What is a director in a company exactly? What is their role? How does it differ to the role of a CEO or managing director?

As a small business owner, what do you need to understand about the role of a director?

What is a director of a company?

The director of a company is the person responsible for managing a company’s business activities. Larger companies will have multiple directors working as a collective to manage or advise a company – usually referred to as a board of directors

Does a small business need a board of directors?

While you may run a small business that doesn’t mean you escape the need for a director. Regardless of the size of your company, every company needs at least one director, not necessarily a board of directors.

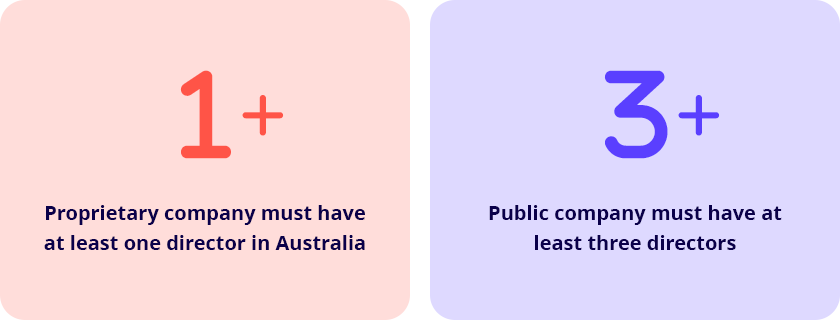

The Australian Securities and Investments Commission (ASIC) insist that a proprietary company must have at least one director who ordinarily resides in Australia. A proprietary company is only expected to have one director, but a public company must have at least three directors.

Most small businesses are proprietary companies, so just the one director is required, but every company must also have at least one member. A member is generally referred to as a shareholder. A director can also be a member of the company, which is common with small companies.

ASIC firmly state that a person serving as a director must “act in the best interests of the company, even where this may conflict with their own personal interests”. Members of a company are generally free to act in their own interests.

As cited through the Corporations Act of 2001, company directors have the following legal obligations and duties:

- A written record (minutes) must be kept of resolutions concerning the management of the company. However, a small business managed by a person serving as a sole director and member may pass any resolutions officially by recording and signing decisions.

- Maintain a distinction between their personal finances and their small business finances. Remember that the company owns the assets. Also, money invested in the company from loans or investors belongs to the company. This is a two-way street, with the company responsible for repaying customer debts.

- Ensure the company has a registered office that is located within Australia, with a principal place of business registered.

- Disclose the personal information of the company’s directors. This includes their names, addresses, and dates of birth.

- Maintain up-to-date and accurate financial records that reflect in full transactions and the company’s financial position.

- Notifying ASIC of company changes and paying any relevant fees to ASIC.

As a small business owner, if you’re serving as a sole director while also being a member, or running a business that is of a size to have multiple directors and members, there’s a strong likelihood that you’re not completely aware of the responsibilities that you do serve as the director of your company.

You should always get professional advice or information if you’re unsure whether you’re meeting all your obligations correctly.

Administrative, civil, or criminal action may be taken against any director who fails in their duties – regardless of the size of your business.

When getting started with your small business, establishing a strong foundation is important as you start building from start-up to success. While buying the right equipment, hiring appropriate staff, and using the right software is important, consideration must be given to the legal details surrounding your company.

What is the difference between a director and a manager position?

Put simply, the difference of roles and responsibilities between a director and general manager or manager position is evident in the name – a manager manages and a director directs.

While a manager may execute a business plan or strategy, it’s the duty of the director to concoct and lay out that plan, in order for a manager to handle the plan itself.

What is the difference between managing director and CEO?

The difference between a managing director and a CEO may seem subtle at first but they’re quite distinct roles.

While a managing director has the duties of motivating employees and executing plans (they may have developed themselves), a CEO is usually their direct report and is responsible for communicating with the board. A duty of a CEO may be to strategise, but a managing director executes.

What is the difference between director and managing director?

While quite similar, the most important differentiator between a director and a managing director is rank. Managing directors will outrank executive directors and have the capacity to fire them.

Outside of CEOs, managing director’s hold the companies highest rank and are often the ‘face’ of the business.

We hope by now to have answered the question ‘what is a director of a company?’ and shed light on the role of a director in a company and how a small business director operates.