Reckon make it easy to set up a bank feed from major Australian banks. Whether via Open Banking or a direct bank feed, you can link your bank accounts and credit cards in just a few clicks. With support for over 100 banks and account types, the setup process is quick and simple. Just enter your account number once, and transactions will flow directly into Reckon, giving you a clear view of your cash flow. |

|

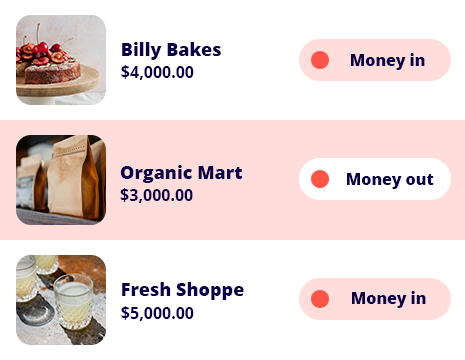

Bank feeds for credit cards and bank accounts

|

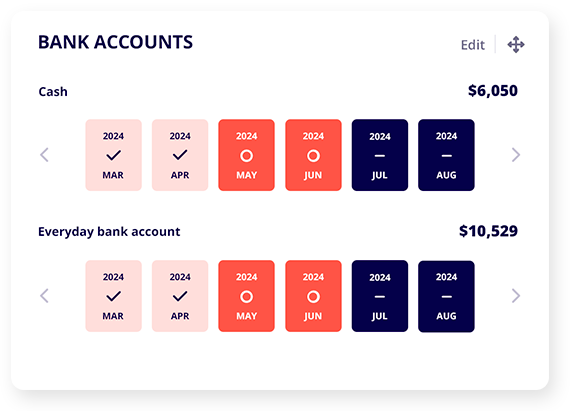

Reckon’s bank feeds allow you to split payments into different bank accounts, manage recurring credit card charges, and process multiple bank transactions at once. Over time, the system learns from your activity, making reconciliation faster, more accurate, and helping you save time every week. |

|

Secure bank feeds and safe data entry

| All bank transactions flow into Reckon using encrypted connections. Whether you’re reconciling a bank account or a credit card, your financial data is always secure. |  |

Real-time bank feeds keep cash flow under control

| Stay on top of your finances with real-time bank feeds. Instant updates mean you can reconcile quickly, reduce data entry, and always have visibility of your cash flow. |  |

Plans that fit your business needs and your pocket

30-Day free trial

Cancel anytime

Unlimited users

† Free data migration offer includes 1 year of historical data + YTD only. Paid subscriptions only.

Helping thousands of businesses with their accounting

What are the benefits of bank reconciliation?

- Save time: Automatic bank feeds reduce reconciliation from an hour to under 10 minutes.

- Stay on top of cash flow: Reconcile bank accounts and credit cards quickly for a complete financial picture.

- Prevent errors and fraud: Regularly checking bank transactions helps you catch mistakes, charges, or discrepancies.

- Track unpaid invoices: Ensure your records match your bank account balances so your business stays on track.

Frequently asked questions

How does the 30-day free trial work?

The Reckon One free trial allows you to try our accounting software for a period of 30 days to ensure it meets the needs of your business. After this period, your subscription will automatically convert to a paid one to avoid any interruptions to your data. However, if you find that Reckon One small business accounting software is not suitable for your needs, you can cancel your subscription before the billing renewal date and your credit card won't be charged.

If life got in the way and you weren’t able to use your trial, no worries! Just give our friendly support team a shout and we’ll see if we can get you up and running again.

How do I set up a bank feed?

Reckon supports three methods to connect your bank account:

1. Open Banking – secure, government-backed access to your financial data

2. Direct bank feeds – connect directly with major Australian banks

3. Yodlee Inc. – a third-party banking integration

Once the setup process is complete, all bank transactions flow automatically into Reckon. You’ll just need your account number and login details. How to add an open banking feed >

Direct feeds are available for: ANZ, Bank of Melbourne, Bank of Queensland, Bank of SA, Bendigo Bank, CBA, Heritage Bank, NAB, PayPal, St George, and Westpac. Learn more here.

What is open banking?

Open Banking is part of the government’s Consumer Data Right. It provides a secure, standardised way to share your bank transactions. Compared to other methods like direct feeds or screen scraping, it’s safer and faster.

Benefits include:

-

More data from more banks

-

Secure access to your bank accounts

-

One consent process covering all banks

-

Immediate daily updates

-

Historical transaction data back to 2017

Reckon partners with SISS Data Services, a leading provider of secure financial data.

What are the benefits of bank reconciliations?

-

Save time: Automated bank feeds cut reconciliation time dramatically.

-

Accurate records: Match your accounting data with your bank account and credit card statements.

-

Catch issues early: Spot errors, fraud, and bank fees before they hurt your business.

-

Stay compliant: Reliable records make reporting easier.

How do I switch from another software to Reckon One?

Making the switch to Reckon One is a breeze with our data migration service! Here’s how it works:

- Fill out our data migration form.

- Sit back and relax while we handle the migration process.

- In just 3 to 5 business days, we’ll reach out to you to review your migrated data.

- Once you’re happy with your migrated information, we’ll transfer ownership of your files to you.

- Start using Reckon with your bank feeds ready to go.

You can find more information here.

Is my data secure?

Yes. We use bank-level security and encrypted connections. Reckon One is hosted on secure Australian AWS servers, ensuring your bank accounts, credit cards, and all bank transactions remain safe.

See our data security page for more information.

Can I grant access to other people?

Yes, invite colleagues, bookkeepers, or accountants to manage bank feeds and reconcile bank transactions with you. And the best part is, you can do it regardless of which plan you’re on. Simply invite users and assign the appropriate permissions, so they can help you manage your business.

Can I change my software plan later on?

Definitely! Reckon One offers you the flexibility to change your plan to fit the unique needs of your business. Whether it’s downgrading or upgrading, you can easily make these changes right from your Reckon account.

Do you provide customer support?

We offer email, chat, and phone support, plus webinars, guides, and the Reckon Community to help you save time and get the most out of your bank feeds.

Is there a minimum subscription period?

Enjoy the benefits of Reckon One with the flexibility of monthly payments and if you decide it's not the right fit for your business, you can easily cancel at any time.

Try our automatic bank feeds and reconciliation tools today – free for 30 days!

Unlimited users. Cancel anytime.