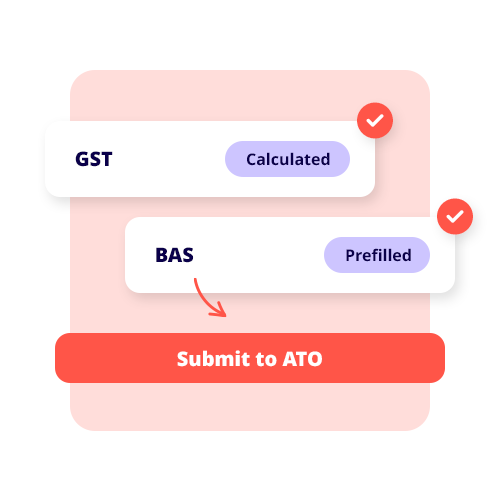

Manage GST and lodge your BAS effortlessly

Automatically calculate GST and submit your business activity statement BAS straight to the ATO, making tax time easy!

Easily track, prepare and

lodge BAS

Reckon One business activity statement software automatically calculates GST as you go and prefills BAS, which makes doing your tax and preparing your business activity statement a breeze! You’ll always know how much you owe and when it’s due, so you’re ready to lodge your business activity statements BAS quickly and easily.

Manage GST transactions like

a pro

Track and manage GST transactions like a pro from the get-go. Reckon allows you to see individual transactions and business expenses that make up the GST totals in your business activity statements, as well as make GST adjustments from your BAS form as required – it’s GST information made easy!

Follow our step by step video tutorial for calculating your BAS figures in Reckon One.

Prepare tax reports for the ATO

Prepare your BAS reporting and PAYG & GST reports ready to submit to the ATO, on any device! You can keep track of their status and get your latest BAS from the ATO, saving you time and speeding up the BAS process!

Plans that fit your business needs and your pocket

30-Day free trial

Cancel anytime

Unlimited users

† Free data migration offer includes 1 year of historical data + YTD only. Paid subscriptions only.

Helping thousands of businesses with their accounting

Frequently asked questions

Does a sole trader need to do BAS?

If you’re a sole trader and registered for GST, yes you will need to lodge a Business Activity Statement.

You must register for GST if:

- Your business has a GST turnover (gross income minus GST) of $75,000 or more per financial year

- Your non-profit organisation has a GST turnover of $150,000 or more per financial year

- You are a taxi driver and ride-sharing driver no matter what your turnover is

Our Reckon One BAS software for sole traders makes lodging your bas statement easy.

How do I prepare my BAS with Reckon One?

Reckon One makes lodging your BAS easy. Run the Reckon One “Activity Statement (BAS)” report that will help you generate the exact figures to enter onto your business activity statement form. Save and mark as lodged to help you stay organised. All Reckon accounting products are Simpler BAS enabled including Reckon One. Follow our step by step video tutorial for calculating your BAS figures in Reckon One.

How do I record a GST refund in Reckon One?

It’s easy to process a GST refund in Reckon One. Read our article here for the simple steps to follow.

We’ve also written a handy article that includes everything you need to know about GST refunds and claiming GST.

Try Reckon One free for 30 days

Cancel anytime.