Plenty of questions about GST will abound the mind of a new small business owner, whether they be about thresholds, BAS lodgment, GST free sales, ATO requirements, input tax credits, accounting, and tax invoices.

But how does GST actually work for small business?

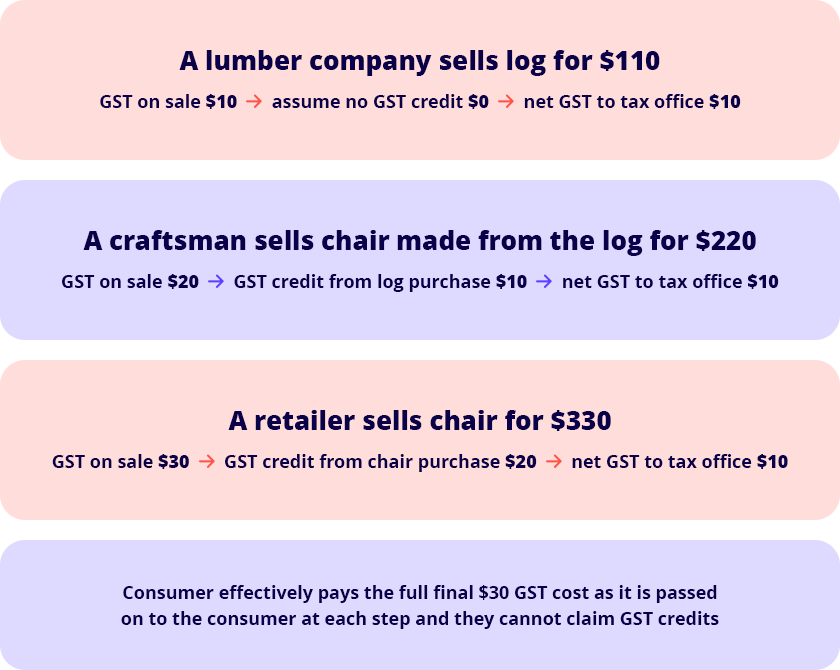

In a nutshell, the goods and services tax (GST) is a tax of 10% on most goods and services in Australia. Generally, registered businesses include GST in their sales (and tax invoices) to customers and can claim back GST on items purchased through their BAS statements.

Let’s have a look at an example of GST for small business:

As you can see, it’s ultimately the consumer who pays all the GST due. The lumber company, toy manufacturer and retailer can all claim credits and any GST that they have to pay they on-charge up the chain.

Do small business have to pay GST?

As a small business, do you need to charge GST? Well that depends on your income. So, what is the GST threshold?

- Small businesses in Australia who turn over less than $75,000 per year don’t have to pay GST.

- If you’re a registered not-for-profit, you also don’t have to pay GST as long as your turnover is less than $150,000.

- If you run a taxi service or are an uber driver, for example, you must always pay GST, regardless of income.

However, you do have a choice when it comes to paying GST as a small business. You can choose to charge GST if you believe you’re about to exceed the threshold. To get ahead of the game (and the ATO), it’s a smart move to charge GST if you’re aiming for this result. If you need you can use our GST calculator tool to check the amount of GST you should charge based on your product/service(s).

GST limit for small business

To reiterate, the magic GST threshold for small business in Australia is $75,000. Pay attention to current and expected turnover at all times to ensure you remain compliant with the ATO’s GST requirements.

GST exemption for small business

When are you exempt from GST as a small business in Australia? Apart from the GST threshold, there a few factors to consider.

As a small business, you don’t include GST in the price of items or services your business sells that are already GST-free. However, your small business can still claim credits for the GST included in the cost of items your business used to create those products.

For example, if you grow apples and sell them at a market, you don’t include GST in the price. However, you can still claim for GST credits on the business purchases you made in order to grow those apples (tools and fertiliser for example).

GST exemptions include, but are not limited to:

- most basic food

- some education courses, course materials

- some medical, childcare and health services

- some medicines

- some exports

- some religious services and charitable activities

GST benefits for small business

As brushed upon, there are small business benefits to registering for GST, even if you aren’t above the GST threshold.

For example, if you’re purchasing expensive business-related equipment. If you use a car primarily for business purposes, and wish to purchase one, you could do well registering for GST. This is especially true if your customers are primarily GST registered entities.

It means you can claim GST credits on your business-related car purchase and receive a decent GST refund on your BAS statement, despite earning less than $75,000 per year.

If you don’t register for GST, you cannot claim any GST credits. The benefit of registering is essentially a calculation based on your circumstances and the cost of your business related purchases.

There’s also the matter of business perception. If you want to look like a larger, more professional company then registering might help, otherwise you may give across the image that you’re a small or new business by not charging GST.

Of course, every business turning over $75,000 must register, so if your tax invoice doesn’t include GST, you’re sending your buyer a signal in terms of your business size and earnings.

Small business not registered for GST

If you’re earning less than the $75,000 GST threshold you don’t need to register for GST, even though you can voluntarily do so.

What’s the advantage of not being registered for GST?

If your business doesn’t incur many business-related expenses that you paid GST on, you may do well not registering for GST as you will not get any GST refunds or credits from the ATO.

There are other reasons not to register your Australian small business for GST, such as competitiveness. If your goods or services are low in cost and you operate in a competitive market, you’ll not need to add the 10% GST, meaning your prices are attractive and your customers pay less.