Prepare your business for end of financial year

The information you need to manage your tax obligations and breeze through the 2025/26 financial year!

Everything you need to know about EOFY in Australia.

What is end of financial year (EOFY)?

The financial year is a time period of 12 months used for tax and accounting purposes. The Australian financial year starts on 1 July, with the last day occurring the following year on 30 June. At the end of each fiscal year small business owners wrap up their books, create financial statements, and begin finalising their tax time paperwork and accounting. From 1 July through to 31 October, individuals and businesses submit their tax return to the Australian Taxation Office (ATO), who use the information to determine how much tax you owe.

To help you get ready for tax season we’ve created a video to make your end of financial year easy!

When is the start and end of the financial year?

1 July 2025

The fiscal year begins.

30 June 2026

This marks the end of the fiscal year in Australia.

What do I need to do before the end of the financial year?

Businesses must review and finalise their activities for the fiscal year. Here is a simple checklist to make sure you’re EOFY ready!

- Review and update your financial records.

- Review and update your income and expenses.

- Prepare your deductions and tax concessions.

- Finalise Your Payroll and STP. For more information check out our EOFY payroll checklist

- Pay your employees’ super contributions.

If your business uses contractors, finalise your TPAR. It is also worthwhile to strategise for the next financial year and review your business structure. Preparing all your financial records will make sure you’re ready when you need to file your tax return.

Self-employed and sole traders need to lodge an individual tax return at year end. Your business income and expenses go in your individual tax return using a separate business schedule. Individual tax returns can be submitted online via through myTax (accessed through myGov), by paper, or through a registered tax agent. If you’re an Australian resident for tax purposes, you must declare all income you earned both in Australia and internationally on your Australian tax return.

Companies lodge a separate company tax return each year. You must also lodge an individual tax return for income you earn via wages, shares, and dividends from the company. Company tax returns can be lodged using SBR enabled software, through a registered tax agent, or by paper.

How do I complete a tax return?

To complete your tax return accurately you first need to gather, organise and reconcile your financial records. Once your records are in order you can generate the financial statements that provide you the figures to fill out your tax return. The main reports are a profit and loss statement (P&L) and a balance sheet.

A P&L shows your total income and expenses for the year and is useful for tax reporting purposes. Expenses are subtracted from income to show how profitable your business is. The profit you make in a business represents your taxable income. A balance sheet lists your businesses assets and liabilities to work out your net assets.

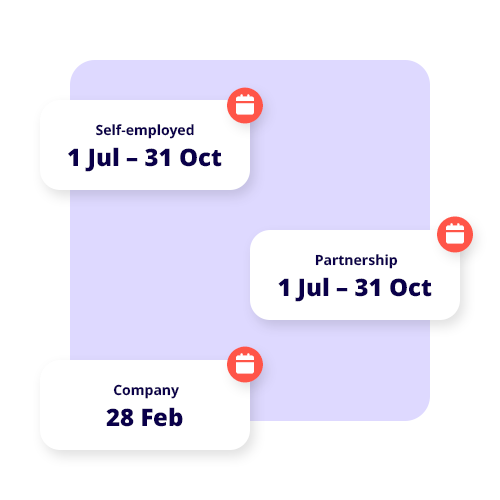

What are the EOFY lodgement dates for small business?

- Sole trader/self employed: If you lodge by yourself your tax return can be lodged from 1 July to 31 October each financial year. If you lodge via a registered tax agent contact them for more information.

- Partnership: If you lodge by yourself your partnership tax return can be lodged from 1 July to 31 October each financial year. If you lodge via a registered tax agent contact them for more information.

- Company: Company tax returns lodgement dates vary. The majority of company tax returns will be due 28 February each financial year, however we recommend you check the ATO website for your specific date as rules can change for different fiscal years.

See the end of financial year calendar below for a full list of key dates.

Stay up to date with our Australian tax year calendar

Financial year dates and cut-offs for businesses with employees including business activity statements (BAS), pay as you go (PAYG), and superannuation obligations.

May 2025

15 May – Company income tax returns due for lodgement and payment

15 May – Partnership & Trust Income tax returns due for lodgement

15 May – Individual income tax returns due for lodgement if using a tax agent

21 May – Lodge and pay April BAS (if you lodge monthly).

21 May – The Fringe Benefit Tax return is due by today if you lodge by paper.

28 May – The Fringe Benefit Tax return is due by today if you lodge electronically.

*Note: The FBT tax year runs from 1 April to 31 March.

July 2025

1 July – New Financial Year! Q1 Starts. Individual income tax returns due from now until 31 October if preparing and lodging yourself.

