SMALL BUSINESS RESOURCES

How to do a tax return

4 min read

Submitting a tax return sits at the heart of compliance with the Australian Taxation Office (ATO). Whether you are a sole trader, partnership, company, or trust, you need to be preparing for taxes every year to ensure your tax responsibilities with the Australian government are met.

Let’s run through the basics of tax returns, how they’re performed, what’s included, and how to submit them.

What is tax filing in Australia?

Tax filing is simply the submission of your tax forms, or tax return, to the relevant government authorities to deduce your taxable income and tax bill. In the case of Australia, this function is performed by the ATO.

A tax return needs to be lodged by businesses and individuals each tax year, which is defined as between 1 July and 30 June.

Why do we care about the preparation of tax returns?

So why do you need to file your tax returns every year? Why is this important and what function does it serve? It comes down to taxes and how much you owe the government.

When you earn business income, you need to add income tax on these earnings. This is so that when it’s time to lodge your tax return, the ATO can ascertain exactly how much tax you need to pay to them for the year.

How to prepare taxes for small businesses

The preparation of your tax return will depend on what type of business you operate. Generally, you can either do your own taxes or rely on a registered tax agent to lodge on your behalf. In this article, we’ll outline different business types and how to prepare your tax return for each.

What to include in the tax return

The information you’ll need to include on your tax return will depend on your business structure, and will also become immediately clear once you undertake the process or talk to an accountant or tax advisor. However, as a business owner, you’ll most certainly need to keep records of your income and expenses.

Other reporting requirements (such as PAYG and GST) will be covered by your BAS statements, not your tax return.

How to lodge your tax return

Tax returns can be lodged in a few ways. How you choose to lodge is also based on your business type or structure.

In terms of lodgment procedures, there are also several options. The procedure you choose will depend on your circumstances, personal preferences and business structure.

Sole trader tax returns

Sole traders lodge the same income tax return as individuals. Sole traders, will need to fill out an additional supplement called ‘business and professional items schedule for individuals’, but only need to file one tax return.

To lodge your tax return, you can:

- Complete it online via the ATO myTax portal

- Go through a registered tax agent or tax preparer

Fill out a paper tax return and mail it to the ATO

Partnership tax returns

If your business is a partnership, you’ll need to lodge a partnership tax return. The partnership doesn’t pay tax as an entity, instead they will lodge a ‘partnership tax return’ to deduce tax payable, and then the individuals who comprise that partnership lodge individual tax returns.

To lodge your partnership tax return, you can choose from the following options:

- By using SBR-enabled software

- Through a registered tax agent or tax preparer

Fill out a paper tax return and mail it to the ATO

Company tax returns

If you’re registered as a company, you must submit a company tax return. This is distinct from an individual tax return, which you must also lodge to report any salary that you may have earned from the company or other sources.

To lodge your company tax return, you can choose from the following options:

- By using SBR-enabled software

- Through a registered tax agent or tax preparer

Fill out a paper tax return and mail it to the ATO

Trust tax returns

If you operate a trust, the trustee must submit a trust tax return. While trusts typically do not pay tax as an entity, you must still submit a tax return to detail the trust’s net income, which is passed through to the trust beneficiaries. Each beneficiary of the trust will then have to prepare an individual tax return to report this income and pay tax on it.

To lodge your trust tax return, you can choose from the following options:

- By using SBR-enabled software

- Through a registered tax agent

- Fill out a paper tax return and mail it to the ATO

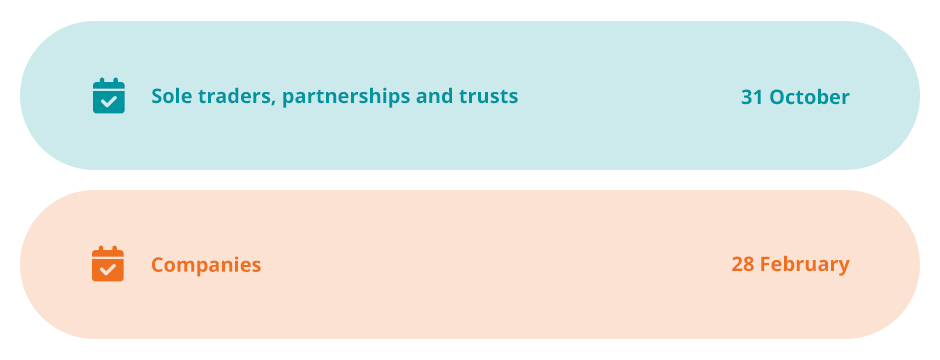

When is the due date to lodge a tax return?

This, once again, depends on your business structure.

- For individuals, partnerships, and trusts: if you do your own tax return, the lodgment due date is 31 October. However, if you use a tax agent, timings will be a lot more flexible, (so long as you’ve registered with a tax agent as of 31 October).

- For companies: your lodgment date will vary, and you should be notified directly. Most company tax returns will commonly be due by 28 February, however, you should check with the ATO to determine your exact lodgement dates.

How to use accounting software to help with your tax preparation?

Good quality accounting software is becoming indispensable in the preparation of income tax returns for businesses.

Accounting software can easily help you create income statements and expense records, which are required for tax filing, while SBR-enabled software can be directly used to file tax returns. It is thus highly recommended that you use sole trader accounting software to help prepare data and reports for your tax lodgment.

Accounting software is also useful for storing records, such as receipts, that are required to be held as proof of business expenses.

To find out more about tax filing and preparation for sole traders, partnerships, companies, and trusts, you should refer directly to the ATO for further information and advice.

Download our free bookkeeping guide

Understand the basics of bookkeeping for small business owners

Track and manage GST with Reckon One

Cancel anytime.