Streamline your super payments with Ozedi

Simplify your superannuation obligations.

Powered by Ozedi.

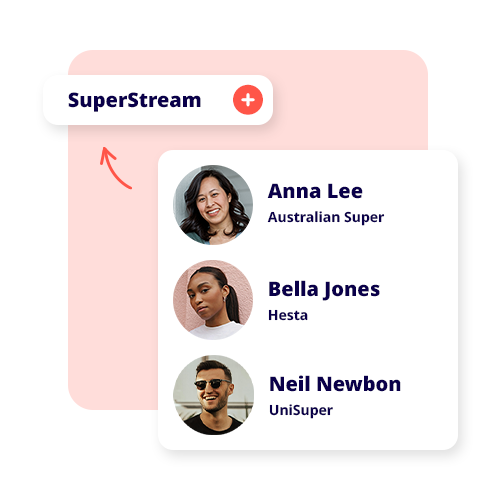

What is SuperStream?

SuperStream streamlines superannuation by enabling the data to be sent electronically between employers, funds and the ATO. Ozedi was the first SuperStream gateway helping over 50,000 businesses since 2013. Reckon has partnered with Ozedi to provide easy SuperStream compliance for our customers.

A single transaction across multiple super funds

Ozedi SuperStream allows you to submit a single transaction no matter how many funds you are transacting with. This means that even if employees are with different funds, you can make all the necessary super contributions in one batch. Saving you time and money in manually processing individual contributions to each super fund!

Stay in control of cash flow with flexible payment options

You can pay your contributions directly from your bank account using your banking software. You control the payments rather than a third party determining the payment date and debiting your account in their timeframe.

Ozedi also allows you to pay your superannuation using an American Express card to fully automate the process. You can even earn reward points when you pay super on your Amex via RewardPay!

Available for Reckon Accounts Desktop & Hosted

Reckon Accounts and Accounts Hosted will produce a SuperStream Alternate File Format (SAFF) file that you upload to Ozedi. Ozedi manages the distribution of remittance advices to the superannuation funds and you can make payment directly from your bank account or using American Express to complete Superannuation compliance.