14 July – Employers must issue PAYG withholding payment summaries to employees by today. Note: if reporting via STP this information is in myGov for your employees.

21 July– Lodge and pay June BAS (if you lodge monthly).

28 July – Lodge and pay Q4 (April – June) BAS (if you lodge quarterly).

28 July – Super guarantee contributions for Q4 (April – June) is due by today.

September 2025

21 Sept – Lodge and pay August BAS (if you lodge monthly).

November 2025

21 Nov – Lodge and pay October BAS (if you lodge monthly).

January 2026

1 Jan – New Year’s Day, Q3 Starts

21 Jan – Lodge and pay December BAS (if you lodge monthly).

26 Jan – Public Holiday

28 Jan – Super guarantee contributions for Q2 (Oct – Dec) is due by today.

March 2026

21 Mar – Lodge and pay February BAS (if you lodge monthly).

May 2026

15 May – Company income tax returns due for lodgement and payment

15 May – Partnership & Trust Income tax returns due for lodgement

15 May – Individual income tax returns due for lodgement if using a tax agent

21 May – Lodge and pay April BAS (if you lodge monthly).

21 May – The Fringe Benefit Tax return is due by today if you lodge by paper.

28 May – The Fringe Benefit Tax return is due by today if you lodge electronically.

*Note: The FBT tax year runs from 1 April to 31 March.

July 2026

1 July – New Financial Year! Q1 Starts

1 July – Individual income tax returns due from now until 31 October if preparing and lodging yourself.

14 July – Employers must issue PAYG withholding payment summaries to employees by today. Note: if reporting via STP this information is in myGov for your employees.

21 July – Lodge and pay June BAS (if you lodge monthly).

28 July – Lodge and pay Q4 (April – June) BAS (if you lodge quarterly).

28 July – Super guarantee contributions for Q4 (April – June) is due by today.

June 2025

21 Jun – Lodge and pay May BAS (if you lodge monthly).

30 Jun – Prepare for end of financial year and wrap up your books for the 2024/25 year.

August 2025

14 Aug – PAYG withholding payment summary annual report is due.

21 Aug – Lodge and pay July BAS (if you lodge monthly).

October 2025

1 Oct – Q2 Starts

21 Oct– Lodge and pay September BAS (if you lodge monthly).

28 Oct – Lodge and pay your Q1 (July – Sept) BAS (if you lodge quarterly).

28 Oct – Super guarantee contributions for Q1 (July – Sept) is due by today.

31 Oct – Last day to submit individual income tax returns.

31 Oct – Not For Profit self-review return deadline

December 2025

21 Dec – Lodge and pay November BAS (if you lodge monthly).

25 Dec – Christmas Day

26 Dec – Boxing Day

February 2026

21 Feb– Lodge and pay January BAS (if you lodge monthly).

28 Feb – Lodge and pay Q2 (Oct– Dec) BAS (if you lodge quarterly).

April 2026

1 Apr – Q4 Starts

21 Apr – Lodge and pay March BAS (if you lodge monthly).

28 Apr – Lodge and pay Q3 (Jan– March) BAS (if you lodge quarterly).

28 Apr – Super guarantee contributions for Q3 (Jan- Mar) is due by today.

June 2026

21 Jun – Lodge and pay May BAS (if you lodge monthly).

25 Jun – Fringe Benefit Tax return due (if filing electronically via a registered tax agent)

30 Jun – EOFY

30 Jun – Prepare for end of financial year and wrap up your books for the 2025/26year.

Want to know more about your tax time obligations and due dates? Check out these handy links.

PAYG, Superannuation & Tax Compliance | Single Touch Payroll | Business Activity Statements | EOFY Videos

EOFY tax time guide!

Download our free end of financial year guide for small businesses, with important EOFY dates, tips to help you stay compliant and in control of your tax obligations.

Ultimate Financial Year Timeline Poster!

Free and printable Financial Year Timeline Poster which contains all the key tax and financial year dates small business owners need to know.

Reckon One makes your EOFY easier!

A stress free tax season is all about good record-keeping because you need to account for every dollar that comes in and out of your business for tax reporting purposes. Reckon One can save you time and money and help you stay on top of your finances throughout the year.

The latest resources to help you manage end of financial year

EOFY checklist for small businesses.

Read more >

Tax deduction for small businesses: what can I claim? Read more >

Claiming home office expenses. Read more >

What is and how does instant asset write-off work? Read more >

What can I claim on tax without receipts? Read more >

9 tips to help you prepare for EOFY.

Read more >

Try Reckon One free for 30 days

Cancel anytime.