Over the last decade, over $41 billion of superannuation payments have gone unpaid. Australian workers rely on their super to enjoy retirement and be financially independent, so businesses across Australia are legally obligated to provide super guarantees for their employees; it is part of the trust between workers and business owners.

So, what’s gone wrong, and how do you, as a small business owner, ensure that your payroll and super obligations are compliant?

Missing superannuation payments

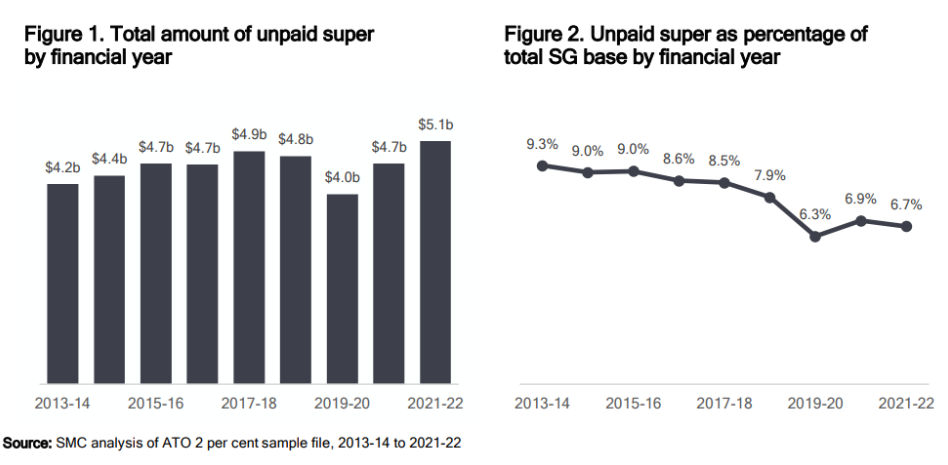

Research conducted by the Super Management Council, based on the ATO’s super data collected over the decade, has found that over $41 billion dollars worth of super payments have gone unpaid over a nine-year period.

The research shows that 1 in 4 working Aussies have been affected by this, with a whopping $5.1 billion dollars worth of super unpaid from 2021-2022.

These are eye-watering figures, to say the least. So, how did it happen, and in what industry did it occur most?

Industries at risk

Several factors contribute to super going unpaid to Aussie workers. These include:

- Poor business practice and payroll management

- Low employee awareness

- Ineffectual enforcement

Whether it is one or a combination of these factors, the research shows that one in three workers in their 20s, more than a quarter in their 30s, and a quarter of workers in their 60s are more likely to be affected. It also shows that the lowest-paid workers are at a higher risk of unpaid super.

The following industries are at the highest risk when it comes to unpaid or underpaid super:

- Construction

- Trades

- Transport

- Retail

- Food services

Super Confusion

The most common issues regarding missed or underpaid super payments are oversights, payroll mistakes, and cash flow mismanagement.

Employees not getting their super is a serious issue, as unpaid or underpaid superannuation guarantees impact an individual’s future, and the knock-on effect compounds.

For example, take the average underpayment of $1,800 in the financial year of 2021-2022. If an Aussie worker were to be underpaid this amount, it could potentially leave them with approximately $30,000 less at retirement.

As a small business owner, making super payments is essential to your business operations and employer obligations. If you operate in any of the abovementioned industries, here are a few tips on making sure you are compliant.

Tips on super guarantee

Australia’s superannuation system is complex, and it’s up to small business owners to be up-to-date with their employees’ chosen super funds and get contributions paid on time. As a small business owner, you can do several things to remain compliant with the Australian Tax Office and contribute to your employees’ future retirement.

Confirm your employees’ super fund

It is important to know whether your employee has an industry super fund or a self-managed super fund. Make sure that whatever option they have is correctly entered into your payroll system so that superannuation payments can be accurately allocated.

Check the superannuation rate

The annual superannuation rate for the 2024-2025 financial year is 11.5%. This is the compulsory minimum that is contributed to, inclusive of, or exclusive of your employees’ salary packages. Your integrated payroll software should automatically calculate these figures for you, but if you’re unsure or need to double-check, you can use a superannuation calculator to crunch the numbers for you.

It is also essential to review what award or enterprise agreement your employees have with you, or whether any of your employees have a salary-sacrificing agreement.

Use a super stream service provider

Once you have completed a pay run and superannuation has been allocated to your employees, depending on when you process your super payments, you may need to upload these contributions to a super clearing house to distribute the payments to your employees’ designated super funds.

This process can be slightly complicated, so it’s worth considering if a superstream service provider can help automate the process for you.

Review your payroll procedures

Reviewing your payroll procedures is always productive for small business owners. Unsure where to begin? It may be time to call your trusted financial advisor, accountant, or bookkeeper. Help is always available, and when it comes to your small business, getting the right advice will help you stay compliant.

Back your employees as a small business owner

As a small business owner, trust is part of your commitment to your employees. Ensuring they are paid the correct super lets your employees know their future is safe. Australia has one of the most robust retirement plans in the world with our superannuation fund system, so keeping compliant is one way to show you are taking care of your employees.