Accounting software

made for every

small business

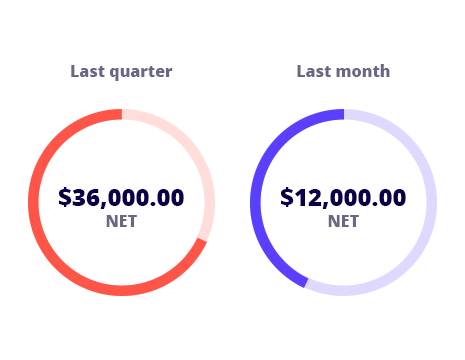

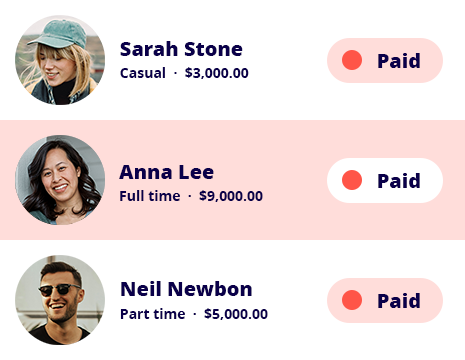

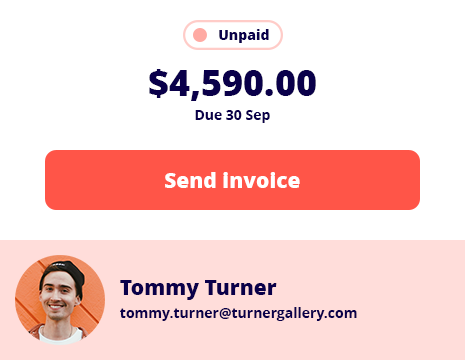

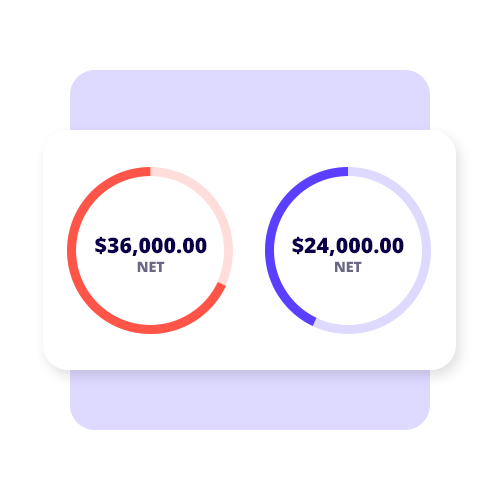

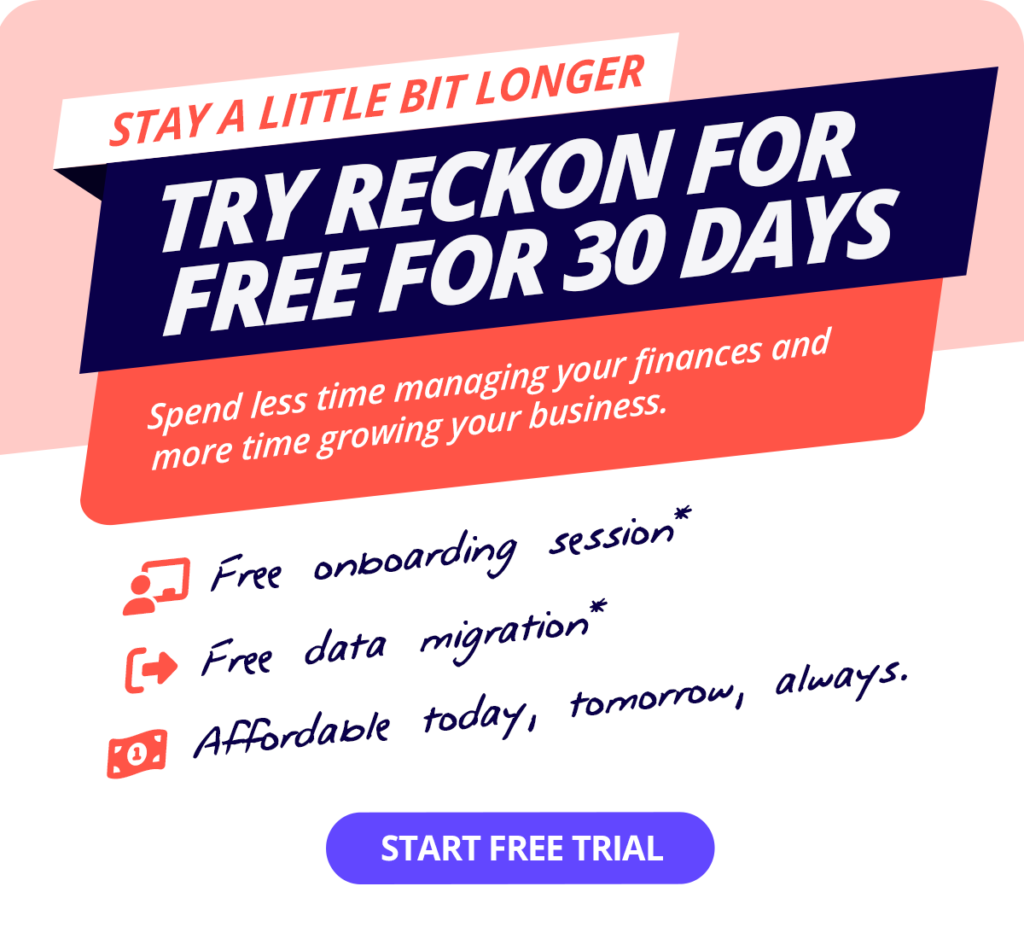

Spend less time managing your finances and more time growing your business. Plans start from just $5.50/month*.

We know running a business isn’t easy.

But our software is.

Need more? Explore additional solutions for your business

Plans that fit your business needs and your pocket

30-Day free trial

Cancel anytime

Unlimited users

† Free data migration offer includes 1 year of historical data + YTD only. Paid subscriptions only.

Helping thousands of businesses with their accounting

We’ve got your industry covered

Find out how Reckon achieves success for your industry.